Ultra Low Latency Technology in the Trading Industry | Resource (original) (raw)

There are exciting innovations happening across the trading industry today. Leading the charge of what’s next in trading are high-frequency trading firms using algorithms to achieve the fastest trade possible.

But underpinning the lightning-fast trades these firms use to make their fortunes are ultra low latency technologies. These technologies enable transaction data transfers at incredible speeds.

The team at Zayo recently had the pleasure of joining trading industry thought leaders at The Trading Show in Chicago. Zayo’s Director of Product Management, Stacie Loidolt, moderated a panel of industry experts during a session on “Emerging trends in ultra low latency” during the conference.

During the session, we heard from Drake Livingston, Director of Sales at McKay Brothers LLC, Jerry Nelligan, CTO at XR Trading, Tony Pettipiece, Chairman, GRIP Investments, and Ciaran Kennedy, Sales Manager at Orolia. The topics discussed ran the gamut from the challenges faced in the industry today to the promising technologies of tomorrow. However, a few key topics kept coming up during the course of the fascinating 45-minute session.

In this blog, we’ll unpack three key topics that came up during the panel session.

Racing to zero latency with infrastructure innovation

Trading speeds can mean the difference of millions of dollars for high-frequency traders.

For an industry always seeking a faster way to trade, even nanoseconds of latency can make all of the difference. This race to zero latency is not likely to end anytime soon, and getting there comes down to the network. Networking decisions are one piece of the ultra low latency strategy puzzle.

Hollow core fiber optic cable is one of the latest innovations aiming to achieve lower latency and lower loss in the high-frequency trading space. While most fiber is solid core using a propagation medium of solid glass fibers and silicate, hollow core optical fibers are, as the name suggests, instead filled with air. Low latency technology uses only a small amount of physical propagation medium – often glass – to transmit a signal.

What makes hollow core so buzzy in the high-frequency space is speed. In fact – hollow core fiber promises to offer 30-40% faster speeds over traditional fiber. This could have major implications in the long run.

“The long-term goal is to use it like normal fiber over thousands of kilometers,” Livingston explains, “the end goal of hollow core is more than just low latency, it’s wide bandwidth that’s allowed through a medium that doesn’t use silica or glass or a physical substance. If you can provide submarine cables with that, you would have a lot more bandwidth across what is normally a limited resource on a submarine cable.”

For an increasingly globalized trading space often hindered by the latency that long distances bring, this could be huge.

Transform your business with Zayo

The necessity for accurate timestamping in high-frequency trading

Accurate, provable timestamping is absolutely critical to high-frequency trading firms today. Without it, financial services firms would have a hard time verifying transactions, justifying ownership, and settling disputes. Digital ledger technology records the exact time in which a trade is executed, allowing financial services firms to accurately trace transactions to the nanosecond.

Today, thanks in large part to ultra-low latency trading, traders are responding to transactions in 30-40 nanoseconds. But how time is tracked differs amongst firms.

In the US, exchanges often timestamp on the way into the exchange, changing the game a little bit. “Once you start timestamping on the way into the exchange, it’s no longer about time to execution, but who gets there first,” Kennedy discusses.

Kennedy uses the analogy of ticket lines for a concert to explain this phenomenon, “[Let’s say you] queue for tickets for a concert and three record stores are queueing outside but it’s for the same pool of tickets. That’s kind of the way it will likely go with timestamps.”

White Rabbit is one innovation discussed during the panel that ensures high-precision, nanosecond-level timing. Leaders in the high-frequency trading industry use this technology to provide the same time reference within and across different geographical locations.

The battle between regulation and technology

Regulations within the high-frequency trading space bring consistency, smoother transactions, and dispute resolution. However, they also put the onus on firms to find network and cloud-based solutions like digital ledger technology, outlined above. This technology is used to accurately, verifiably, and securely timestamp transactions in order to comply with regulatory requirements.

“I don’t think the regulation has caught up to what the technology is doing yet,” Kennedy admits.

Markets in Financial Instruments Directive II (MiFID II), the regulatory reporting framework in Europe, for example, puts timestamping in the millisecond range while firms are already trading in the tens of nanoseconds range.

Unfortunately, some of the rules governing the fast-paced world of high-frequency trading are dated and unclear. It isn’t always readily apparent how these rules apply to the technology being used, leaving a grey area and confusion for trading firms.

These rules and regulations certainly exist today, but there are often no ways to detect when they’re broken. Some firms may follow the rules, but there are certainly firms getting away with not following them. Specifically, some crypto exchanges are thriving in the absence of clear rules and taking advantage of the grey area.

Pettipiece says about this: “If the HFT players are into crypto, they’ll take advantage of the slowness and the size of spreads. All the exchanges are different – they have really bad protocols, there are no central books so they go out there in the central exchanges, put up what’s called a mempool where all the transactions are waiting to be cleared and they copy it, sample, and front-run it. They’re frontrunning everyone else because they’re taking advantage of it.”

To be most effective, the regulations today must consider the technology trading firms and crypto exchanges are using today and will be using tomorrow.

Zayo Empowers What’s Next for High-Frequency Trading

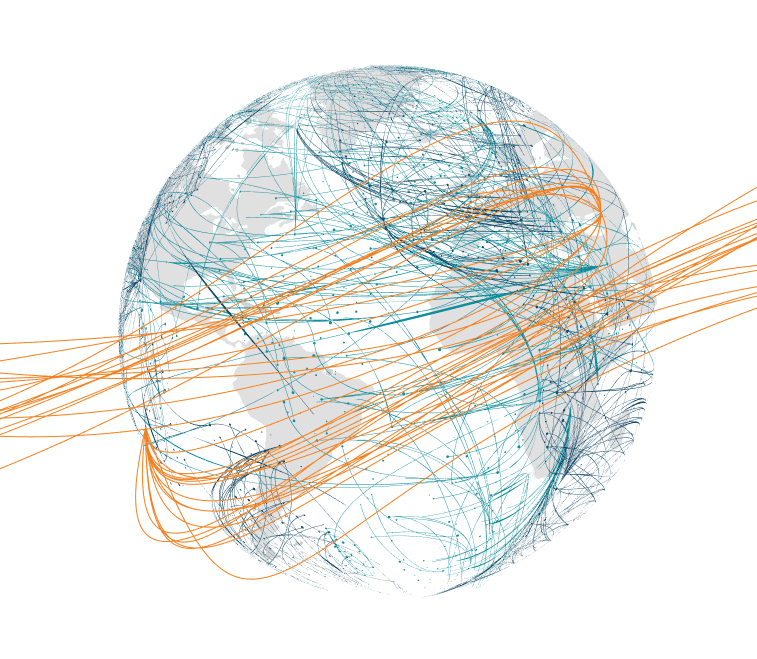

Zayo’s Global Low Latency Exchange Network provides dependable, low latency connections to key financial and commerce centers around the world. Our direct, diverse fiber portfolio includes the fastest, most secure paths between New York and Chicago, Chicago and Toronto, and the New Jersey Equity Triangle.

What’s more, our recent coast-to-coast upgrades to 400G Wavelengths ensure our customers in financial services have the bandwidth to innovate from the technology hub of San Jose to the financial world capital of New York City.