Best Forex Trading Platforms And Brokers In 2024 (original) (raw)

Edited By

Tobias Robinson

Fact Checked By

William Berg

We’ve tested hundreds of platforms to bring you our selection of the best forex brokers. Explore the forex trading platforms that excel for their:

- Excellent selection of currency pairs

- Great pricing on short-term trades

- Intuitive Forex charting platforms

- High levels of regulation and trust

- Fast and reliable order executions

Best Forex Trading Platforms And Brokers In 2024

Following our exhaustive tests, these 7 brokers continue to stand out as the best for day trading forex:

- Pepperstone: 90+ currency pairs. Fast execution of 30ms. 0.1-pip spreads on EUR/USD.

- Eightcap: Superb forex trading app. AI-driven market insights. Neat learning via Eightcap Labs.

- CMC Markets: 330+ forex pairs and indices. No rejections or partial fills. Award-winning platform.

- IG: Best-in-class FX research. Intuitive flagship platform. 80+ currency pairs and forex indices.

- IC Markets: Low fees for day traders. Reliable execution and no requotes. Up to 1:500 leverage.

- AvaTrade: Forex ideas through AvaSocial. Transparent, stable spreads. Terrific forex education.

- FOREX.com: User-friendly forex platform. Great pricing for active traders. Highly trusted broker.

Comparison of Top Forex Brokers

Top Forex Brokers Comparison

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| Number of Currency Pairs | 90+ | 50+ | 330+ | 80+ | 70+ | 50+ | 80+ |

| EUR/USD Spread | 0.2 | 0.1 | 0.5 | 0.1 | 0.02 | 0.9 | 0.2 |

| Minimum Deposit | 0∣0 | 0∣100 | 0∣0 | 0∣0 | 200∣200 | 200∣100 | $100 |

| Charting Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView | Web, MT4 | IG Web, ProRealTime, L2 Dealer, MT4 | MT4, MT5, cTrader, TradingView | MT4, MT5, Web Trader, AvaOptions, AvaTradeGO | MT4, MT5, TradingView, Web Trader |

| Regulators | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, CySEC, SCB | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FRSA, BVI, ADGM | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

1. Pepperstone

Why We Chose It

Pepperstone has earned our ‘Best Forex Broker’ award twice in the last five years, most recently in 2024, and distinguishes itself with its superior range of currency pairs and indices, industry-leading platforms MT4, MT5, TradingView, and cTrader, plus its rapid execution speeds with no requotes.

Add in low spreads from 0.0 pips during tests with rebates for active traders, alongside licenses from 4 ‘Green-Tier’ regulators. Pepperstone delivers the complete package for forex day traders at all levels.

Pepperstone – cTrader Platform

Pros

- Pepperstone supports 90+ forex CFDs (majors, minors, exotics, crosses, NDFs) and three currency indices (USDX, EURX, JPYX), providing more opportunities than nearly every forex broker we’ve tested.

- Our direct experience with Pepperstone’s four platforms reveals a first-rate charting environment for serious day traders, especially since adding TradingView, with 230+ indicators in total, plus the Smart Trader MetaTrader add-on with 28 further indicators.

- Pepperstone offers very fast execution speeds of 30ms, with a 99.90% fill rate and no partial executions or requotes, helping day traders secure optimal prices in volatile foreign exchange markets.

- Pepperstone offers excellent pricing for day trading currencies, especially since cutting its forex spreads in recent years, now featuring average spreads of just 0.1 pips on the EUR/USD and 0.2 pips on the AUD/USD, plus rebates of 25%+ for high-volume traders.

Cons

- Despite enhancing its platform offering, now providing 4 of the best-known third-party solutions, Pepperstone still hasn’t developed its own software for trading currencies like AvaTrade, which could provide an easier entry point for newer day traders.

- Pepperstone’s demo account expires after just 30 days, providing limited opportunities to test short-term trading strategies, especially compared to IC Markets’ simulator, which is available for 90 days.

- Despite a well-stocked selection of education, including 30+ guides to forex trading, they are mainly delivered in long-form articles, lacking the engaging elements found at alternatives like Eightcap’s Labs.

2. Eightcap

Why We Chose It

Year after year Eightcap delivers for forex day traders, earning it a ‘Runner Up’ position in our selection of the best forex brokers in 2024. Despite offering a smaller selection of FX pairs than Pepperstone, at around 50, it stands out with its best-in-class tools, notably the AI-powered economic calendar.

Its mobile trading offering is also excellent with a terrific social investment network through TradingView and reliable integration with MetaTrader, allowing for user-friendly charting in horizontal mode during testing.

