Current Accounts | Open A Current Account Online - HSBC UK (original) (raw)

Make managing your money easy with an HSBC current account. Apply for your account today and take full control of your finances.

Show your money who's boss with our Bank Account. Discover an account that gives you everything you need for everyday banking, with no monthly account fee.

Not sure which account to choose? Compare our current accounts and find the one that suits you best.

We make switching banks simple. Make the move from your old bank to HSBC in just a few easy steps.

What kind of current account are you looking for?

All accounts

Make day-to-day banking a breeze with our everyday current accounts.

Business accounts

Find an account that works for you, whether you're a start-up, sole trader or SME.

Before you get your current account

Read our guides to make sure you've got your head around the finer details.

Overdrafts explained

Find out how overdrafts work, how you can use them, and things to watch out for.

Our most popular bank accounts

Premier Bank Account

The premium bank account that gives you access to preferred products, Premier specialists and exclusive benefits and rewards.

You must meet one of the following criteria:

You must have either: (1) an income of £100,000+, or (2) £100,000 in savings or investments with us, or (3) hold and qualify for HSBC Premier in another country or region. Other eligibility criteria and T&Cs apply.

Bank Account

Our most popular, everyday current account that provides all you need to stay on top of your finances.

Gives access to retail offers and our Regular Saver Account, with no monthly account fee.

Advance Bank Account

Everyday banking with retail offers and no monthly account fee.

You'll need to be a UK resident, 18+ and qualify for an optional arranged overdraft of at least £1,000. Other eligibility criteria and T&Cs apply.

What other people are asking

What is a current account?

Current accounts are bank accounts designed to make and receive everyday payments including managing your income and everyday spending. You can use a current account to:

- Pay household bills

- Set up Direct Debits or standing orders to make regular payments

- Receive money such as your salary, pension, or benefits payments

- Withdraw money from cash machines

- Pay for goods and services with a debit card

Current accounts sometimes include an arranged overdraft facility. This allows you to borrow money over a short period of time, though you're likely to be charged interest for using it. How many current accounts can I have?

There’s no hard limit on the number of current accounts you can have. You may want to have a different current account for different types of spending. For example, you may want separate accounts for:

- Everyday spending

- Travelling

- Direct Debits and standing orders

You can also open a joint account with someone else, for example to share household costs or other joint spending. How do I switch current accounts?

Tell your bank or building society you want to switch bank accounts using the Current Account Switch Guarantee.

They'll take care of everything from there. This will include making sure your balance and any incoming or outgoing payments are switched to your new account.

You can switch your current account to HSBC in just 7 days.

Do you get interest on a current account?

Most current accounts won’t pay any interest on your balance. Those that do pay interest may come with criteria that you have to meet, like paying in a certain amount each month.

A savings account or Cash ISA is a good option for building your savings and interest.

Does opening a current account affect credit score?

You may see your credit score lower temporarily when you open a new bank account. If you need to open multiple accounts, try to wait before opening the next one. This will give your credit score time to recover.

How do I open a current account?

There are different ways to apply for a current account:

- Online or in a mobile app

- In branch

- By telephone

- By post

Make sure you have all the documents you need to open a current account. What's the difference between current account and savings account?

A current account is designed for making and receiving everyday payments, while a savings account helps you build up money over time for larger purchases or emergencies.

Unlike most current accounts, a savings account lets you earn credit interest on the money you pay in. Different savings accounts also have different features. For example, you may get a higher interest rate if you don’t withdraw money for a set period.

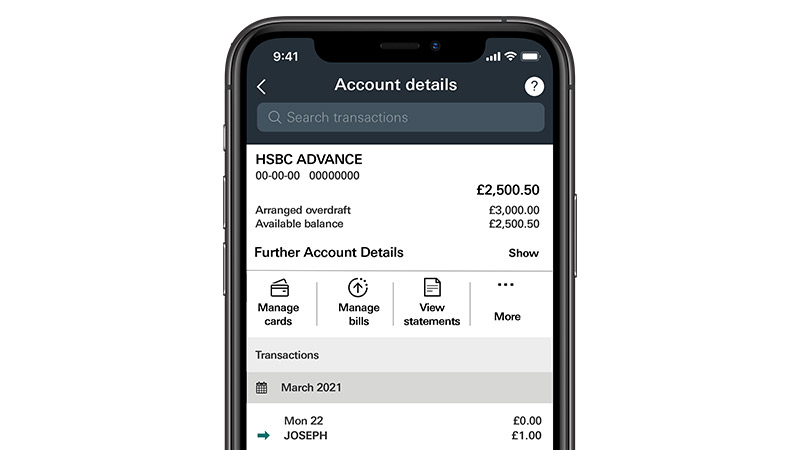

Banking at your fingertips

Take a look at our app

Managing your money is easy and secure with our Mobile Banking app. Device restrictions apply.

Make the most of your current account

Find out how you can use your account to stay on top of your money.

What is a bank transfer?

If you need to move money electronically, a bank transfer allows you to send money both locally and internationally.

What is a standing order?

Making regular fixed payments to another account? A standing order can help you streamline the process.

What is a Direct Debit?

If you have multiple bills or subscriptions, approving automatic withdrawals can save you time and simplify payments.

What is Faster Payments?

Need to quickly transfer money between two UK accounts? Learn how a real-time payments system helps you do this.