Neuromarketing: the hope and hype of neuroimaging in business (original) (raw)

. Author manuscript; available in PMC: 2011 Apr 1.

Published in final edited form as: Nat Rev Neurosci. 2010 Mar 3;11(4):284–292. doi: 10.1038/nrn2795

Abstract

The application of neuroimaging methods to product marketing — neuromarketing — has recently gained considerable popularity. We propose that there are two main reasons for this trend. First, the possibility that neuroimaging will become cheaper and faster than other marketing methods; and second, the hope that neuroimaging will provide marketers with information that is not obtainable through conventional marketing methods. Although neuroimaging is unlikely to be cheaper than other tools in the near future, there is growing evidence that it may provide hidden information about the consumer experience. The most promising application of neuroimaging methods to marketing may come before a product is even released — when it is just an idea being developed.

Despite many common beliefs about the inherently evil nature of marketing, the main objective of marketing is to help match products with people. Marketing serves the dual goals of guiding the design and presentation of products such that they are more compatible with consumer preferences and facilitating the choice process for the consumer. Marketers achieve these goals by providing product designers with information about what consumers value and want before a product is created. After a product emerges on the marketplace, marketers attempt to maximize sales by guiding the menu of offerings, choices, pricing, advertising and promotions.

In their attempts to provide these types of inputs, marketers use a range of market research techniques, from focus groups and individual surveys to actual market tests — with many approaches in between (see Supplementary information S1 (box)). In general, the simpler approaches (focus groups and surveys) are easy and cheap to implement but they provide data that can include biases, and are therefore seen as not very accurate1–4. The approaches that are more complex and therefore harder to implement, such as market tests, provide more accurate data but incur a higher cost, and the product, production and distribution systems have to be in place for market tests to be conducted. There are some compromise approaches between these two extremes, which include simulated markets, conjoint analyses, markets for information and incentive-compatible pricing studies (see Supplementary information S1 (box) ). As in all compromises, these approaches provide solutions with intermediate levels of cost, simplicity, realism and quality of data (TABLE 1).

Table 1.

Comparison of selected marketing research approaches

| Focus groups | Preferencequestionnaires | Simulated choicemethods | Market tests | |

|---|---|---|---|---|

| What is measured | Open-ended answers,body language andbehaviour; not suitable forstatistical analysis | Importance weighting forvarious product attributes | Choices among products | Decision to buy andchoice among products |

| Type of response process | Speculative, except whenused to assess prototypes | The respondent must tryto determine his decisionweightings throughintrospection, then mapthose weightings into theresponse scale | A hypothetical choice,so the same process asthe actual purchase —but without monetaryconsequences | An actual choice, withcustomers’ ownmoney, and therefore fullyconsequential |

| Typical use in new-product development processes | Early on to aid generalproduct design; at userinterface design forusability studies | Design phase, whendetermining customertrade-offs is important | Design phase, whendetermining customertrade-offs is important;may also be used as aforecasting tool | End of process, to forecastsales and measurethe response to otherelements of marketing,such as price |

| Cost and competitive risk | Low cost; risk comes onlyfrom misuse of data by theseller | Moderate cost andsome risk of alertingcompetitors | Moderate cost (higherif using prototypesinstead of descriptions)and some risk of alertingcompetitors | High cost and high risk ofalerting competitors, plusthe risk of the productbeing reverse engineeredbefore launch |

| Technical skill required | Moderation skills forinside the group andethnographic skills forobservers and analysts | Questionnaire design andstatistical analysis | Experiment designand statistical analysis(including choicemodelling) | Running an instrumentedmarket and forecasting(highly specialized) |

The incorporation of neuroimaging into the decision-making sciences — for example, neuroeconomics — has spread to the realm of marketing. As a result, there are high hopes that neuroimaging technology could solve some of the problems that marketers face. A prominent hope is that neuroimaging will both streamline marketing processes and save money. Another hope is that neuroimaging will reveal information about consumer preferences that is unobtainable through conventional methods. Of course, with such high expectations, there is the accompanying hype. Several popular books and articles have been published that push a neuromarketing agenda, and there are now a handful of companies that market neuromarketing itself5. In this Perspective, we aim to distinguish the legitimate hopes from the marketing hype. As such, we hope that this article serves the dual purpose of recognizing the real potential of neuro imaging in business and providing a guide for potential buyers and sellers of such services.

Why use brain imaging for marketing?

Marketers are excited about brain imaging for two main reasons. First, marketers hope that neuroimaging will provide a more efficient trade-off between costs and benefits. This hope is based on the assumptions that people cannot fully articulate their preferences when asked to express them explicitly, and that consumers’ brains contain hidden information about their true preferences. Such hidden information could, in theory, be used to influence their buying behaviour, so that the cost of performing neuroimaging studies would be outweighed by the benefit of improved product design and increased sales. In theory, at least, brain imaging could illuminate not only what people like, but also what they will buy.

Thus far, this approach to neuromarketing has focused on this post-design application, in particular on measuring the effectiveness of advertising campaigns. The general approach has been to show participants a product advertisement, either in the form of a print advertisement or commercial, and measure the brain’s response in the form of a blood oxygenation level-dependent (BOLD) measurement, which is taken as a proxy for neural activation.

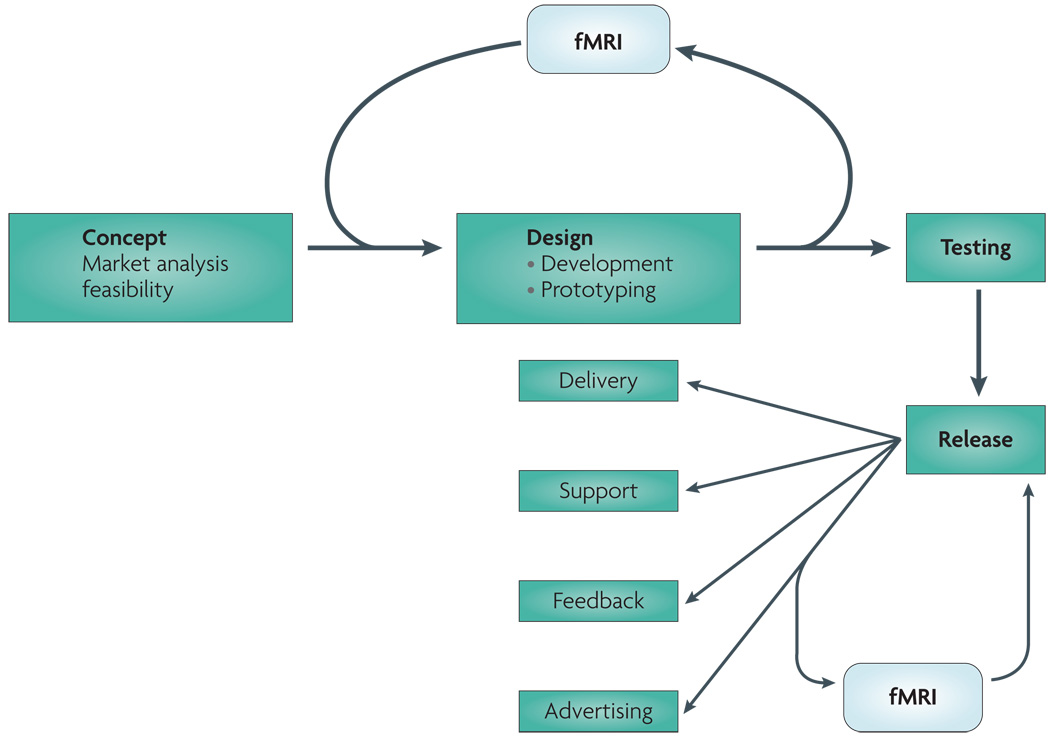

The second reason why marketers are excited about brain imaging is that they hope it will provide an accurate marketing research method that can be implemented even before a product exists (FIG. 1). The assumption is that neuroimaging data would give a more accurate indication of the underlying preferences than data from standard market research studies and would remain insensitive to the types of biases that are often a hallmark of subjective approaches to valuations. If this is indeed the case, product concepts could be tested rapidly, and those that are not promising eliminated early in the process. This would allow more efficient allocation of resources to develop only promising products.