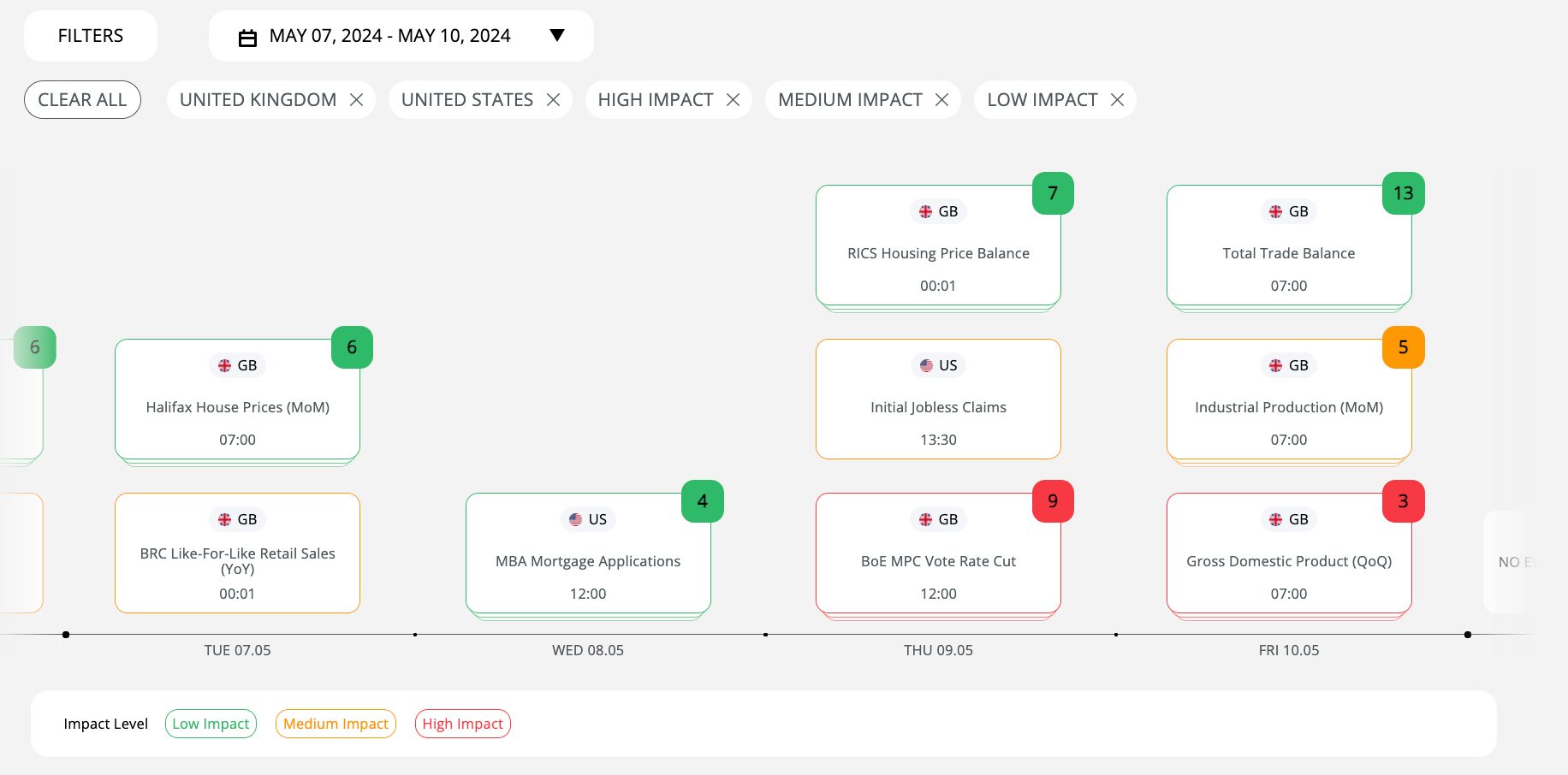

Eightcap – AI Calendar

Pros

- Eightcap’s AI-enabled calendar is best-in-class, allowing you to filter by country, plus high, medium and low impact, helping to identify events such as interest rate decisions from central banks which may affect currency prices, even highlighting FX pairs that may be affected.

- Eightcap’s TradingView app is a game-changer for many new traders, sporting a genuinely intuitive interface, a 50+ million strong social trading network, plus push notifications which proved invaluable for keeping abreast of market movements during testing.

- Eightcap’s Labs provides well-written and informative educational resources for newer forex traders with deep insights into all aspects of the foreign exchange market, from short-term trading strategies to charting analysis and risk management.

Cons

- Although Eightcap has bolstered its selection of digital currencies, now providing a market-leading selection of 200+ crypto derivatives, it only offers around 50 traditional currencies, seriously trailing Pepperstone.

- The onboarding process at Eightcap falls below alternatives like IC Markets – it took us 2 attempts including one rejection without explanation, followed by a slow 2-day wait time.

- Eightcap’s offering varies significantly depending on your location, with no Raw spread account for advanced forex traders in the UK for example, just the Standard solution with spread-only pricing.

3. CMC Markets

Why We Chose It

CMC Markets is a first-rate FX broker, delivering over 330 currency pairs – more than every alternative we’ve assessed, with diverse trading opportunities on currencies from developing and emerging markets.

After investing over $100M in its software, the CMC Web platform is now one of the most feature-rich I’ve used, while it scooped our ‘Best Trading App’ award in 2023.

Additionally, CMC is highly trusted, having launched in 1989 and earning the trust of our experts with authorization from 6 ‘Green-Tier’ regulators in line with DayTrading.com’s Regulation & Trust Rating.

CMC Markets – Web Platform

Pros

- CMC Markets still can’t be beaten in its range of currency pairs with a superior selection of majors, minors and exotics, from EUR/USD to HKD/CHF. CMC is also one of a select few brokers, alongside Pepperstone, that offer currency indices (12 FX indices including USD, EUR and GBP).

- CMC is one of the fastest forex trading platforms we’ve tested with execution speeds from just 3 milliseconds and no rejections or partial fills based on trade sizes, ensuring you get the currency trades you want.

- The CMC Web platform is a breeze to use with an incredibly receptive interface and value-add features, notably client sentiment data and Reuters news that can be accessed in two clicks by pressing on the three dots next to an FX pair and heading to Market Pulse in the pop-up menu.

Cons

- While average spreads are competitive (beating AvaTrade), only serious traders get the best pricing, earning up to a 40% spread discount through Alpha and Price+, while FX Active (introduced in 2022) offers spreads from 0.0 on six majors with a low commission, plus a 25% spread discount on 300+ others.

- Although the Web platform is excellent and CMC offers the long-standing MT4 (which was built for forex trading), CMC is behind the trend of offering more modern and intuitive third-party solutions, notably TradingView, which was integrated by Pepperstone and IC Markets in 2022.

- Despite a host of education in the Learn Hub, including 28 forex guides, the content and delivery need to be improved. I’ve read them and I got bored by the long-form text, lack of unique insights, and the sometimes bland images and videos, especially compared to AvaTrade’s Education Centre.

4. IG

Why We Chose It

IG just missed out on a top-three spot, but after enhancements to its research and education, most recently its Trade Live with IG morning show, it’s become an obvious choice for up-and-coming forex traders.

You can trade 80+ currency pairs with low spreads from 0.1 pips on EUR/USD. Plus, you have a pick of excellent forex software, notably IG’s flagship solution which has been one of our team’s platform of choice for real-money trading.

IG – Web Platform

Pros

- IG’s research tools are the best we’ve seen, featuring IGTV with live videos covering market events and charting analysis, its own forum that regularly hosts discussions on forex, and it even runs DailyFX, a dedicated website for real-time news and analysis focusing on major currency pairs.

