Best Yearly Premium Auto Insurance in 2024 (Our Top 10 Picks) | AutoInsurance.org (original) (raw)

Best for Yearly Premium: Travelers

13,128 reviews

13,128 reviews

Company Facts

Full Coverage for Yearly Premium Auto Insurance

$1188/yr

Pros & Cons

Affordable rates for high-risk drivers

It’s easy to get a Progressive auto insurance quote online

Snapshot can help low-mileage, safe drivers save money

Expensive rates for teen drivers

Customer service ratings aren’t as good as competitors

13,128 reviews

13,128 reviews

Best for Membership Benefits: Allstate

11,413 reviews

11,413 reviews

Company Facts

Full Coverage for Yearly Premium Auto Insurance

$708/yr

Pros & Cons

Multiple coverage options

Various discounts

Additional savings programs

Low-mileage policy option

Lower than average customer service ratings

Higher than average auto insurance rates

11,413 reviews

11,413 reviews

Best for Competitive Rates: Nationwide

3,019 reviews

3,019 reviews

Company Facts

Full Coverage for Yearly Premium Auto Insurance

$1380/yr

Pros & Cons

SmartRide program provides discounts based on driving habits

Various discounts, including multi-policy and safe driver savings

Wide network of local agents for personalized service

Mixed customer reviews on claims processing speed

Add-ons can increase overall policy cost

3,019 reviews

3,019 reviews

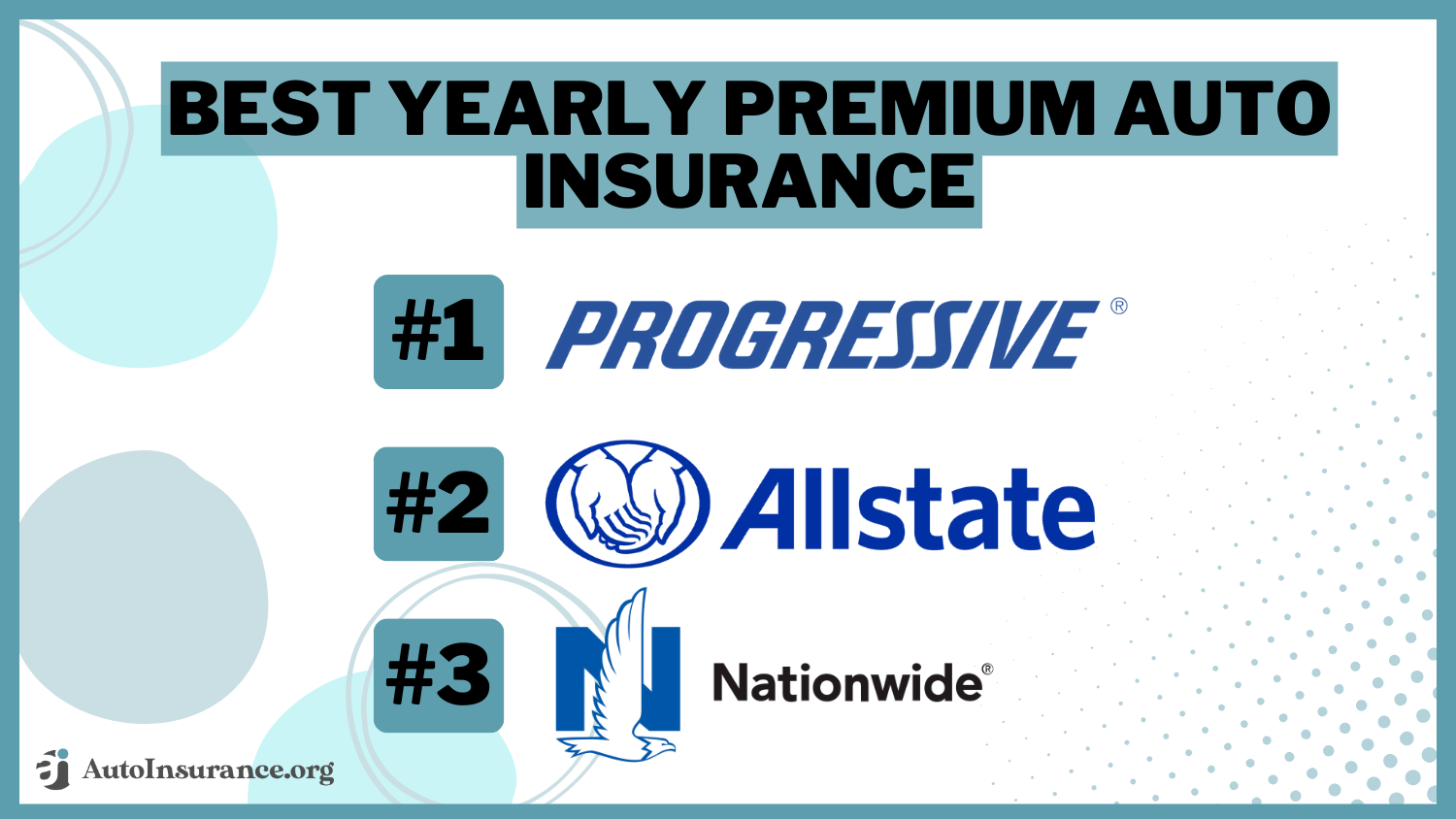

Progressive, Allstate, and Nationwide are the top picks for the best yearly premium auto insurance companies, with rates starting from 468,468, 468,264, and $528 per year.

Similarly to buying products in bulk, purchasing auto insurance with a yearly premium can help you save money in the long-run. Many people rush to get cheap auto insurance, without thinking about getting the best yearly premium auto insurance.

Our Top 10 Company Picks: Best Yearly Premium Auto Insurance

Compare RatesStart Now →

Like most people, you understand that your annual auto insurance will help you pay for certain things when you have an accident, but there’s more to purchasing auto insurance for a year than that.

If you understand what you’re buying, there’s nothing wrong with getting instant auto quotes so that you can find the right carrier and the right coverage at a good price.

If you are wondering which policy has the lowest annual premium, enter your ZIP code above to compare yearly auto insurance policy rates from top companies in your area.

Things to remember...

- There are many factors when it comes to buying auto insurance for a year

- Consumers can choose between semi annual and annual car insurance policy terms

- Buying a yearly auto insurance means your rates can’t change for an entire year

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

#1 – Progressive: Top Pick Overall

Pros

- Extensive Coverage: Progressive’s extensive network of service centers and repair shops, make it convenient for policyholders to get their vehicles repaired.