Figure 1. Product development cycle.

Neuromarketing applications of functional MRI (fMRI) can potentially enter into the product development cycle in two places. In the first, fMRI can be used as part of the design process itself. Here, neural responses could be used to refine the product before it is released. In the second, fMRI can be used after the product is fully designed, typically to measure neural responses as part of an advertising campaign to increase sales.

Thus, the issue of whether neuroimaging can play a useful part in any aspect of marketing depends on three fundamental questions, which we will address in this paper. First, can neuromarketing reveal hidden information that is not apparent in other approaches? Second, can neuromarketing provide a more efficient cost–benefit trade-off than other marketing research approaches? Third, can neuromarketing provide early information about product design?

Revealing hidden information

Brain activity and preference measurement

Allowing for the assumption in neuromarketing that the brain contains hidden information about preferences, it is reasonable to set aside, for the moment, the issue of ‘hidden’ and ask what relationships are known to exist between brain activity and expressed (that is, not hidden) preference.

As it turns out, different methods of eliciting a person’s preference often result in different estimations of that preference3,4,6,7. This makes it difficult to know which method provides the truest measure of ‘decision utility’ (that is, the expected utility, which would ultimately drive choice in the marketplace). It is clear that market tests give the most accurate answer, but having to run a market test on every product would defeat the purpose of market research — namely, to provide early and cheap information. Similarly, we suspect (and economists are certain) that methods that are incentive compatible are better than methods that are not. Incentive-compatible elicitation methods are methods that encourage the participant to truthfully reveal what is being asked of him because to do so would maximize the participant’s satisfaction (for example, he would earn the most money or receive the product he likes the best). In other words, it is in the participant’s interest to answer product-related questions truthfully. However, using such methods is not always possible.

One important question for the potential of neuromarketing is whether the neural signal at the time of, or slightly before, the decision (assumed to be a measure of decision utility) can be a good predictor of the pleasure or reward at the time of consumption (the ‘experienced utility’)8. A second question is whether the link between these two signals holds even when the preference elicitation methods are not incentive compatible. If the answer to both of these questions is positive, neuromarketing could become useful for measuring preferences.

Measurements such as willingness to pay (WTP) have only recently come under functional MRI (fMRI) examination. In one experiment, subjects bid on the right to eat snacks during the experiment. The amount they were willing to pay (a measure of decision utility) correlated with activity levels in the medial orbitofrontal cortex (OFC) and prefrontal cortex (PFC)9,10. Interestingly, similar activation in the OFC has been observed when subjects anticipate a pleasant taste11, look at pretty faces12, hear pleasant music13, receive money14,15 and experience a social reward16,17. Such generally close correspondence in regional brain activity between the anticipation of rewarding events, the consumption of enjoyable goods and the willingness to pay for them suggests that the representation of expected utility may rely, in part, on the systems that evaluate the quality of the consumption experience. The theme of common systems for expectation and experience also applies to things that are unpleasant or even painful (although this involves a different network including the insula)18–21. Such similarities suggest that neuroimaging can become a useful tool in measuring preferences, particularly when incentive compatibility is important but there is no easy way to achieve it (for example, when the products have not been created). However, such similarities do not necessarily mean that brain activation is the same across different elicitation methods, and there are differences between the neural activation representing decision utility and that representing experienced utility14,22,23. This caveat aside, the generally close correspondence does suggest that neural activity might be used as a proxy for WTP in situations in which WTP cannot easily be determined — although this has yet to be demonstrated.

Reverse inference and reward

The practice of measuring an increase in BOLD activity in a region such as the ventral striatum or OFC and then concluding that a ‘rewardrelated’ process was active has become increasingly common. This form of deductive reasoning is known as ‘reverse inference’24,25. Given the readiness of many to interpret brain activation as evidence of a specific mental process, it is worth examining this type of inference. Using a Bayesian analysis, it is possible to estimate the specificity of activation in a particular region of the brain for a specific cognitive process. For example, Poldrack used the BrainMap database to analyse the frequency of activation of Broca’s area in language studies24. He found that activation of Broca’s area implied a Bayes factor of 2.3 for language involvement, which means that taking brain activity into account can make a small but significant improvement to one’s prior estimate of whether a language process was involved.

Many studies have shown that striatal activity correlates with hedonic rating scales26. Neuromarketers have been quick to invert this finding and use ventral striatal activity as an indication that an individual likes something; but what is the evidence for this? Using Poldrack’s method to analyse the BrainMap database, we estimated the posterior probability for a reward process given the observation of nucleus accumbens (NAc) activation27. The prior probability of engaging a reward-related process was assumed to be 0.5 (1:1 odds). According to this estimation, based on the number of fMRI papers reported in the BrainMap database with and without ‘reward’, and with and without NAc activation, NAc activation increases the probability of a reward-related process taking place to 0.90 (odds 9:1). This yields a Bayes factor of 9, which is considered moderate to strong evidence for a causal relationship (BOX 1). Although meaningful in a statistical sense, the assumptions behind such a calculation are rather liberal and may suffer from a publication bias for positive results as well as differing definitions of reward. In real-world settings, the ability to infer whether an individual likes something based on NAc activation alone may be substantially less.

Box 1 NAc activation in studies of tasks with and without reward.

The BrainMap database was searched for functional MRI studies with and without a reward task and with and without nucleus accumbens (NAc) activation. The NAc was defined as a bilateral region of interest with vertices from MNI (Montreal Neurological Institute) coordinates (−12, 0, −12) to (12, 12, 0). The frequencies that were obtained are shown in the table below.

Assuming that the prior probability of engaging in a reward-related process is 0.5, calculations showed that NAc activation increases the probability of a reward-related process taking place to 0.90, yielding a Bayes factor of 9:

Probability of NAc activation given a reward task = 27/68 = 0.397

Probability of NAc activation given no reward task = 59/1283 = 0.046

Assuming the prior probability of reward = 0.5, then Probality of a reward task given NAc activation=0.397(0.397+0.046)=0.90

| Reward task | No reward task | |

|---|---|---|

| NAc activated | 27 | 59 |

| NAc not activated | 41 | 1,224 |

In the context of a product likeability experiment, Knutson et al. found significant correlations between NAc activity and product preferences in college students28. However, in logistic regression (R2) calculations aimed at predicting consumer choice, self-reported preferences outperformed brain activation alone. Adding brain activation to a logistic model improved predictions, but only slightly (increasing R2 from 0.528 to 0.533). Re-analysis with more sophisticated machine-learning algorithms further improved the predictive value of brain activation29.