- IG is the only forex broker we’ve rated 5/5 for education, offering invaluable tools for aspiring traders, most notably IG Academy, which has 18 course categories split between beginner, intermediate, and advanced, plus interactive quizzes and progress tracking.

- IG has earned the trust of our experts, several of whom have personally chosen the broker for live forex trading. It has 50+ years in the industry, authorization from seven ‘Green-Tier’ bodies in our Regulation & Trust Rating, and it’s one of the few publicly listed brokers (LSEG:IGG), ensuring financial transparency.

Cons

- Although IG offers direct market access (DMA), where you can directly interact with the underlying forex market for competitive spreads from 0.1 pips and greater transparency, it doesn’t use the electronic communication (ECN) model favored by many forex day traders.

- If you’re willing to put in the work to tailor IG’s own platform to your needs it delivers a first-rate experience with smooth charts and comprehensive data, but new users may be overwhelmed by the array of tools, research and customization options, especially compared to FOREX.com’s web terminal.

- Whilst IG’s forex spreads are low, outside of its DMA account they trail the cheapest forex brokers based on our analysis, starting from 0.6 on EUR/USD vs 0.5 at CMC Markets, and from 0.9 on EUR/GBP vs 0.7 at CMC Markets.

5. IC Markets

Why We Chose It

IC Markets has earned a podium finish in our ‘Forex Broker’ awards every year for the last five years, reflecting its superb environment for all types of forex traders. It offers high-quality order executions, some of the best pricing in the industry, plus high leverage up to 1:500, amplifying results for short-term traders.

IC Markets is also highly trusted – it’s authorized by 2 ‘Green-Tier’ regulators (ASIC and CySEC), plus we’ve traded currencies on the platform using real money with no withdrawal issues.

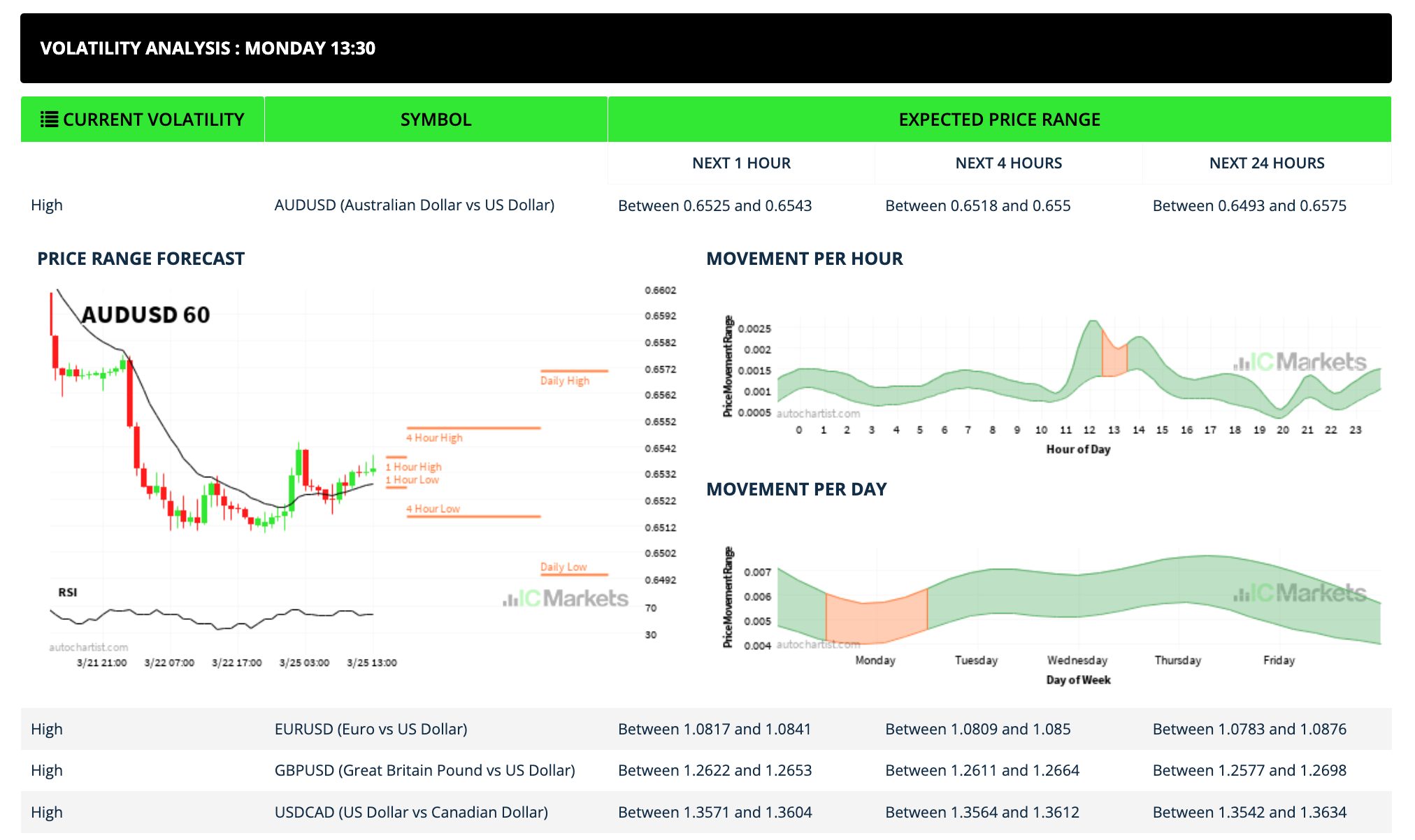

IC Markets – Forex Volatility Analysis

Pros

- IC Markets continues to offer some of the lowest forex trading fees with spreads as tight as 0.1 pips on EUR/USD and 3persidecommissionsoncTraderduringtesting.ItsRawTraderPlusschemealsorewardshigh−volumetraders,withrebatesupto3 per side commissions on cTrader during testing. Its Raw Trader Plus scheme also rewards high-volume traders, with rebates up to 3persidecommissionsoncTraderduringtesting.ItsRawTraderPlusschemealsorewardshigh−volumetraders,withrebatesupto2.50 per lot.

- IC Markets offers under 35ms execution speeds, minimal slippage, and no requotes, thanks to its high-speed fibre-optic connections to Equinix NY4 and LD5 data centers, making it ideal for day traders and scalpers seeking optimal pricing in fast-moving forex markets.

