2024 Search Market Share: 5 Hard Truths About Today's Market (original) (raw)

When it comes to online search, people can choose from more than 20 different search engines. Most, however, stick with the most popular search engines, like Google and Bing.

Other contenders include search engines like Baidu, Yahoo, Yandex, OneSearch, DuckDuckGo, Naver, and Dogpile. Haven’t heard of these search engines?

You’re probably not alone since Google holds the top spot with ease. The search market share for 2022, however, does hold a few hard truths.

Keep reading to learn more about the five difficult facts of today’s search engine market share!

P.S. Want more search traffic for your website? Enter your URL here to get personalized SEO recommendations in 60 seconds!

1. Google doesn’t lead search engine market share, it dominates

With a more than 90 percent market share in 2022, Google claims the top spot with ease. While search engines like Bing, Yandex, and Yahoo take the number two, three, and four spots, their market share doesn’t compare to Google. Google’s domination of the search engine market is unprecedented, resulting in claims that the company maintains a monopoly on search. For users, however, Google provides exactly what they need.

Since the search engine launched in 1998, it’s undergone dozens of updates, refining its algorithm to provide users with relevant results and seamless search experience.

The company’s ability to deliver personalized results, based on features like browsing history and location, also enhances its value. This emphasizes which search engine digital marketers should focus on for search engine optimization (SEO).

While companies may receive website traffic from Bing and Yahoo, it’s Google that sends the most traffic and sets the standard for search engine algorithms.

2. Amazon rethinks how people search and shop, capturing search market share

In recent years, analysts have seen a shift in search market share between Amazon and Google.

Today, more than 50 percent of product searches start on Amazon, not on Google. While product searches are only one small part of the 5.6 billion searches that Google processes each day, they still contribute to the company’s search market share.

They also impact Google’s business model, which includes pay-per-click (PPC) advertising. A product search on Google often features a series of shopping ads, which encourage users to click and buy the item advertised.

It’s worth mentioning Google’s involvement in shopping ads because of Amazon’s evolving business model. Amazon’s invested in advertising services for Amazon.com, allowing businesses to promote their products across the website and in product searches.

The move’s proven successful, with Amazon now ranking as the number three advertising platform, behind Google and Facebook.

That translates to an annual investment of more than $31 billion by businesses. As Amazon changes how people search for products, as well as how companies advertise their products, it impacts Google’s operations on multiple levels.

From taking the search market share to valuable advertising dollars, Amazon is becoming a competitor to Google, at least in the advertising and ecommerce space. If you want to learn more about Amazon advertising, check out our recommended readings below!

Recommended Reading: Types of Amazon Ads

Recommended Reading: Amazon Advertising Platform

Recommended Reading: Amazon SEO Services

3. Bing leverages Yahoo to maximize its search engine market share

When looking at the search market share of Bing in 2022, many people forget about the search engine’s deal with Yahoo, another top search engine.

This agreement skews the search engine market shares of both Bing and Yahoo. Back in 2009, Microsoft (which owns Bing) approached Yahoo with the possibility of Bing powering all Yahoo searches. Yahoo agreed, and the change went live in 2012.

A few years later, in 2015, the companies modified the agreement so that Bing only powered the majority of Yahoo searches. Even though Bing and Yahoo operate as separate websites, they both rely on the Bing search algorithm.

While some users may prefer Yahoo, not many of them realize that their results come from Bing, rather than Yahoo. From one perspective, you could look at the search engine market share of Yahoo as evidence of the company’s brand value.

While Bing doesn’t compare to Google, it does provide an example of a search engine that managed to accelerate its market share through collaborations and partnerships.

4. DuckDuckGo highlights user privacy concerns with real growth in search market share

For many users, privacy while searching is becoming a priority. Even though many users appreciate the personalization provided by their data, like their past browsing history and location, privacy scandals from Facebook and Google have caused some to rethink their preference.

That shift in thinking has allowed DuckDuckGo to show significant growth in search market share in the last few years. The privacy-focused search engine claims the number six spot on search market share lists but more than doubled its number of queries between 2019 and this year, 2024.

In 2022, the search engine had more than 100 billion searches per day.

With its rapid growth, DuckDuckGo provides proof of changing user preferences. Compared to other smaller search engines, like Dogpile, DuckDuckGo also shows an unprecedented level of growth for search engines today.

Like Bing, DuckDuckGo has received support from larger companies, including Apple. In 2014, Apple made DuckDuckGo a search option for its iOS devices, as well as its Internet browser, Safari.

Mozilla also updated its Internet browser, Mozilla Firefox, to include DuckDuckGo as a search option for users. It’s worth mentioning that DuckDuckGo also partners with search engines like Yahoo, Bing, and Yandex to deliver additional search features to users.

For example, the Yahoo partnership allows DuckDuckGo to offer date filters as a search option. With the increase of DuckDuckGo’s market share, it’s becoming a search engine worth watching.

5. Facebook continues to power through privacy scandals

In 2018, Facebook experienced a series of setbacks due to data breaches and privacy scandals. While the press and users aren’t thrilled with the social media network, it continues to perform well in the search market, as well as its revenue channels.

The company’s revenue year-over-year, for example, increased 30 percent in 2018. That year, it also grew its number of monthly users by two percent, another notable accomplishment for a social media network with more than 15 years of history.

That growth hasn’t slowed, either. In 2022, Facebook’s revenue increased by over $31 billion from 2020.

From a search market perspective, Facebook claimed around one percent of the U.S. search engine market share in 2018. While insignificant in comparison to Google, Bing, and DuckDuckGo, it’s a substantial amount for a social media network.

Facebook’s success, however, serves as a direct contrast to DuckDuckGo. While DuckDuckGo grew in response to privacy concerns, Facebook showed zero impact from its mishandling of sensitive data. It’s a thought-provoking study of user behavior, emphasizing the role of social media platforms, like Facebook, on the lives of consumers today.

For businesses, it also demonstrates that marketing and advertising their companies on Facebook is still worthwhile. It’s the top social media network, offering access to advanced ad target options and a vast audience.

The global search engine market in 2022

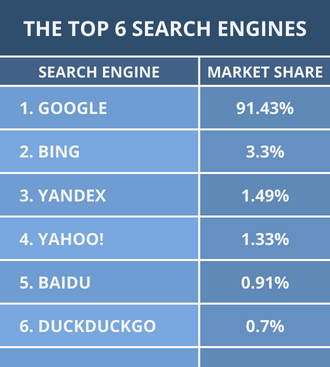

Looking for a complete breakdown of the global search engine market share in 2022? Get a breakdown of the top six search engines worldwide:

Get the latest updates on search market shares

If you’re looking to stay up-to-date on search market shares in 2022 and beyond, our newsletter is the perfect solution. With its exclusive content, plus expert tips and strategies, our newsletter offers everything you need. Join our newsletter today!