Although some have argued for the existence of a “buy button” in the brain5, current evidence suggests that the cognitive processes associated with purchase decisions are multi factorial and cannot be reduced to a single area of activation. Conversely, a given brain region may be involved in multiple cognitive processes. A recent review of value-based decision making divided the process of making a choice into five categories: representation of the decision; assignment of value to different actions; action selection; outcome evaluation; and learning30. Even within this simplified framework, current data suggest that responses to marketing efforts and consumer choices depend on an array of neurobiological processes, and that no single brain region is responsible for a consumer choice. But is it possible that some brain regions are more involved than others? Because the field of neuroeconomics grew out of early brain-imaging studies of the neurobiology of reward31,32, most of the neuroeconomic data are about valuation mechanisms and the associated responses of dopamine-rich brain regions. The OFC and striatum have been consistently implicated in goal-directed action9,22,33–35. It is also generally accepted that the insula has a key role in physiological arousal, which is typically, although not exclusively, aversive in nature21. But because of the reverse inference problem, using striatal and OFC activity as a read-out of ‘liking’ and the insula as a ‘disgust-meter’ is probably too simplistic to be of use in a real-life setting. In the context of neuromarketing, the statistical power of these single-region correlations may be too low for the correlations to be of use as predictors of consumption unless, perhaps, the neuroimaging data is combined with other measures of preference.

fMRI as a brain decoder

Given the limited power of reverse inference from single-region brain activations, more data-driven methods for interpreting brain imaging data have been at the forefront of analysis techniques. These techniques treat sites of brain activity agnostically — that is, without reference to prior hypotheses. The primary assumption is that, regardless of how an individual’s brain represents information, it does so consistently. The representations may be spatially dispersed, and they may be distributed differently in different individuals, but they can still be reliably detected through multi-voxel pattern analysis (MVPA). Because MVPA methods are not reliant on the activation of a small subset of brain regions, they have substantially increased sensitivity to detect activation36. A crucial advantage of MVPA techniques over approaches in which activation in a particular brain region of interest is measured is that MVPA has the statistical power to predict the individual choices of a subject. Because MVPA involves statistical associations of complex activation patterns that occur when an individual choice is being made, it does not depend on the vagaries of an experimenter interpreting the meaning of an activation map. Some of the most impressive demonstrations of MVPA have been in decoding visual responses to simple stimuli37–39 and subsequently, to watching films40, the meanings of nouns41, event boundaries of written narratives42 and city navigation43,44.

It is possible, even likely, that such methods will soon be able to handle almost any circumstance that can be created in an MRI environment. With increasing stimulus complexity, simple interpretations of brain activation will become more difficult. However, for real-world marketing applications, it may be more important to predict future behaviour than to understand the ‘why’ of behaviour. Such a data-driven application of imaging (perhaps even lacking an underlying theory) is analogous to identifying a genetic polymorphism associated with a particular cancer without understanding what that gene does — which is likely to yield specific but not general insights.

Costs and benefits

As noted above, it is not yet clear whether neuroimaging provides better data than other marketing methods (TABLE 1), but through the use of MVPA methods it might be possible to reveal the ‘holy grail’ of hidden information. Assuming that this is the case, will using expensive neuroimaging ultimately be more efficient than using cheaper methods? Typical charges for scanning in a university research setting average about US$500 per hour. In a commercial setting, these will be higher. However, actual scan charges account for a small portion of the total cost, with personnel and overhead expenses accounting for at least 75% of the costs of an imaging project. If neuromarketing is to compete with conventional marketing approaches on the basis of efficiency, then the costs of labour and overheads will have to be reduced.

One area in which the cost of neuroimaging can be compared with conventional marketing approaches is in the post-design phase, the goal of which is to increase sales of an existing product — for example, through advertisements and other types of framing effects. Early neuromarketing studies therefore used imaging approaches to evaluate consumer responses to advertisements. At this point, it is important to distinguish between neural responses to the consumption of a product (that is, experienced utility) and neural responses to representations of the product that may lead to future consumption. Only certain types of products can be consumed in an MRI scanner. Therefore, much of the post-design neuromarketing literature has focused on brain responses to visual representations of products, such as pictures28,45 or advertisements for the product46–48; however, these advertisement studies, which used magneto encephalography and electroencephal ography (BOX 2), did not link imaging data to actual purchase decisions or other ratings, so it is not yet possible to determine the value of this approach.

Box 2 Neuromarketing technologies.

Functional MRI (fMRI)

The technique uses an MRI scanner to measure the blood oxygenation level-dependent (BOLD) signal. The BOLD changes are generally correlated with the underlying synaptic activity. Spatial resolution is 1–10 mm, and temporal resolution is 1–10 s. In general, the higher the spatial resolution, the lower the temporal resolution. Of the three imaging technologies described in this Box, fMRI has a substantial advantage in resolving small structures and those that are deep in the brain. However, some important brain regions, especially the orbitofrontal cortex, are affected by signal artefacts that may reduce the ability to obtain useful information. State of the art MRI scanners cost approximately US$1 million per Tesla and have annual operating costs of 100,000–100,000–100,000–300,000.

Electroencephalography (EEG)

EEG uses electrodes applied to the scalp and measures changes in the electrical field in the brain region underneath. EEG has very high temporal resolution (milliseconds) and can therefore detect brief neuronal events. Because the skull disperses the electrical field, EEG has low spatial resolution (~1 cm) that depends on how many electrodes are used. The number of electrodes can be as few as two or range up to hundreds in high-density arrays. The greater the number of electrodes, the better the spatial resolution. Apart from the low spatial resolution, EEG has poor sensitivity for deep brain structures. Equipment costs can be low (<$10,000) but increase with high-density arrays and the concomitant resources needed to process the data. A common technique is to measure the left–right asymmetry of the frontal EEG78. This is typically measured by the power in the alpha band (8–13 Hz). This research has suggested that relatively greater activity in the left frontal region is associated with either positive emotional states or the motivational drive to approach an object79. Although there are strong correlations between frontal EEG asymmetry and personality traits, the degree to which the asymmetry changes from moment to moment is still debated. Some have suggested a minimum of 60 s to reliably estimate power asymmetry80, in which case the temporal advantage of EEG over fMRI is lost. Although some have used this approach to measure momentary fluctuations in emotion in response to advertisements81, without accounting for autocorrelations in time or multiple statistical comparisons, the validity of such approaches is dubious.

Magnetoencephalography (MEG)

An expensive cousin of EEG, MEG measures changes in the magnetic fields induced by neuronal activity. Thus, MEG has the same advantage of high temporal resolution and, because the magnetic field is less distorted by the skull than is the electrical field, it has better spatial resolution than EEG. Like EEG, MEG is most sensitive to superficial cortical signals (primarily in the sulci). MEG requires a magnetically shielded room and superconducting quantum interference detectors to measure the weak magnetic signals in the brain. An MEG set-up costs approximately $2 million.

Transcranial magnetic stimulation (TMS)

TMS uses an iron core, often in the shape of a toroid wrapped in electrical wire, to create a magnetic field strong enough to induce electrical currents in underlying neurons when placed on the head82. TMS can be used as a single pulse, paired pulse or repetitive stimulation, and the neuronal effects range from facilitation to inhibition of synaptic transmission. As a research tool, TMS has been used to study the causal role of specific brain regions in particular tasks by temporarily taking them ‘offline’.

