GARP Risk Institute | GARP (original) (raw)

The research and thought leadership arm of GARP

GARP Risk Institute is the research and thought leadership arm of GARP. It helps leaders across the commercial and regulatory sectors by examining risk management trends and challenges and proposing impactful approaches. With a current focus on sustainability and climate change risk, GARP Risk Institute creates articles, reports, webcasts, podcasts, and other forms of neutral, fact-based content for its climate risk resource center. GARP Risk Institute also moderates conversations at its annual Climate Symposium and convenes stakeholders to elevate awareness and advance best business practices.

Visit the Global Sustainability and Climate Risk Resource Center

Articles

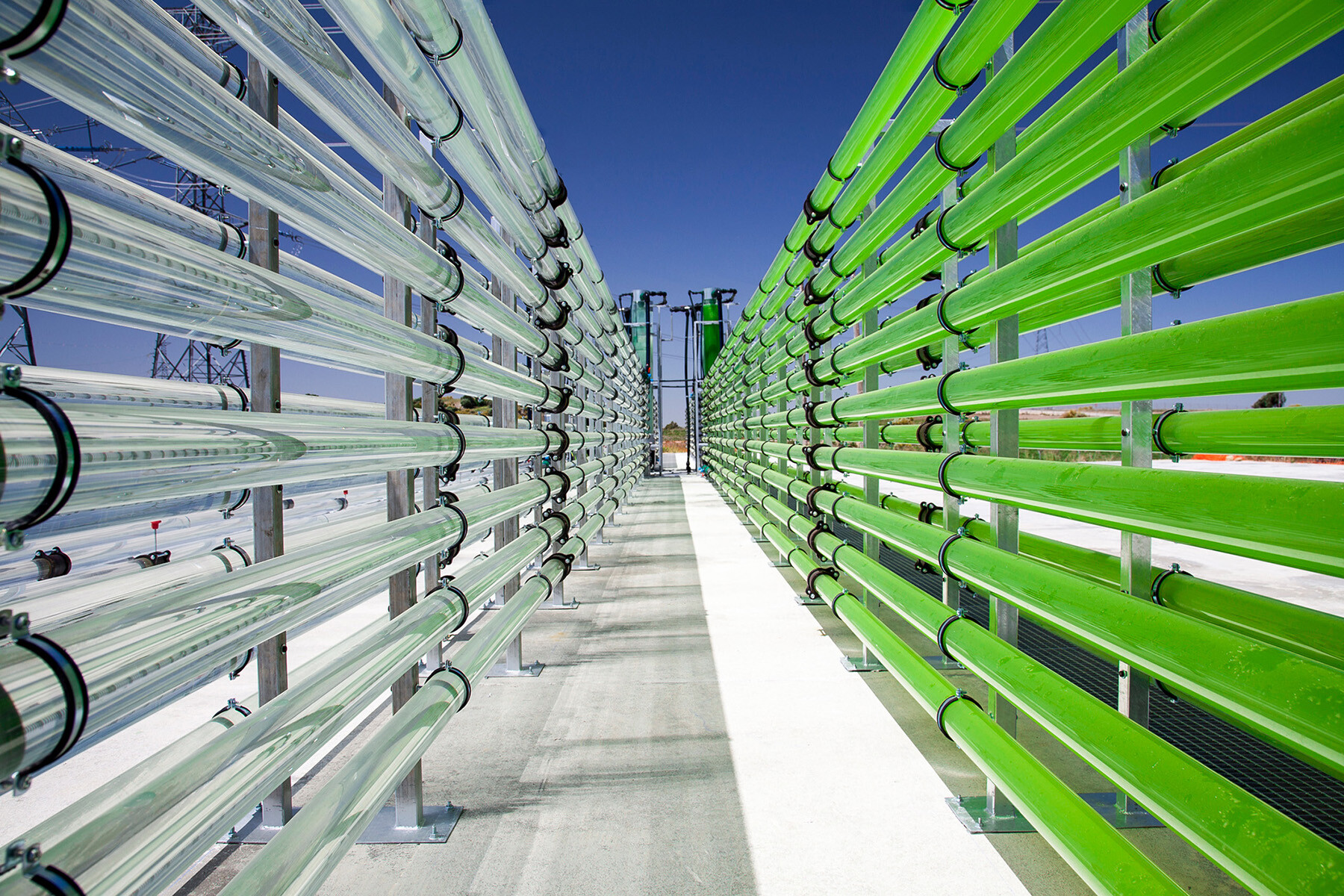

SUSTAINABILITY & CLIMATE

Climate Risk Leadership: Lessons From 4 Annual Surveys

In this new report, GARP Risk Institute examines key trends from the previous four annual Global Climate Risk Surveys, offering a holistic view of the evolution of climate risk practices as well as insights into how the most advanced firms are managing climate risk.