- Snapshot Program: Progressive’s Snapshot Program offers discounts based on driving habits (Read more: Progressive Snapshot Review).

- Multi-policy discount: Discounts for bundling policies help yearly premium for car insurance.

Cons

- Rate Increases: Rates reportedly can increase after an accident, which would increase annual car insurance premiums.

- Difficult Claims Process: Some customers report issues navigating Progressive’s claims process. Our complete Progressive review goes over this in more detail.

#2 – Allstate: Best Membership Benefits

Pros

- Membership Benefits: Allstate offers extensive coverage options, allowing policyholders to customize their policy to fit their needs.

- Accident Forgiveness: This feature ensures that rates won’t go up after an accident.

- Deductible Rewards: Policyholders can receive $100 off their deductible for every year of safe driving.

- New Car Replacement: Totaled new cars can be replaced with a brand-new one with this feature. Read more about this provider in our Allstate auto insurance review.

Cons

- Higher Price: Yearly car insurance can be expensive without discounts.

- Mixed Customer Reviews: Some reviews state issues regarding claims process.

#3 – Nationwide: Best Competitive Rates

Pros

- Competitive Rates: Nationwide’s personalized service’s competitive rates stand out among its competitors.

- Multi-policy Discounts: Nationwide offers discounts for bundling policies. Explore more add-on options in our Nationwide auto insurance review.

- Great Customer Service: Nationwide is known for having incredible customer care, making claim processes easier.

Cons

- Potentially Higher Costs: Prices can be higher for some drivers.

- Limited Availability: Nationwide is not available in every region.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

#4 – Farmers: Best Competitive Rates

Pros

- Customizable Coverage: Farmers offers a variety of options to cover unique needs.

- Multiple Discounts: Farmers offers discounts for safe driving, multi-policy, a good student discount, and more.

- Strong Financial Stability: Farmers has a stable financial outlook, indicating consistent rates and streamlined claim processes.

Cons

- Higher Rates: Farmers has higher rates than many competitors.

- (Find out more in our review of Farmers car insurance).

- Limited Coverage: Farmers insurance policies are not available in every location.

#5 – Liberty Mutual: Best Personalized Service

Pros

- Personalized Service: The Cover Customizer Tool allows policy personalization including accident forgiveness and new car replacement.

- Multiple Discounts Available: Liberty Mutual offers discounts for safe driving and more. You can find more information about discounts in our Liberty Mutual auto insurance review.

- Strong Financial Ratings: Liberty Mutual has strong financial ratings, meaning the company is financially able to pay out claims without issues.

Cons

- Possible High Rates: Liberty Mutual’s policy rates can be higher than competitors.