The role of expectations

It has long been known that the manner in which choices are presented can have a dramatic effect on decisions49. This is where advertisements and product placement come into play. To date, experiments have examined fairly simple choices and responses to things that can be presented in an MRI scanner. Before neuroimaging can be used to predict consumer choice, a greater understanding of the interplay between the decision maker, the elicitation method and the decision context is needed.

BOLD responses are influenced by so-called ‘expectation’ effects, which include pricing effects, biases in the way the choice is presented50 and placebo responses. This suggests that neuromarketing could be helpful in identifying individual differences in consumer reactions to different types of inputs. In a study of neural responses to sips of wine, medial OFC responses were higher when subjects were told that the wine was expensive ($90 per bottle) versus inexpensive ($5 per bottle)23. Activity in this region also correlated with self-report ratings of how much participants liked the wine, even though all wines were actually the same. These results suggest that the instantaneous experience of pleasure from a product — that is, experienced utility — is influenced by pricing, and that this effect may be mediated by the medial OFC9. This result parallels a similar, behavioural finding that the strength of the placebo effect for analgesia is greater for more expensive ‘medications’51. Subjects’ expectations also play an important part in how the experimenter should interpret striatal responses. Many studies have shown that the reward-related signals in the ventral striatum and NAc can be more accurately linked to prediction errors for reward than to reward itself22,52,53.

Placebo responses are an interesting aspect of neuromarketing. The mechanism of the placebo response has been debated for decades54, but ultimately it can be considered an effect of marketing (that is, the actions of a doctor, pharmaceutical company or experimenter). The neural correlates of the analgesic placebo effect are widespread but generally point to a modulation of the cortical pain matrix in the brain55,56. Because consumers cannot consciously report placebo effects, the demonstration of neural correlates of these effects suggests that having access to hidden brain information could enable a marketer to measure the effectiveness of a placebo marketing strategy in a particular individual. How well this type of information generalizes to a larger population will determine the cost–benefit ratio of doing neuroimaging.

The aforementioned manipulations of expectations are simple and direct. For example, the experimenter can manipulate a single dimension of expectation, such as price or descriptive words (for example, “ultra” and “new and improved”), and measure the effect on the consumer behaviourally and neurally. More cognitively complex forms of expectations can be created through advertisements and commercials. Post-design applications of neuroimaging have, for the most part, confirmed what was known about the behavioural effects of product placement, which bypass the counter-arguments in which people naturally engage when facing advertisements. The imaging studies confirm that there are neural correlates of exposure to advertisements but do not directly suggest that maximizing activity in a particular brain region results in more sales.

Culture and advertising

Neuroimaging is often hyped as an exciting new tool for advertisers. Despite its enormous cost, advertising effectiveness is a poorly understood area of marketing. Although advertising has been investigated in a few neuroimaging studies57,58, it is still unknown whether neuroimaging can prospectively reveal whether an advertisement will be effective. In a famous Coke–Pepsi study, participants who described themselves as Coke drinkers showed significant activation in the hippocampus and right dorsolateral PFC when they were cued about the upcoming drink of Coke45. Self-described Pepsi drinkers did not have this response. In the absence of brand information, there was no significant difference in preference during a taste test. The study suggested that any differences in the response (behavioural and neural) to the two brands must be culturally derived. One possibility is that brands achieve a life of their own by becoming animate objects, sometimes with human attributes, in the minds of consumers. However, one fMRI study that compared brain responses to persons and brands found that activation patterns for brands differed from those for people — even for brands with which subjects are identified — suggesting that brands are not perceived in the same way as people59. Another possibility is that specific emotions can be elicited in response to advertisements, although whether neuroimaging will help to reveal these emotions may ultimately be limited by reverse inference constraints, especially if tied to specific regions.

The issue of how culturally derived identities become embedded in the brain is of great interest, not only from a marketing perspective. Although neoclassical economic theory describes a framework in which individuals assess costs and benefits during their decision-making processes, it is clear that people base many decisions on sociocultural rules and identities. Some are in a commercial context (for example, “I am a PC” or “I am a Mac”) but many are not (for example, “I am a Democrat” or “I am a Republican”). These issues extend beyond the mundane questions of advertisement effectiveness and raise the more profound question of how the marketing of ideas affects decision making. But whether neuroimaging provides an efficient tool to answer this question has yet to be shown.

Early product design

As the ability of neuroimaging to predict or influence post-design purchase decisions seems to be limited (see above), neuroimaging may be better suited to gauging responses before products are marketed. The primary reason is that neuroimaging may yield insights into the product experience itself.

Food products

Various food products and beverages have been administered in the MRI scanner, from simple sugar solutions to chocolate, wine, sports drinks and colas. Beverages are particularly easy to administer, with the usual route through a computercontrolled pump attached to a tube that delivers controlled amounts of fluid into the participant’s mouth. The perception of flavour is a multisensory integration process and thus provides several opportunities for neuroimaging to disentangle a complex perception that subjects might not be able to articulate; taste, odour, texture, appearance and even sound all contribute to the gustatory experience. These different dimensions have been mapped onto distinct brain regions but with substantial overlap60,61. The OFC is consistently linked to perceived pleasantness, whereas viscosity and fat content seem to be represented in the insula62. The use of neuroimaging by commercial manufacturers to design a more appealing food product is both feasible and likely. For this to work, however, one would need to identify which dimension of gustation is to be studied (for example, taste, odour or texture) and maximize a brain response to variations in that dimension.

The drawback to such an approach is the possibility of creating food products that are so highly tuned to neural responses that individuals may over-eat and become obese (see BOX 3 for a discussion of some ethical issues related to neuromarketing). Is it possible that such a neuroimaging approach could create a ‘super-heroin of food’ — a product so delicious that all but the most ascetic individuals would find it irresistible? It is an extreme but real possibility. However, that does not mean that neuroimaging is necessarily problematic for food product development. Indeed, the same techniques could be applied to making nutritious foods more appealing.

Box 3 The ethics of neuromarketing.

The introduction of neuroimaging into an environment in which the ultimate goal is to sell more product to the consumer may raise ethical issues.

- Businesses will be able to read the minds of consumers. This concern is about the privacy of thoughts. Can neuroimaging be used to gauge a person’s preferences outside of the specific task being performed? Possibly. This concern may be mitigated through transparency of purpose: subjects must know what kind of endeavour they are helping, and their data should only be used for that purpose.

- Private versus public information about preferences. Individuals need to be able to exercise control over what they choose to reveal about their personal preferences. A privacy breach occurs if neuroimaging reveals a private preference that is outside the scope of the neuromarketer’s research question.

- Information will be used to discriminate against individuals or exploit particular neurological traits found in a subgroup of individuals. Neuroimaging data could potentially target marketing to specific people or groups. Many people would find this tactic repugnant because it exploits a biological ‘weakness’ that only exists in some people. Similarly, this information could be used to time pricing moves to capitalize on individual weaknesses that are known to coincide with particular biological states (for example, raising beverage prices when someone is known to be thirsty).

- Central versus peripheral routes of influence. A central route aims to influence consumers’ preferences about the functional aspects of the product (for example, fewer calories in a beer). A peripheral route attempts to manipulate preferences through things that are peripherally related to the product (for example, sex appeal of people in advertisements). Neuroimaging could potentially be used to enhance both types of influence, but some consider the attempts to optimize the peripheral route more ethically dubious.

- Brain responses obtained from a small group of subjects will be used to generalize to a large population. Of course, this is done all the time in the scientific literature. If neuromarketing data are used in product design and the product injures someone, neuroimaging will be partly to blame.