- IC Markets offers high leverage up to 1:500 on currencies (location dependant), affording experienced day traders significant buying power, magnifying potential returns and losses. The broker’s margin calculator is also useful for showing the outlay required.

Cons

- IC Markets offers useful research tools, notably WebTV, which offers daily commentary through short videos, but it often covers stocks and commodities rather than currencies, trailing the resources from best-in-class broker Pepperstone.

- IC Markets provides a forex news feed and time zone tracker, however they aren’t integrated into the client dashboard, making for a less seamless and frustrating user experience.

- IC Markets’s support has room for improvement – we contacted the team 5 times over the course of a week, often waiting in a queue for upwards of 15 minutes, not ideal if you have an urgent query, and noticeably slower than the <5 minute wait times at AvaTrade.

6. AvaTrade

Why We Chose It

After improvements to its offering in recent years, notably tighter spreads and social trading opportunities, AvaTrade now sits among the best brokers for day trading currencies. It offers a degree of price certainty for aspiring traders through fixed spreads, excellent educational tools including forex courses, plus its own AvaSocial app with an active community feed.

AvaTrade also offers a bespoke risk management feature, AvaProtect, providing up to $1 million in protection, a tool we’ve not seen at the vast majority of forex trading platforms we’ve used over the years.

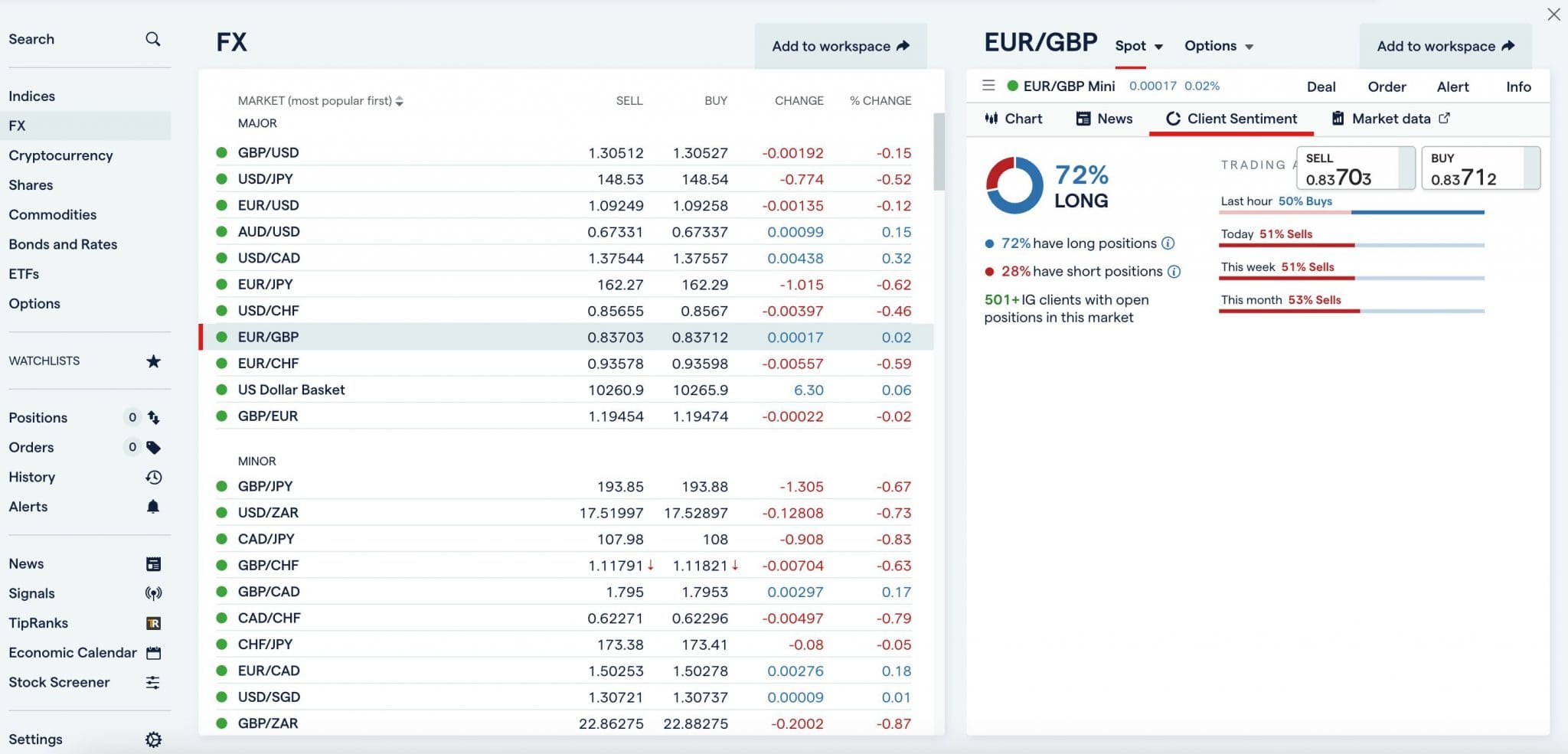

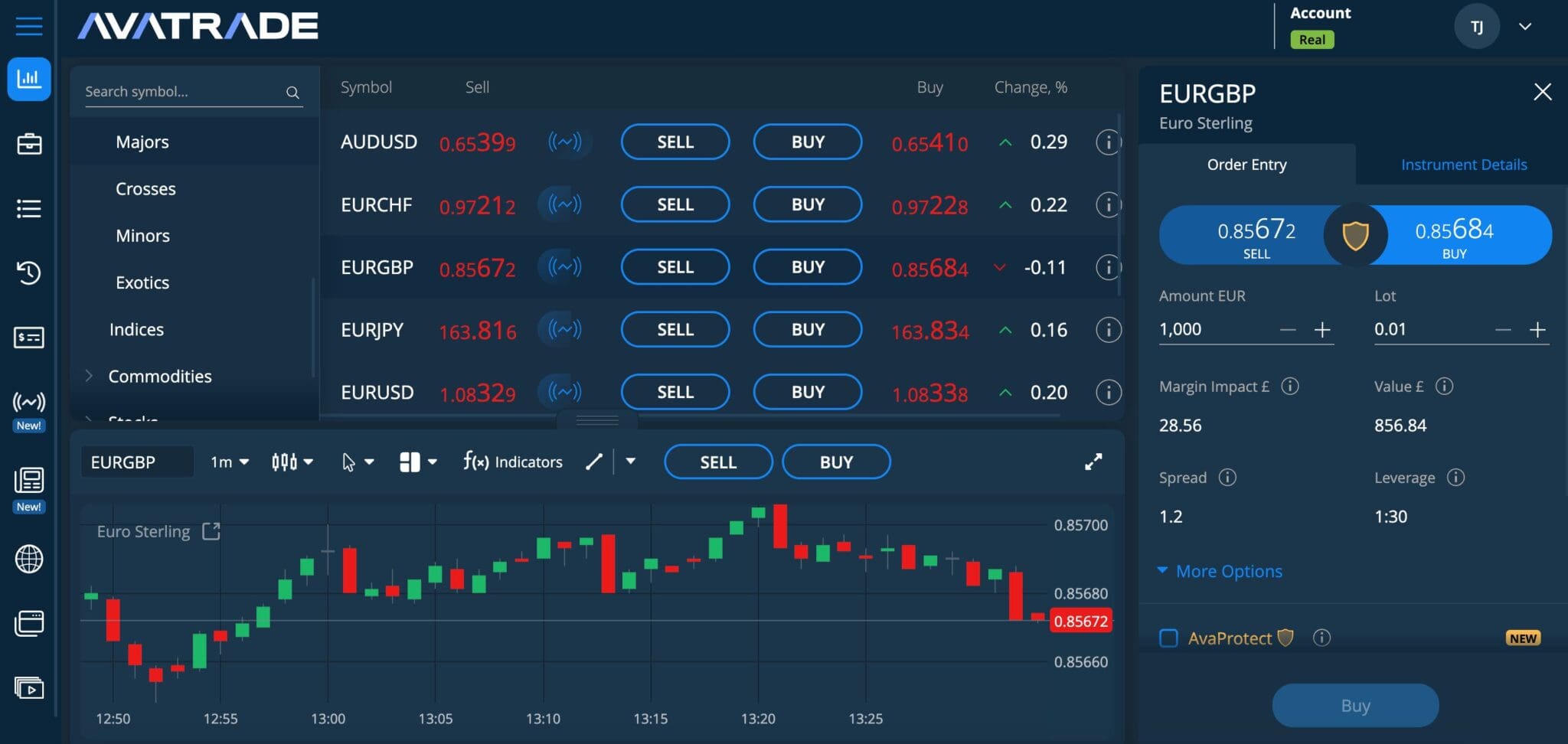

AvaTrade – Web Trader

Pros

- AvaTrade offers stable, fixed spreads with zero commissions which will appeal to traders looking for price transparency. Tests show spreads on popular currency pairs also come in cheaper than rival fixed spread brokers, such as SuperForex, with a 0.9 pip spread on the EUR/USD at AvaTrade and a 2.0 pip spread at SuperForex.