- Mixed Reviews: Some policyholders have reported delays and disputes during the claims process.

#6 – AAA: Best Innovative Coverage

Pros

- Innovative Coverage: AAA offers innovative coverage options that will help you save on car insurance yearly premiums.

- Good Customer Service Reputation: AAA is well known for their exceptional customer service.

- Transparent Policies: AAA’s concise policies offer peace of mind for those looking for the best premium yearly auto insurance.

Cons

- Limited Coverage: AAA is not available in all states, limiting options for some.

- Membership Required: Customers must be AAA members to access AAA insurance (Read more: AAA Auto Insurance Review).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

#7 – Travelers: Best Member Discounts

Pros

- Competitive Prices: Travelers’ competitive rates are cheaper than other insurers.

- Great Customer Service: Customer Service at Travelers make it easy to customize your plan and policy.

- Member Discounts: Travelers offers discounts for safe driving, student discounts, and more.

Cons

- Limited Availability: Not every state is covered by Travelers auto insurance.

- Mixed Reviews: Policyholders’ reviews note issues with customer service and the claims handling process.

#8 – American Family: Best Financial Stability

Pros

- Financial Stability: American Family’s high financial ratings indicate stability for the company. Read our AmFam insurance review to learn more.

- KnowYourDrive Program: The KnowYourDrive program rewards safe driving habits with lower rates.

- Multiple Discount Options: American Family’s various discount offerings can help lower overall insurance costs.

Cons

- Higher Costs: Some drivers report American Family has higher rates than other insurance providers.

- Limited Availability: American Family is not widely available, so it is not an option for some.

#9 – USAA: Best Loyalty Perks

Pros

- Loyalty Rewards: USAA offers discounts for military members and families, helping many save on yearly auto insurance premiums.

- Good Customer Service Reputation: USAA is known for their incredible customer support and assistance for policyholders..

- Comprehensive Coverage Options: The variety of coverage options USAA offers help clients match their policy to their budget.

Cons

- Exclusive to Military and Military Family: Only those in the military or in military families qualify for coverage. Check out our USAA auto insurance review to learn more!

- Difficult Claims Process: Delays and disputes have been reported by some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

#10 – State Farm: Best Military-Focused Coverage

Pros

- Military-Focused Benefits: State Farm offers military benefits like military service centers, a deployment discount, a storage discount, flexible payment options, and coverage for military equipment.

- Drive Safe & Save Program: State Farm’s telematics program is able to track driving habits and offer lower rates for safe drivers.

- Multiple Coverage Options: State Farm’s coverage options provide flexibility for drivers to match their specific needs.

Cons

- High Rates for Some: Insurance rates are less affordable for customers who do not qualify for the discounts they are offered.

- Limited Regional Availability: Some areas are not eligible for State Farm auto insurance coverage.

Buying Yearly Auto Insurance

All standard vehicle insurance policies for compact cars, sedans, trucks, and minivans are sold in terms. The term is a policy period that lasts from the effective date to the expiration date that’s found on your paperwork.

While you would think policies could be more customizable, standard carriers only offer policyholders one or two-term options.

Buying yearly insurance is possible, but it’s not always an option wherever you’re shopping.

As you’re looking for the right term for you and your family, you’ll find that you can either select a 6-month term or a 12-month term. Some companies will offer both and others will only offer one of the two.

So if you want to know does Geico or Progressive have 12-month policies, visit their websites or call them to find out for sure.

This is why it’s important to assess companies before assessing semi annual car insurance quotes and find the best companies.

Yearly Auto Insurance Policies Have Different Costs

To see how much prices for an annual auto insurance policy are at major insurers, take a look at the table below.

Yearly Premium Auto Insurance Rates by Coverage Level

Compare RatesStart Now →

Even though low coverage is the cheapest, we do not reccommend it, as you will have to pay a lot more out of pocket after an accident.

Purpose of Auto Insurance Terms

It seems odd to sell a product that expires when auto insurance is something that you need indefinitely.

As long as you own a car you’re going to need insurance. For some, owning a car may be short-lived but most Americans have at least two cars in their household.

By selling something like insurance in terms, it creates an inconvenience for the consumer.

As inconvenient as it might be to buy and review insurance every six months to a year, selling this type of contract in terms is a must. The main purpose of setting a term before the policy is sold is to protect both the named insured and the insurer.

When the policy takes effect and is issued, you’re protected from mid-term rate increases.

The insurer is also protected by selling insurance in a semi-annual or annual term. The protection afforded is different in that it relieves the company of the burden of protecting certain households for too long.