- Abnormal findings. Approximately 1% of the population will have an abnormality on their MRI83. In a population without clinical symptoms, the clinical significance of an MRI abnormality is unknown. Many will be false positives; others will be real and require referral. Currently, there is no standard for how to handle these situations. However, it is standard practice to have a written policy in place for abnormal findings. Failure to do so opens both the neuromarketing firm and their clients to medical liability.

- A lack of regulation. Traditional marketing methods, because they are not typically viewed as experimentation, have not been subject to institutional review board (IRB) oversight. MRI scans are approved by the US Food and Drug Administration (FDA) for clinical use but, because no diagnosis is being made in a marketing setting, there is the potential to circumvent both FDA and IRB requirements. The burgeoning neuromarketing industry would be well advised to adopt an industry standard of independent review. Clients should demand it.

- Management of perceptions. How will the public react when they discover that neuroimaging has been used to design or market a product? The public’s response to genetically modified food could provide an indication.

- Companies might not be primarily concerned with the best interests of the consumer. Companies and consumers maintain complex relationships in which some of their goals are compatible while others are in conflict. On the one hand, companies seek to design, manufacture and sell products that consumers seek to buy, resulting in compatible goals that benefit both parties. On the other hand, companies also aim to maximize their short- or long-term profits, sometimes to the detriment of their consumers. Much like marketing itself, understanding consumer preferences can be used for goals that are in the best interests of both the company and their consumers or for objectives that are in the interests of the company and to the detriment of their consumers. Which approaches neuromarketers choose is an open question.

Entertainment

As a typical big-budget Hollywood film costs over $100 million, with almost as much spent on marketing, it would be surprising if film producers were not interested in using neuroimaging to improve their product. After static images, films are probably the easiest product to present in the scanner. Moreover, an fMRI measurement is time locked to the film timeline. A film presents the same basic visual and auditory stimuli to everyone viewing it and thus should serve as a cognitive synchronizer. Indeed, an fMRI study of subjects viewing a segment of the classic Western The Good, the Bad and the Ugly40 showed that large extents of the cortex responded similarly in time across subjects, suggesting that much of the cortical response is essentially stereotypical. In another study, the ability to recall narrative content of the TV sitcom Curb Your Enthusiasm three weeks later was correlated with the strength of hippocampal and temporal lobe responses during viewing63.

Such stereotypical responses suggest that fMRI could be used during the editing process. For example, different cuts of a movie could be measured against these cortical responses, which could then be used to select the final cut for release. Although it seems hopelessly complex to interpret such brain responses, it may not be necessary if the only goal is to release the most profitable movie. Provided there were a metric of quality (for example, box office returns or test audience reports), brain activation patterns could be chosen to optimize outcomes without any knowledge of what the patterns meant. Several neuromarketing companies have targeted their efforts towards the entertainment industry but, as most of this work is unpublished, it is difficult to evaluate the quality of the product. However, guidelines for general quality of scientific work can be formulated based on two decades of neuroscience research. Thus, without passing judgment on whether neuromarketing works, we can at least identify the items to look for in a quality operation (BOX 4).

Box 4 What to look for when hiring a neuromarketing firm.

We provide a list, which is by no means exhaustive, of what could be considered standard practice in the application of neuroimaging methods in cognitive neuroscience and related fields. It is based on standard criteria for reviewing research proposals and adapted to a business setting.

- What is to be gained from neuroimaging? Good neuromarketers will begin by discussing the pros and cons of the proposal in detail. For example: what will neuroimaging yield over traditional methods? Ask for data about the predictive value of neuroimaging findings in a real-world setting.

- What are the dependent and independent measurements? Assessing brain activation is not generally useful without correlating it with some other measurement. It is necessary to have another behavioural measurement to anchor the interpretation of the brain activation. Be wary if someone claims to know what a person thinks based solely on brain activation.

- How many subjects are needed? Apart from the simplest of tasks, any task invoking a response that is expected to vary across individuals demands a sample size of at least 30 (REF. 84). If groups of individuals are being compared under different treatments or conditions, the sample size will need to be much greater to detect differences between groups and between different treatments.

- What is the nature of the stimuli? Simple stimuli are the easiest to analyse. Real-world images, as might appear in an advertisement, become difficult to characterize unless one element at a time is varied. For statistical power, a minimum of 10 repetitions within a stimulus category are required, although 20–30 would be more likely to achieve meaningful results.

- What type of software will be used to analyse the neuroimaging data? Several software packages exist, and although these programmes make neuroimaging seem simple, it takes a minimum of 1 year of training to be able to use them and 3 years to become fully competent.

- How will motion correction be performed?

- Are conditions balanced in time? If not, how will subjects’ drifting attention be compensated for?

- Is this a whole-brain analysis or is a specific part of the brain being examined? These necessitate different thresholds of identifying activation. The chance of an activation appearing somewhere in the brain is high due to random noise.

- Will regions of interest be defined a priori? If so, what is the justification for this? Conclusions based on activation of a single region will have relatively little predictive power over conventional behavioural methods.

- If multi-voxel pattern analysis (MVPA) methods will be used, will they be completely data-driven (principal component analysis or independent component analyses) or will they be based on classifier training of subject responses (support vector machine, relevance vector regression or Gaussian process regression)? How will the resulting activity maps be interpreted?

- How robust are the results? Ask for a ‘bootstrap’ — for example, testing on a ‘fresh’ subsample of data.

- What type of scanner will be used? Either 1.5 or 3 Tesla scanners can yield images of acceptable quality. Open MRIs do not have the field homogeneity or the gradient technology necessary for fMRI. What quality control checks are performed to make sure the scanner is operating optimally and consistently from day to day? What steps will be taken to minimize signal artefacts in areas with poor signal?

Architecture

A growing number of neuro-scientists and architects have begun to consider the relationships of the brain to the architectural experience64. The neuroscience of architecture could be considered from two perspectives: first, the neural activity associated with seeing specific aspects of a building; and second, the use of neural responses to guide the architectural design process. Clearly, one would need to identify these neural responses before attempting to use them in architectural design, but it is precisely the application in design that places neuroimaging within the neuromarketing framework.

Virtual reality can provide a surprisingly accurate simulation of an architectural experience and can be used in an MRI scanner. It has already been used to understand neural activation during automobile driving65,66. In spatial navigation tasks such as driving, and presumably navigating a building, the hippo campus has a key role. These early virtual reality experiments suggested that the hippocampus is active when the subject makes navigation decisions but not when they are externally cued65. Perhaps taking into account ‘hippocampal load’ may be a useful tool in architectural design — for example, to make buildings easier to navigate. Extending this idea by considering the neurobiological changes associated with ageing, it might be possible to design buildings and retirement communities that mitigate the memory loss associated with Alzheimer’s disease.

Political candidates

Finally, neuromarketing might be applied to perhaps the greatest marketing campaign of all: politics. According to the Federal Election Commission (see Further information), the cost of the 2008 US Presidential race was approximately $1.6 billion. It was also around that time that neu-roimaging made its way into politics, perhaps most prominently in the form of a New York Times op-ed piece67. Peer-reviewed studies have shown a complex pattern of activation in response to statements about candidates; these patterns have been interpreted as evidence that motivated reasoning involves activation in the ventromedial PFC, the anterior cingulate cortex, the posterior cingulate cortex and the insula68. Subsequent studies have suggested that activation of the medial PFC might be associated with maintaining a subject’s preference for a candidate in response to advertisements, whereas activity in the lateral PFC might be associated with changing candidates69.