- The AvaSocial app sports a slick design which is enjoyable to use while featuring real-time trading signals and a social feed, which is great for discussing ideas and forex setups.

- AvaTrade has clearly invested in its learning tools with its Education Centre that features 25+ user-friendly platform tutorials, well-designed forex trading guides, plus comprehensive lectures for beginners through to advanced traders.

Cons

- AvaTrade offers the user-friendly Web Trader, alongside MT4 and MT5, providing a smooth entry into forex trading, however there are limited options to tailor the workspace with slow loading times during tests.

- Despite an accessible $100 minimum deposit and a fast sign-up process that took us 5 minutes, there is no ECN account with raw spreads that will appeal to advanced forex day traders and available at alternatives like IC Markets.

- Although it won’t impact active day traders, the 50inactivityfee,whichkicksinafter3months,ismorepunitivethanmostforexplatformswhotypicallychargebetween50 inactivity fee, which kicks in after 3 months, is more punitive than most forex platforms who typically charge between 50inactivityfee,whichkicksinafter3months,ismorepunitivethanmostforexplatformswhotypicallychargebetween10-$15 per month, while Pepperstone has no inactivity fee.

7. FOREX.com

Why We Chose It

FOREX.com continues to stand out for its optimal environment for day traders, featuring a genuinely intuitive charting platform, superb insights through SMART Signals, an above-average selection of 80+ FX pairs, plus consistently tight spreads from 0.0 pips and low commissions of $5.

FOREX.com has also earned our trust, alongside that of over 400,000 other traders, with licenses from 9 ‘Green-Tier’ regulators, more than 20 years of industry experience, and a parent company, StoneX Group Inc, that’s listed on the NASDAQ, underlining its legitimacy.