SUSTAINABILITY & CLIMATE

Biodiversity Loss: An Introduction for Risk Professionals

In this new report, GARP Risk Institute examines the nature of biodiversity loss, its connection with climate change and why it has gained increasing focus as an urgent and systemic environmental threat that demands the attention of risk managers and their firms.

SUSTAINABILITY & CLIMATE

Fourth Annual Global Survey of Climate Risk Management at Financial Firms: Steady Progress Amid Increasing Regulatory Scrutiny

The 2022 edition of our annual Global Survey of Climate Risk Management at Financial Firms offers updated, independent insights into climate risk management across the financial system today, along with the challenges companies are facing in incorporating climate risk into business-as-usual risk management.

SUSTAINABILITY & CLIMATE

Steering the Ship: Creating Board-Level Climate Dashboards for Banks

As climate change risks increase worldwide, company boards will be critical in ensuring their firms remain resilient and on a path to carbon neutrality. Developed through insights from 50 top financial institutions, this collaborative report from GARP and the United Nations Environment Programme Finance Initiative (UNEP FI) provides banks with a comprehensive framework for establishing a board-level climate dashboard that can be used to report decision-useful climate information and metrics.

SUSTAINABILITY & CLIMATE

2022 Best Practices of Climate Risk Management Leaders

In this paper, GARP Risk Institute highlights the best practices implemented by climate risk management leaders and outlines the steps others can take to join them. The study captures the key dimensions of firms’ climate risk management including governance; strategy for dealing with actual and potential climate risks; metrics, targets, and limits used to assess and manage climate risks and opportunities; and more.

View Past Report:

2020

TECHNOLOGY

Cryptocurrencies, Stablecoins and CBDCs: A Primer for Risk Managers

Digital currencies pose risks to financial institutions, nonfinancial firms, investors and others. This primer introduces cryptocurrencies (such as Bitcoin), stablecoins (such as Tether) and central bank digital currencies, and offers a practical breakdown of both the familiar and unfamiliar risks they present.

MARKET

A Guide to the Leveraged Loan Market: Evolution, Players and Risks

Leveraged loans are on track to be the next subprime, imposing large losses on lenders and the economy and destabilizing the financial system. Understanding the players, the instruments and the history behind this highly-complex market is vital to limiting the risks. Each of the four articles in this series offers a unique perspective.

SUSTAINABILITY & CLIMATE

Climate Risk Management at Financial Firms: Challenges and Opportunities

The treatment of climate risk at financial institutions has changed significantly over the past five years. Whereas it used to be viewed mostly as a reputational risk that could be addressed through the environmental, social and governance (ESG) agenda, climate change is now seen by many firms as a financial risk that needs to be integrated into existing risk management frameworks.

OPERATIONAL

Building Operational Resilience: The Critical Need to Learn from Failure

Three distinct points of view are presented on turning lessons learned from failures into the building blocks of an organization's resilience. These include a review of cross-industry insights, guidelines for effective incident reporting and perspective on the connection between culture and misconduct. As threats have grown increasingly complex, firms must anticipate, prepare for and learn from operational failure.

CULTURE & GOVERNANCE

A Code of Practice for Supervisory Stress Tests

The quality of supervisory stress tests could be significantly improved through international agreement on a common framework. While not all aspects of stress testing should necessarily be harmonized, there are elements that would benefit both supervisors and banks, reducing the costs involved, improving the quality of the outputs and making the Basel Principles on Stress Testing more achievable.

OPERATIONAL

Model Risk Management at the Crossroads: Meeting New Demands with Limited Resources

The number of models used by financial firms has risen significantly. This reflects many factors, such as regulatory requirements and the opportunities offered by advanced analytics to improve firms’ performance. Models are used to address a wide range of issues, from meeting regulatory requirements to identifying potential new customers and more.

Leadership

JO PAISLEY

President

Jo Paisley’s career began at the Bank of England where she worked in various economist roles, ran the Statistics Division and spent the last part of her career in Supervision.

Inquiries

For questions or to learn more about GARP Risk Institute, please contact our team.