In marketing terms, the political candidates are the products that must be sold to the electorate. Therefore, like other products, candidates and their campaigns have pre-and post-design phases. Political marketing is aimed at selling an existing candidate but, with more foresight, can also be used to ‘design’ a better candidate. The aforementioned neuroimaging studies have focused on the post-design responses to advertisements for political candidates68,69.

Could neuroimaging also be used to design a candidate? Although potential nominees already go through a ‘grooming’ process, it is worth examining this prospect. A candidate’s appearance, trustworthiness and message content might determine a voter’s decision. Considerable neuroimaging work has been done on the perception of human faces70 and features such as facial symmetry, skin colour and attractiveness. Key brain structures in visual processing include the fusiform face area for basic face processing71, the superior temporal sulcus for gaze direction and intention and the NAc for attractiveness12. A recent study on the effect of political candidates’ appearance found that insula activation in response to seeing a picture of a candidate was associated with a greater likelihood of that candidate losing the election72. In addition, dorsolateral PFC and anterior cingulate cortex activation occurred when subjects viewed images of a candidate of a political party different from their own73. The neurobiology of trust has also become quite popular to study with both fMRI and, more recently, pharmacological manipulations74–76. These studies have found that different dimensions of trust, such as reputation, fairness and uncertainty, correlate with activity in different brain regions. Moreover, the hormone oxytocin affects human behaviour in various economic exchanges that depend on social interactions77. Finally, a candidate’s message content could be viewed as an experiential product. One could theoretically attempt to maximize striatal and OFC responses to platform statements although, for the reasons stated above, this is not necessarily predictive of success.

Conclusions and future directions

Neuromarketing has received considerable attention in both the scientific community and the media. Although few scientific neuro marketing studies have been conducted, the existing evidence suggests that neuroimaging could be used advantageously in several domains of marketing. For a marketer, neuroimaging could be attractive because it might be cheaper and faster than current marketing tools, and because it could provide hidden information about products that would otherwise be unobtainable. We think it unlikely that neuroimaging will be more cost-effective than traditional marketing tools, and so the first point is mostly hype. However, continuing developments in analytical tools for neuroimaging data — for example, MVPA — suggest that neuro imaging will soon be able to reveal hidden information about consumer preferences. Although this information could boost post-design sales efforts, we think that the real pay-off will come during the design process. Using fMRI data during design could affect a wide range of products, including food, entertainment, buildings and political candidates.

There are two sides to the use of such information. Product manufacturers could use neural information to coerce the public into consuming products that they neither need nor want. However, we hope that future uses of neuromarketing will help companies to identify new and exciting products that people want and find useful. One example is a new trend in ‘user design’ in which companies allow consumers to participate, through the internet, in the design of new products and by doing so create products that are more useful for the companies and for their customers. Perhaps a next phase in user design is one that incorporates not only what consumers express, but also what they think.

Finally, we return to the opening question: hope or hype? It is too early to tell but, optimists as we are, we think that there is much that neuromarketing can contribute to the interface between people and businesses and in doing so foster a more human-compatible design of the products around us. At the same time, neuromarketing as an enterprise runs the risk of quickly becoming yesterday’s fad. Seasoned marketers still remember the hype around subliminal advertising, which quickly faded and died despite the research interest that surrounded it (and research on subliminal priming remains a large part of academic research in social psychology). How can we make sure that neuromarketing will not suffer a similar fate? For one, the academic community should take this topic seriously and not leave it to the neuromarketers and the op-ed page of the New York Times. We should also ask deeper questions on how marketing works — and not simply examine whether type X of advertising works better or worse than type Y. If we take neuromarketing as the examination of the neural activities that underlie the daily activities related to people, products and marketing, this could become a useful and interesting path for academic research and at the same time provide useful inputs to marketers.

Supplementary Material

Supplement

Acknowledgements

This work was supported by grants to G.S.B. from the National Institute on Drug Abuse (R01DA016434 and R01DA025045), the Office of Naval Research and Air Force Office of Scientific Research, and the National Science Foundation (BCS0827313).

Footnotes

SUPPLEMENTARY INFORMATION

See online article: S1 (box)

ALL LINKS ARE ACTIVE IN THE ONLINE PDF

Contributor Information

Dan Ariely, Fuqua School of Business, Center for Cognitive Neuroscience, Department of Economics, and the Department of Psychiatry and Behavioural Sciences, Duke University, Durham, North Carolina 2770, USA..

Gregory S. Berns, Department of Psychiatry and Behavioural Sciences, Economics Department, Center for Neuropolicy, Emory University, Atlanta, Georgia 30322, USA.

References

- 1.Beckwith NE, Lehmann DR. The importance of halo effects in multi-attribute attitude models. J. Mark. Res. 1975;12:265–275. [Google Scholar]

- 2.Day GS. The threats to marketing research. J. Mark. Res. 1975;12:462–467. [Google Scholar]

- 3.Griffin A, Hauser JR. The voice of the customer. Mark. Sci. 1993;12:1–27. [Google Scholar]

- 4.Green PE, Srinivasan V. Conjoint analysis in marketing: new developments with implications for research and practice. J. Mark. 1990;54:3–19. [Google Scholar]

- 5.Lindstrom M. Buyology. Truth and Lies About Why We Buy. New York: Doubleday; 2008. [Google Scholar]

- 6.Hauser JR, Shugan SM. Intensity measures of consumer preference. Oper. Res. 1980;28:278–320. [Google Scholar]

- 7.Buchanan B, Henderson PW. Assessing the bias of preference, detection, and identification measures of discrimination ability in product design. Mark. Sci. 1992;11:64–75. [Google Scholar]

- 8.Kahneman D, Wakker PP, Sarin R. Back to Bentham? Explorations of experienced utility. Q. J. Econ. 1997;112:375–405. [Google Scholar]

- 9.Plassmann H. O’Doherty, J. & Rangel, A. Orbitofrontal cortex encodes willingness to pay in everyday economic transactions. J. Neurosci. 2007;27:9984–9988. doi: 10.1523/JNEUROSCI.2131-07.2007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Hare TA, Camerer CF, Rangel A. Self-control in decision-making involves modulation of the vmPFC valuation system. Science. 2009;324:646–648. doi: 10.1126/science.1168450. [DOI] [PubMed] [Google Scholar]

- 11.O’Doherty JP, Deichmann R. Critchley, H. D. & Dolan, R. J. Neural responses during anticipation of a primary taste reward. Neuron. 2002;33:815–826. doi: 10.1016/s0896-6273(02)00603-7. [DOI] [PubMed] [Google Scholar]

- 12.Aharon I, et al. Beautiful faces have variable reward value: fMRI and behavioral evidence. Neuron. 2001;32:537–551. doi: 10.1016/s0896-6273(01)00491-3. [DOI] [PubMed] [Google Scholar]

- 13.Zatorre RJ, Chen JL, Penhume VB. When the brain plays music: auditory-motor interactions in music perception and production. Nature Rev. Neurosci. 2007;8:547–558. doi: 10.1038/nrn2152. [DOI] [PubMed] [Google Scholar]