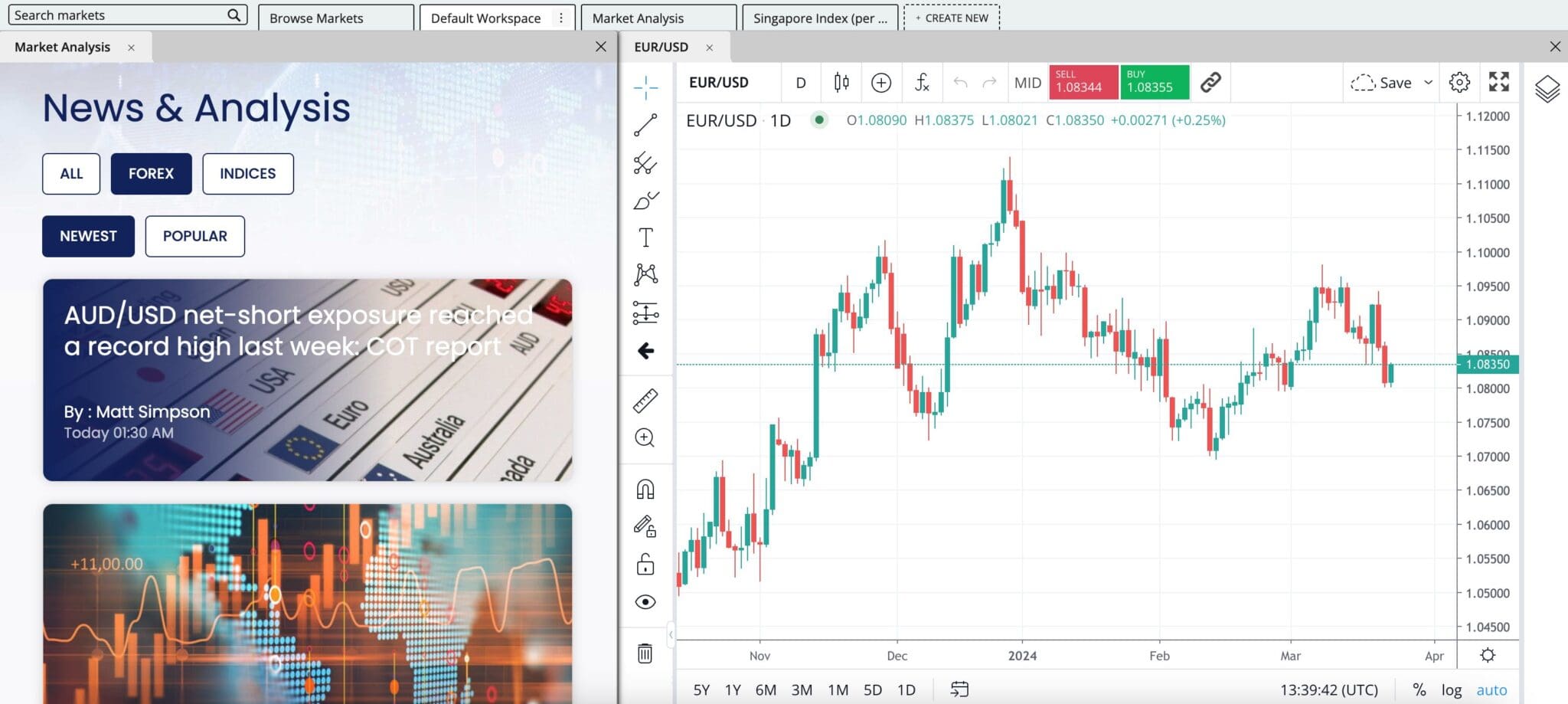

FOREX.com – Trading Workspace

Pros

- The FOREX.com platform remains one of the best we’ve used, sporting 80+ indicators, and in-built financial calendars, plus the SMART Signals engine that tracks 36 large markets, scanning thousands of price points to highlight short-term trading opportunities.

- Pricing at FOREX.com excels for serious currency traders, especially when combining the ‘RAW Spread’ account with the Active Trader program, which features rebates up to 15% and exclusive perks like expert webinars and relationship managers.

- FOREX.com offers one of the largest selections of currency pairs in the market, with over 80 FX pairs and an especially strong suite of exotics, providing opportunities to speculate on less-established economies, such as Thailand, Mexico and South Africa.

Cons

- While not unusual, FOREX.com does not offer negative balance protection to US traders, meaning you can accumulate losses beyond your account balance trading currencies, increasing the level of risk.

- Despite boasting more servers for hosting MetaTrader than most forex brokers globally, there are just 600 instruments on its MetaTrader suite, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Although FOREX.com offers fairly reliable 24/5 support, including directly via the app, the automated chatbot is frustrating to deal with from our direct interactions, with lots of information required and hoops to jump through before you can speak to an agent.

Comparing Forex Brokers

To find the best brokers for day trading forex we identified those that deliver in critical areas:

Currency Pairs

We chose forex platforms with a wide range of currency pairs, providing diverse trading opportunities while enabling investors to spread risk and use various short-term strategies.

💡

Experienced traders, in particular, may prefer a platform with a larger selection of FX pairs, notably exotics like the EUR/MXN and GBP/ZAR, which exhibit high levels of volatility that can be capitalized on by skilled day traders.

Our analysis below shows that all our top forex brokers offer upwards of 50 currency pairs, while CMC Markets leads the pack with an industry leading 330+ currency pairs, featuring a particularly extensive suite of exotics plus forex indices.

Comparison of Currency Pairs

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| Number of Currency Pairs | 90+ | 50+ | 330+ | 80+ | 70+ | 50+ | 80+ |

| Forex Indices | Yes | No | Yes | Yes | No | No | No |

| Investment Offering | 4.6/5 | 4.1/5 | 4.5/5 | 4.5/5 | 3.5/5 | 4.2/5 | 4.4/5 |

Pricing

We chose low-cost forex trading platforms that will help maximize returns, as even small differences in fees can add up over many day trades.

We evaluated both the minimum spreads on key currency pairs, notably the EUR/USD, GBP/USD and EUR/GBP, but also average spreads. We did this by recording spreads during the most actively traded sessions – the US/London overlap and the Sydney/Tokyo overlap. We then compared these with industry averages.

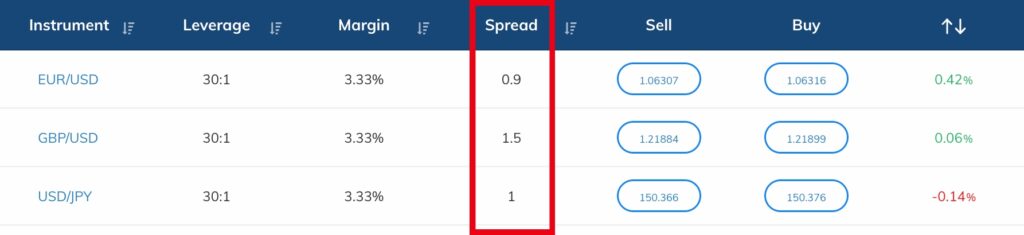

AvaTrade – FX Spreads

Following that, we factored in any commissions and non-trading fees, from deposit and withdrawal charges to inactivity penalties. This allowed us to paint a complete picture of the costs you can expect when day trading currencies.

Our analysis below shows that our top forex brokers all deliver excellent pricing with spreads of <1 pip on the EUR/USD, plus no or low deposit/withdrawal charges and inactivity fees, resulting in an overall fee rating of at least 4/5.

That said, IC Markets shines as the lowest-cost forex broker overall with industry-low spreads year after year.

