Opex (operational expenditure) (original) (raw)

Opex (operational expenditure) is the money a company or organization spends on an ongoing, day-to-day basis to run its business. These expenses can be one-time or recurring. Depending on the industry, these expenses can range from the ink used to print documents to the wages employees are paid. Businesses might also pay for cloud computing services and car leasing out of Opex.

Opex includes selling, general and administrative expense, which are costs incurred through the main business activities, or overhead. Opex excludes the cost of goods sold (COGS), which are costs directly attributable to the production and sales of specific goods and services, including raw materials and components.

Opex is used to calculate operating income, which is then used to calculate net income -- or the bottom line -- as shown in the following formulas:

Gross profit = revenue - COGS

Operating income = gross profit - OPEX - depreciation - amortization

Net income = operating income - interest - taxes

Profit margin is then calculated as follows:

Gross profit margin = gross profit / revenue

Operating profit margin = operating income / revenue

There's often an indirect correlation between Opex and the stock price of a company. When business operations maintain the same level of production and quality, while decreasing Opex, the profit margin increases. Consequently, the overall value of the enterprise also increases.

How operational expenditures compare to capital expenses

What is the difference between Opex and Capex?

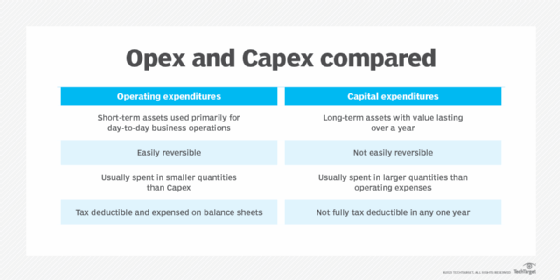

When a business wants to buy something, it can buy it out of Opex or capital expenditure (Capex). Opex is used for small, one-time or regularly occurring expenses; Capex is used for large, one-time expenses.

Operational expenditures are listed on income statements and can be deducted for the year in which the expenses occurred. Capital expenditures are spent on the improvement or purchase of fixed assets. Capital expenditures are listed on a company's balance sheet -- or in a cash flow statement when they are considered as investments. Capex generally can't be directly deducted from taxes. However, fixed assets can be depreciated over time to spread out the expense over the useful life of the assets.

Operational expenditures are usually smaller, regularly occurring expenses that a lower-level manager can approve. Capital expenditures are usually for major purchases designed to be used long term and generally require approval higher up in the organization.

Cloud computing services are usually bought through Opex, which provides flexibility. A pay-as-you-go pricing model doesn't lock a company into a long contract. A company only pays for what its users consume rather than a specified amount of resources.

What are some examples of Opex?

Opex focuses on the following day-to-day business expenses:

- equipment leases

- rent

- professional fees

- license fees

- payroll

- electricity and gas

- internet and phone services

- cloud computing services

- car leases

- property taxes

- travel expenses

What are some examples of Capex?

Capex falls into two categories: tangible and intangible assets. Tangible assets refer to items a person can physically touch, such as equipment, whereas intangible assets include items of value that can't be touched, such as trademarks. Capex examples include the following:

- real estate

- land

- buildings

- furniture

- computers

- software other than software as a service

- machinery and equipment

- vehicles

How do the leading public cloud providers stack up? Learn what features AWS, Microsoft and Google offer, as well as pricing.

This was last updated in February 2023