- 14.Knutson B, Adams CM, Fong GW, Hommer D. Anticipation of increasing monetary reward selectively recruits nucleus accumbens. J. Neurosci. 2001;21:RC159. doi: 10.1523/JNEUROSCI.21-16-j0002.2001. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.O’Doherty J, Kringelbach ML, Rolls ET, Hornak J, Andrews C. Abstract reward and punishment representations in the human orbitofrontal cortex. Nature Neurosci. 2001;4:95–102. doi: 10.1038/82959. [DOI] [PubMed] [Google Scholar]

- 16.Izuma K, Saito DN, Sadato N. Processing of social and monetary rewards in the human striatum. Neuron. 2008;58:284–294. doi: 10.1016/j.neuron.2008.03.020. [DOI] [PubMed] [Google Scholar]

- 17.Rilling JK, et al. A neural basis for social cooperation. Neuron. 2002;35:1–20. doi: 10.1016/s0896-6273(02)00755-9. [DOI] [PubMed] [Google Scholar]

- 18.Ploghaus A, Becerra L, Borras C, Borsook D. Neural circuitry underlying pain modulation: expectation, hypnosis, placebo. Trends Cogn. Sci. 2003;7:197–200. doi: 10.1016/s1364-6613(03)00061-5. [DOI] [PubMed] [Google Scholar]

- 19.Ploghaus A, et al. Dissociating pain from its anticipation in the human brain. Science. 1999;284:1979–1981. doi: 10.1126/science.284.5422.1979. [DOI] [PubMed] [Google Scholar]

- 20.Koyama T, McHaffie JG, Laurienti PJ, Coghill RC. The subjective experience of pain: where expectations become reality. Proc. Natl Acad. Sci. USA. 2005;102:12950–12955. doi: 10.1073/pnas.0408576102. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Craig AD. How do you feel? Interoception: the sense of the physiological condition of the body. Nature Rev. Neurosci. 2002;3:655–666. doi: 10.1038/nrn894. [DOI] [PubMed] [Google Scholar]

- 22.Hare TA, O’Doherty J, Camerer CF, Schultz W, Rangel A. Dissociating the role of the orbitofrontal cortex and the striatum in the computation of goal values and prediction errors. J. Neurosci. 2008;28:5623–5630. doi: 10.1523/JNEUROSCI.1309-08.2008. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Plassmann H, O’Doherty J, Shiv B, Rangel A. Marketing actions can modulate neural representations of experienced pleasantness. Proc. Natl Acad. Sci. USA. 2008;105:1050–1054. doi: 10.1073/pnas.0706929105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Poldrack RA. Can. cognitive processes be inferred from neuroimaging data? Trends Cogn. Sci. 2006;10:59–63. doi: 10.1016/j.tics.2005.12.004. [DOI] [PubMed] [Google Scholar]

- 25.Poldrack RA. The role of fMRI in cognitive neuroscience: where do we stand? Curr. Opin. Neurobiol. 2008;18:223–227. doi: 10.1016/j.conb.2008.07.006. [DOI] [PubMed] [Google Scholar]

- 26.Delgado MR. Reward-related responses in the human striatum. Ann. NY Acad. Sci. 2007;1104:70–88. doi: 10.1196/annals.1390.002. [DOI] [PubMed] [Google Scholar]

- 27.Fox PT, Lancaster JL. Mapping context and content: the BrainMap model. Nature Rev. Neurosci. 2002;3:319–321. doi: 10.1038/nrn789. [DOI] [PubMed] [Google Scholar]

- 28.Knutson B, Rick S, Wimmer GE, Prelec D, Loewenstein G. Neural predictors of purchases. Neuron. 2007;53:147–156. doi: 10.1016/j.neuron.2006.11.010. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Grosenick L, Greer S, Knutson B. Interpretable classifiers for FMRI improve prediction of purchases. IEEE Trans. Neural Syst. Rehabil. Eng. 2008;16:539–548. doi: 10.1109/TNSRE.2008.926701. [DOI] [PubMed] [Google Scholar]

- 30.Rangel A, Camerer C, Montague PR. A framework for studying the neurobiology of value-based decision making. Nature Rev. Neurosci. 2008;9:545–556. doi: 10.1038/nrn2357. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Camerer C, Loewenstein G, Prelec D. Neuroeconomics: how neuroscience can inform economics. J. Econ. Lit. 2005;43:9–64. [Google Scholar]

- 32.Glimcher PW. Decisions, decisions, decisions: choosing a biological science of choice. Neuron. 2002;36:323–332. doi: 10.1016/s0896-6273(02)00962-5. [DOI] [PubMed] [Google Scholar]

- 33.Yin HH, Ostlund SB, Balleine BW. Rewardguided learning beyond dopamine in the nucleus accumbens: the integrative functions of cortico-basal ganglia networks. Eur. J. Neurosci. 2008;28:1437–1448. doi: 10.1111/j.1460-9568.2008.06422.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Padoa-Schioppa C, Assad JA. Neurons in the orbitofrontal cortex encode economic value. Nature. 2006;441:223–226. doi: 10.1038/nature04676. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Schoenbaum G, Roesch M. Orbitofrontal cortex, associative learning, and expectancies. Neuron. 2005;47:633–636. doi: 10.1016/j.neuron.2005.07.018. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Norman KA, Polyn SM, Detre GJ, Haxby JV. Beyond mind-reading: multi-voxel pattern analysis of fMRI data. Trends Cogn. Sci. 2006;10:424–430. doi: 10.1016/j.tics.2006.07.005. [DOI] [PubMed] [Google Scholar]

- 37.Haynes JD, Rees G. Decoding mental states from activity in humans. Nature Rev. Neurosci. 2006;7:523–534. doi: 10.1038/nrn1931. [DOI] [PubMed] [Google Scholar]

- 38.Kamitani Y, Tong F. Decoding the visual and subjective contents of the human brain. Nature Neurosci. 2005;8:679–685. doi: 10.1038/nn1444. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Kay KN, Naselaris T, Prenger RJ, Gallant JL. Identifying natural images from human brain activity. Nature. 2008;452:352–356. doi: 10.1038/nature06713. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40.Hasson U, Nir Y, Levy I, Fuhrmann G, Malach R. Intersubject synchronization of cortical activity during natural vision. Science. 2004;303:1634–1640. doi: 10.1126/science.1089506. [DOI] [PubMed] [Google Scholar]

- 41.Mitchell TM, et al. Predicting human brain activity associated with the meanings of nouns. Science. 2008;320:1191–1195. doi: 10.1126/science.1152876. [DOI] [PubMed] [Google Scholar]

- 42.Speer NK, Zacks JM, Reynolds JR. Human brain activity time-locked to narrative even boundaries. Psychol. Sci. 2007;18:449–455. doi: 10.1111/j.1467-9280.2007.01920.x. [DOI] [PubMed] [Google Scholar]

- 43.Spiers HJ, Maguire EA. Spontaneous mentalizing during an interactive real world task: an fMRI study. Neuropsychologia. 2006;44:1674–1682. doi: 10.1016/j.neuropsychologia.2006.03.028. [DOI] [PubMed] [Google Scholar]

- 44.Spiers HJ, Maguire EA. Decoding human brain activity during real-world experiences. Trends Cogn. Sci. 2007;11:356–365. doi: 10.1016/j.tics.2007.06.002. [DOI] [PubMed] [Google Scholar]

- 45.McClure SM, et al. Neural correlates of behavioral preference for culturally familiar drinks. Neuron. 2004;44:379–387. doi: 10.1016/j.neuron.2004.09.019. [DOI] [PubMed] [Google Scholar]