Comparison of Fees

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| EUR/USD Spread | 0.2 | 0.1 | 0.5 | 0.1 | 0.02 | 0.9 | 0.2 |

| GBP/USD Spread | 0.3 | 0.5 | 0.9 | 0.6 | 0.23 | 1.3 | 0.2 |

| GBP/EUR Spread | 0.3 | 0.5 | 0.7 | 0.5 | 0.27 | 1.2 | 0.2 |

| Inactivity Fee | 0∣0 | 0∣0 | 10∣10 | 10∣12 | 0∣0 | 0∣50 | $15 |

| Fee Rating | 4.4/5 | 4.0/5 | 4.3/5 | 3.5/5 | 4.6/5 | 3.8/5 | 4.6/5 |

Charting Platforms

We chose forex brokers with terrific platforms, with a focus on intuitive interfaces and advanced charting tools given that many day traders use technical analysis to identify opportunities in the foreign exchange market.

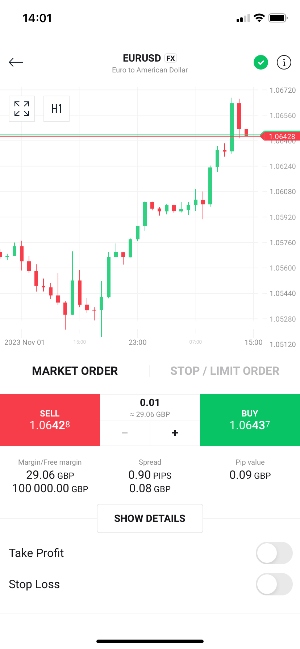

With a rising trend in mobile forex trading, as reported by Astute Analytica, the ability to trade on the move is also crucial. However, after using countless forex apps, we’ve found that not all mobile solutions match their desktop counterparts. Charts may not be mobile-optimized or you can’t work horizontally, resulting in a subpar user experience.

FOREX.com App

CMC Markets App

XTB Forex App

Forex brokerages are increasingly developing their own software, but the two most popular third-party platforms, supported by the vast majority of online brokers, are still:

- MetaTrader 4 (MT4): This is the gold standard for forex traders, with advanced charting, sophisticated technical analysis tools, multiple order types, and extensive customization, though we don’t like the clunky, outdated design.

- MetaTrader 5 (MT5): This is the latest iteration of MetaTrader 4. It has more powerful features, including more order types, analysis tools and faster processing. This is our pick for automated forex trading.

Our analysis below shows that our top forex day trading brokers all deliver in the tooling department, offering the MetaTrader suite, as well as further proprietary and third-party platforms in some instances, with FOREX.com leading the way with its terrific web platform that we love using.

Comparison of Charting Tools

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| Charting Tools | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | MT4, MT5, TradingView | Web, MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | WebTrader, AvaTradeGO, AvaOptions, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Forex App Rating | 4.7/5 | 3.6/5 | 4.2/5 | 4.8/5 | 4.0/5 | 4.3/5 | 4.9/5 |

Regulation and Trust

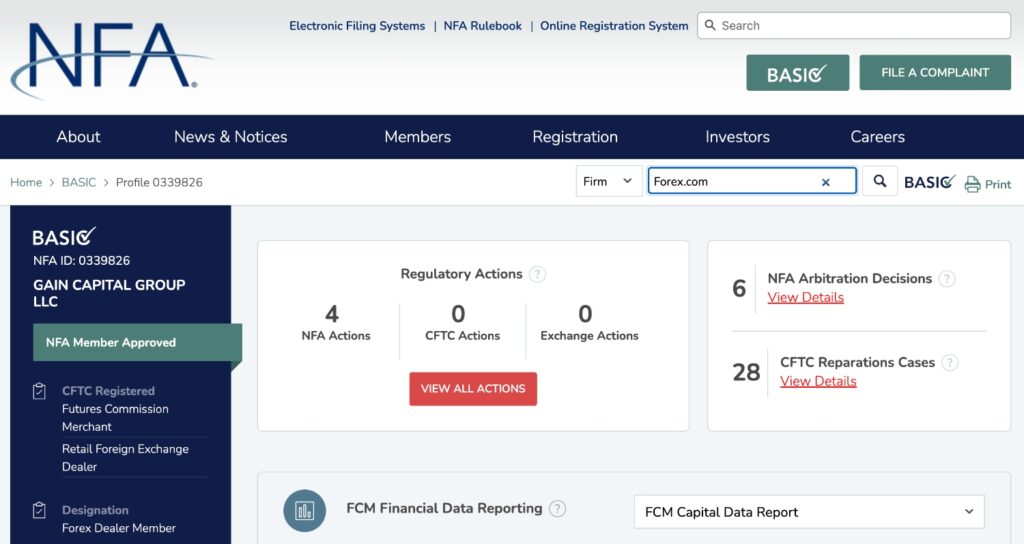

We chose brokers authorized by trustworthy regulators to help protect day traders from scams. This is especially important given that the US Commodity Futures Trading Commission (CFTC) has warned it has “witnessed a sharp rise in forex trading scams in recent years”.

Picking a well-regulated broker also ensures important measures are in place to protect your account, including negative balance protection so you can’t lose more than your balance, limits on leverage to curtail excessive losses, and restrictions on forex bonuses to discourage over-trading.

You can check whether a forex broker is regulated by following these steps:

- Run the firm’s license number (normally visible at the bottom of their website) through the regulator’s online register.

- Confirm the brokerage is allowed to accept traders in your country, either through a local regulator or through an alternative, reputable body.

NFA License – FOREX.com US (Gain Capital Group LLC)

Our analysis below shows that our top forex day trading platforms are all authorized by multiple ‘Green-Tier’ regulators and have earned high trust scores, reflecting their regulatory credentials, industry reputation, and our traders’ direct experiences during the exhaustive review process.

That said, AvaTrade comes out on top with its long row of regulatory licenses and secure day trading environment, featuring bespoke risk management tools you can’t find elsewhere.