Does auto insurance increase every year? Only if your level of risk changes, such as getting a new ticket or crashing a car. Without a term, insurers would be obligated to offer fixed rates indefinitely. If this were the case, the insurer would never be able to reassess risk when risk profiles change.

What happens at the end of a yearly auto insurance term?

After your application is reviewed and the policy is issued, you’ll be comfortable in knowing that your rates will remain the same unless you choose to change the property, drivers, or coverage limits.

When the policy expires, it doesn’t mean that you can’t stay with your carrier. Insurers have to decide if you’re a good risk by running a renewal.

Auto Insurance Renewal

Renewal is a document that says how much you’ll pay if you renew your yearly policy to buy another year’s worth of coverage at a new rate. When will I get my auto insurance renewal?

The renewal is run by the insurer just about 45 days before the policy will expire.

Since the state says that all carriers have to notify their customers of non-renewals 30 days before coverage expiration, you can expect either a new rate or a letter of non-renewal in the mail just around a month before the policy ends.

Underwriters Assess Policy During Renewal

You have to be wondering what carriers are going to be looking at when they are assessing you and your family members.

After all, you were eligible for coverage the first time you purchased your yearly policy so why wouldn’t you be eligible just a year later. Being eligible for one year to the next isn’t guaranteed.

What you might not understand is that a single ticket can really affect your reputation with insurers. A citation could change your rate or lead to a loss of discounts.

If other things in the household change or you have a combination of tickets and accidents, you could be non-renewed. Non-renewal is different than cancellation.

According to the Insurance Information Institute (III), cancellation can occur due to a driver failing to pay a premium, committing fraud, or an expired/revoked driver’s license.

Unlike cancellation, non-renewal can be chosen by either the driver or the insurer, and isn’t always because of a poor driver’s record.

Here’s what underwriters are looking at:

- Each driver’s current motor vehicle reports will be run to look for new citations

- Each driver’s Claims Loss Underwriting Exchange (CLUE) report will be run to look for new chargeable claims reported with other carriers

- The claims data reported by the carrier to assess surcharges when there’s a chargeable claim within the last term

- Drivers in the household who aren’t rated

- Vehicle usage and driving habits

- Credit-based insurance scores and whether or not the score has changed for each named insured

- Reviewing eligibility for multi-line and multi-car discounts to verify you still qualify

These factors will all have an impact on what you pay for yearly auto insurance.

Tickets or Accidents Can Affect Insurance

If you’re convicted of reckless driving three months into your yearly policy, you’ll have nine more months of surcharge-free premiums.

It’s not until the renewal of the ticket conviction or the date that the claim for an auto accident is settled that a charge for the blemish will be assessed. It will be harder to find cheap car insurance after a ticket or accident, but shopping around for rates can help.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Most Auto Insurance Carriers Prefer a Six-Month Policy

As you’re shopping around for insurance with some of the leading players in the marketplace you’ll find that a majority of the big companies sell six-month policies and not yearly ones.

While it seems odd that both are options but finding yearly coverage is more difficult, there’s a reason behind the preference.

Selling six-month contracts to customers benefits the insurance company more than it benefits the policyholder. The more often that the insurer can reassess risk and drop clients, the better.

What you might not understand is that a single ticket can really affect your reputation with insurers. A citation could change your rate or lead to a loss of discounts.

Scott W. Johnson Licensed Insurance Agent

The carrier can not only drop the unappealing risk, the carrier can also raise rates sooner after a ticket or accident with shorter terms. This means higher rates in half the time.

Buying a Yearly Insurance Policy Is Worth It

There are still companies that believe in offering longer terms. Offering these longer annual terms may be a tactic used to attract a certain demographic or it may just be a practice that saves the carrier money in underwriting operational costs.

Either way, there are still a select few carriers that have yearly insurance.

If you’re getting some instant quotes to compare premiums, don’t let the appearance of a six-month rate attract you when you compare six-month vs 12-month car insurance policies.

The rate for coverage that lasts half as long as a yearly policy is obviously going to look better at first glance. This is before you consider the fact that it’s a semi annual premium car insurance.

Here’s why you should spend time looking for annual policies:

- After the policy is issued, you know what you’ll pay for an entire year so that you can easily budget

- You can pay premiums in full for a whole year so you don’t have to worry about payments

- You can earn a pay-in-full discount

- If you have a ticket or accident, it won’t affect your rate until the end of the annual term

- You don’t have to review renewals every six months

You don’t have to shop around as much when you have a policy that lasts for a year. When it is time to shop, make your chore easier by using the Internet as your quoting tool. Use an online comparison tool now and get instant quotes in minutes to find out who has the lowest premium rate for vehicle insurance in your area.

If you are ready to start shopping for car insurance with yearly rates, enter your ZIP code below to find car insurance rates that work for your budget.

Frequently Asked Questions

What is annual auto insurance?

Annual auto insurance refers to a type of vehicle insurance policy that provides coverage for a period of one year. It is a contract between an individual and an insurance company, where the individual pays a premium in exchange for financial protection in case of accidents, theft, or damage to their vehicle.

What does annual auto insurance typically cover?

Annual auto insurance policies generally provide coverage for the following:

- Liability coverage: Pays for damages caused to other people or their property in an accident where you are at fault.

- Collision coverage: Covers repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive coverage: Protects your vehicle against non-collision events such as theft, vandalism, fire, or natural disasters.

- Personal injury protection: Covers medical expenses and lost wages for you and your passengers in case of injury during an accident.

- Uninsured/underinsured motorist coverage: Pays for damages if you are involved in an accident with a driver who has no insurance or insufficient coverage.

What is the annual premium insurance rate for car insurance?

The rates for car insurance can vary widely. Annual insurance costs depend on several factors, including your age, location, driving record, the car you drive, and the coverage you choose. It’s always best to get multiple auto insurance quotes to find the best rate for your specific situation.

What are the advantages of annual auto insurance?

Some benefits of annual auto insurance include:

- Continuous coverage: With an annual policy, you have consistent protection throughout the year, reducing the risk of driving uninsured.

- Potential savings: Insurers often offer discounts for purchasing an annual policy, which can lead to cost savings compared to shorter-term policies.

- Convenience: You don’t need to worry about renewing your policy frequently, as it remains in effect for the entire year.

- Flexibility: Annual policies may provide options for customization, allowing you to tailor coverage to your specific needs.

Are there any disadvantages to annual auto insurance?

Some potential drawbacks of annual auto insurance are:

- Higher upfront costs: Compared to shorter-term policies, annual insurance requires a larger upfront premium payment.

- Limited flexibility: Once you commit to an annual policy, it may be challenging to make changes or switch to a different provider before the term expires.

- Overpaying for unused coverage: If you sell your vehicle or no longer need the insurance during the policy term, you may end up paying for coverage you don’t use.

- Inflexible cancellation terms: Cancelling an annual policy before its expiration date may result in fees or penalties, depending on the insurer.

Can I switch insurers during the term of my annual auto insurance policy?

While it is possible to switch insurers during the term of your annual auto insurance policy, there may be limitations or penalties involved. It is essential to review the terms and conditions of your policy or consult with your insurance provider to understand the specific rules regarding mid-term cancellations or switching providers (Read more: Managing Your Auto Insurance Policy).

How can I find the best annual auto insurance policy for my needs?

To find the best annual auto insurance policy, consider the following steps:

- Evaluate your coverage needs: Determine the level of coverage required for your vehicle based on factors like its value, usage, and personal circumstances.

- Shop around: Obtain quotes from multiple insurance companies to compare prices, coverage options, and customer reviews.

- Assess discounts: Inquire about available discounts such as safe driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

- Review deductibles: Consider the deductible amount you are comfortable with, as it affects your out-of-pocket expenses in case of a claim.

- Read policy terms: Carefully review the terms, conditions, and exclusions of the policy before making.

Which car insurance has the highest customer satisfaction?

Based on various rankings and reviews, companies like Amica Mutual, USAA, and State Farm are often ranked highly for customer satisfaction. Reputable resources for customer satisfaction ratings include J.D. Power, A.M. Best, and Consumer Reports.

Is it cheaper to pay yearly for car insurance?

Why is annual premium cheaper than monthly?

Annual premium car insurance is often cheaper than monthly payments for several reasons. Some reasons are lower administrative costs, reduced risk of non-payment, potential annual premium discounts, and less interest charges.

Who has the lowest premium rate for vehicle insurance?

Progressive, Allstate, and Nationwide have the best premiums for car insurance yearly. An annual auto insurance policy starts at $264/yr for minimum coverage, but it’s important to keep in mind that minimum coverage is not suitable for all drivers. Some insurers offer usage-based auto insurance discounts, which can lower costs.

Can I negotiate insurance premiums?

Yes, it is possible to negotiate insurance premiums with your insurance provider. The first step is researching and comparing different insurers to understand what competitors are offering. If you have been a long-term customer with a good payment history, are able to bundle policies, or use an insurance broker, you may be able to negotiate lower costs. Explain your situation clearly and ask if there are any available discounts or ways to lower your direct auto insurance in the upcoming year.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Written by:

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Reviewed by:

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Certified Financial Planner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.