Comparison of Regulators & Safeguards

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| Regulators | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, CySEC, SCB | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FRSA, BVI, ADGM | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Negative Balance Protection | Yes | Yes | Yes | Yes (Except US) | Yes | Yes | Yes (Except US) |

| Trust Rating | 4.6/5 | 4.4/5 | 4.8/5 | 4.9/5 | 4.6/5 | 4.8/5 | 4.7/5 |

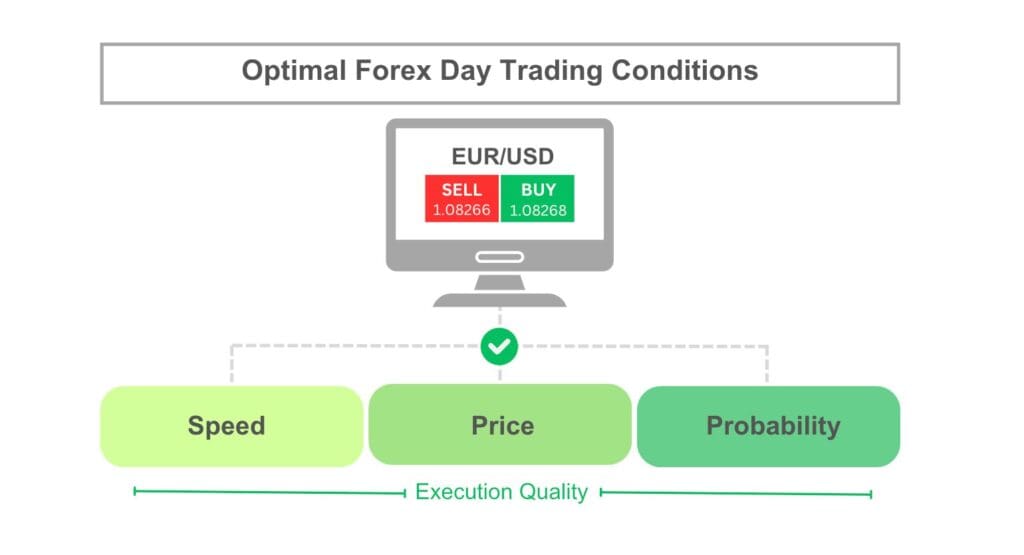

Order Execution

We chose forex trading platforms with fast and reliable order execution, preferably <100 milliseconds with no requotes, given the nature of short-term trading and the dynamics of the foreign exchange market.

The forex market is highly volatile, more so than say stocks, with rapid fluctuations that day traders need to capitalize on to generate profits. Fast execution speeds help ensure currency trades are carried out as close to the desired entry and exit points as possible while minimizing slippage.

Additionally, since day traders typically use leverage to amplify their buying power, even small fluctuations in currency values can trigger substantial returns or losses, with reliable execution helping to maximize returns and keeping a handle on the risks.

Our analysis below shows that all of our best forex brokers meet our benchmarks for order quality, with Pepperstone excelling for its ultra-fast speeds of 30ms.

Comparison of Execution Quality

| Pepperstone | Eightcap | CMC Markets | IG | IC Markets | AvaTrade | FOREX.com | |

|---|---|---|---|---|---|---|---|

| Reliable Order Execution | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

FAQ

What Is Day Trading Forex?

Day trading forex involves speculating on the fluctuations in exchange rates between currencies, such as the EUR/USD or GBP/USD.

Day traders can make a profit by correctly predicting whether the value of one currency will rise or fall relative to another within the same trading day.

How Do I Start Forex Day Trading?

To start day trading forex you will need to open an account with an online broker. You will also need starting capital to fund your account and execute day trades.

Our analysis shows that many of the best forex day trading platforms accept new clients with a minimum deposit up to $250. However, some brokers stand out with no minimum investment, catering to budget traders – the highest-rated is Pepperstone.

Importantly, you will also need a strategy to help you decide which currency pairs to speculate on and when to exit and enter the market. A sensible approach to risk management is also required to ensure you do not lose more than you can afford.

What Is The Best Broker For Day Trading Forex?

The best broker for day trading forex is Pepperstone.

Runners-up based on our latest tests in 2024 are Eightcap, CMC Markets, IG, IC Markets, AvaTrade, and FOREX.com.

What Is The Most Popular Forex Trading Platform?

MetaTrader 4 (MT4) is the most popular forex trading platform.

The third-party trading solution, designed for trading currencies, is offered by the majority of online brokers as a desktop client, web trader and mobile app, having been downloaded from the App Store and Google Play more than 10 million times.

Recommended Reading

For Specific Countries

- Best Forex Brokers In Malaysia 2024

- Best Forex Brokers In Singapore 2024

- Best Forex Trading Platforms In Saint Helena 2024

- Best Forex Trading Platforms In Uzbekistan 2024

- Best Forex Trading Platforms In Bangladesh 2024

- Best Forex Trading Platforms In Pakistan 2024

- Best Forex Trading Platforms In Sri Lanka 2024

- Best Forex Trading Platforms In Qatar 2024

- Best Forex Trading Platforms In Palestine 2024

- Best Forex Trading Platforms In Cameroon 2024

- Best Forex Trading Platforms In South Korea 2024

- Best Forex Trading Platforms In The United Arab Emirates In 2024

- Best Forex Trading Platforms And Brokers In Trinidad & Tobago 2024

- Best Forex Brokers In Jamaica 2024

- Best Forex Trading Platforms In Zambia 2024

- Best Forex Trading Platforms In Somalia 2024

- Best Forex Trading Platforms In Ethiopia 2024

- Best Forex Brokers In Ghana 2024

- Best Forex Brokers In Cyprus 2024

- Best Forex Brokers And Trading Platforms In Tanzania 2024

- Best Forex Brokers In Uganda 2024

- Best Forex Brokers In Zimbabwe 2024

- Best Forex Brokers In Nigeria 2024

- Best Forex Brokers And Trading Platforms In Eswatini 2024

- Best Forex Brokers In Lesotho 2024

- Best Forex Brokers In Namibia 2024

- Best Forex Brokers In Botswana 2024

- Best Forex Trading Platforms In The US 2024

- Best Forex Brokers In Kenya 2024

- Best Forex Brokers And Trading Platforms In Australia 2024

- Best Forex Trading Platforms in India 2024

- Best Forex Trading Platforms In Canada 2024

- Best Forex Brokers In The UK

- Best Forex Brokers In South Africa