- 46.Ambler T, Ioannides A, Rose S. Brands on the brain: neuro-images of advertising. Bus. Strategy Rev. 2000;11:17–30. [Google Scholar]

- 47.Rossiter JR, Silberstein RB, Harris PG, Nield G. Brain-imaging detection of visual scene encoding in long-term memory for TV commercials. J. Advert. Res. 2001;41:13–22. [Google Scholar]

- 48.Astolfi L, et al. Neural basis for brain responses to TV commercials: a high-resolution EEG study. IEEE Trans. Neural Syst. Rehabil. Eng. 2008;16:522–531. doi: 10.1109/TNSRE.2008.2009784. [DOI] [PubMed] [Google Scholar]

- 49.Tverksy A, Kahneman D. The framing of decisions and the psychology of choice. Science. 1981;211:453–458. doi: 10.1126/science.7455683. [DOI] [PubMed] [Google Scholar]

- 50.De Martino B, Kumaran D, Seymour B, Dolan RJ. Frames, biases, and rational decision-making in the human brain. Science. 2006;313:684–687. doi: 10.1126/science.1128356. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 51.Waber RL, Shiv B, Carmon Z, Ariely D. Commercial features of placebo and therapeutic efficacy. JAMA. 2008;299:1016–1017. doi: 10.1001/jama.299.9.1016. [DOI] [PubMed] [Google Scholar]

- 52.Montague PR, Berns GS. Neural economics and the biological substrates of valuation. Neuron. 2002;36:265–284. doi: 10.1016/s0896-6273(02)00974-1. [DOI] [PubMed] [Google Scholar]

- 53.Schultz W, Dayan P, Montague PR. A neural substrate of prediction and reward. Science. 1997;275:1593–1599. doi: 10.1126/science.275.5306.1593. [DOI] [PubMed] [Google Scholar]

- 54.Colloca L, Benedetti F. Placebos and painkillers: is mind as real as matter? Nature Rev. Neurosci. 2005;6:545–552. doi: 10.1038/nrn1705. [DOI] [PubMed] [Google Scholar]

- 55.Wager TD, et al. Placebo-induced changes in fMRI in the anticipation and experience of pain. Science. 2004;303:1162–1167. doi: 10.1126/science.1093065. [DOI] [PubMed] [Google Scholar]

- 56.Benedetti F, Mayberg HS, Wager TD, Stohler CS, Zubieta JK. Neurobiological mechanisms of the placebo effect. J. Neurosci. 2005;25:10390–10402. doi: 10.1523/JNEUROSCI.3458-05.2005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 57.Kenning PH, Plassmann H. How neuroscience can inform consumer research. IEEE Trans. Neural Syst. Rehabil. Eng. 2008;16:532–538. doi: 10.1109/TNSRE.2008.2009788. [DOI] [PubMed] [Google Scholar]

- 58.Lee N, Broderick AJ, Chamberlain L. What is neuromarketing? A discussion and agenda for future research. Int. J. Psychophysiol. 2007;63:199–204. doi: 10.1016/j.ijpsycho.2006.03.007. [DOI] [PubMed] [Google Scholar]

- 59.Yoon C, Gutchess AH, Feinberg F, Polk TA. A functional magnetic resonance imaging study of neural dissociations between brand and person judgments. J. Consum. Res. 2006;33:31–40. [Google Scholar]

- 60.Small DM, Prescott J. Odor/taste integration and the perception of flavor. Exp. Brain Res. 2005;166:345–357. doi: 10.1007/s00221-005-2376-9. [DOI] [PubMed] [Google Scholar]

- 61.Rolls ET. Brain mechanisms underlying flavour and appetite. Philos. Trans. R. Soc. Lond. B Biol. Sci. 2006;361:1123–1136. doi: 10.1098/rstb.2006.1852. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 62.De Araujo IET, Rolls ET. The representation in the human brain of food texture and oral fat. J. Neurosci. 2004;24:3086–3093. doi: 10.1523/JNEUROSCI.0130-04.2004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 63.Hasson U, Furman O, Clark D, Dudai Y, Davachi L. Enhanced intersubject correlations during movie viewing correlate with successful episodic encoding. Neuron. 2008;57:452–462. doi: 10.1016/j.neuron.2007.12.009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 64.Eberhard JP. Applying neuroscience to architecture. Neuron. 2009;62:753–756. doi: 10.1016/j.neuron.2009.06.001. [DOI] [PubMed] [Google Scholar]

- 65.Spiers HJ, Maguire EA. Neural substrates of driving behaviour. NeuroImage. 2007;36:245–255. doi: 10.1016/j.neuroimage.2007.02.032. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 66.Calhoun VD, et al. Different activation dynamics in multiple neural systems during simulated driving. Hum. Brain Map. 2002;16:158–167. doi: 10.1002/hbm.10032. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 67.Freedman J. This is your brain on politics. New York Times. 2005 Jan 18 [Google Scholar]

- 68.Westen D, Blagov PS, Harenski K, Kilts C, Hamann S. Neural bases of motivated reasoning: an FMRI study of emotional constraints on partisan political judgment in the 2004 US Presidential election. J. Cogn. Neurosci. 2006;18:1947–1958. doi: 10.1162/jocn.2006.18.11.1947. [DOI] [PubMed] [Google Scholar]

- 69.Kato J, et al. Neural correlates of attitude change following positive and negative advertisements. Front. Behav. Neurosci. 2009;3:6. doi: 10.3389/neuro.08.006.2009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 70.Tsao DY, Livingstone MS. Mechanisms of face perception. Ann. Rev. Neurosci. 2008;31:411–437. doi: 10.1146/annurev.neuro.30.051606.094238. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 71.Kanwisher N, Yovel G. The fusiform face area: a cortical region specialized for the perception of faces. Philos. Transact. Roy. Soc. B Biol. Sci. 2006;361:2109–2128. doi: 10.1098/rstb.2006.1934. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 72.Spezio ML, et al. A neural basis for the effect of candidate appearance on election outcomes. Soc. Cogn. Affect. Neurosci. 2008;3:344–352. doi: 10.1093/scan/nsn040. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 73.Kaplan JT, Freedman J, Iacoboni M. Us versus them: political attitudes and party affiliation influence neural response to faces of presidential candidates. Neuropsychologia. 2007;45:55–64. doi: 10.1016/j.neuropsychologia.2006.04.024. [DOI] [PubMed] [Google Scholar]

- 74.Fehr E, Camerer C. Social neuroeconomics: the neural circuitry of social preferences. Trends Cogn. Sci. 2007;11:419–427. doi: 10.1016/j.tics.2007.09.002. [DOI] [PubMed] [Google Scholar]

- 75.Kosfeld M, Heinrichs M, Zak PJ, Fischbacher U, Fehr E. Oxytocin increases trust in humans. Nature. 2005;435:673–676. doi: 10.1038/nature03701. [DOI] [PubMed] [Google Scholar]

- 76.King-Casas B, et al. Getting to know you: reputation and trust in a two-person economic exchange. Science. 2005;308:78–83. doi: 10.1126/science.1108062. [DOI] [PubMed] [Google Scholar]

- 77.Baumgartner T, Heinrichs M, Vonlanthen A, Fischbacher U, Fehr E. Oxytocin shapes the neural circuitry of trust and trust adaptation in humans. Neuron. 2008;58:639–650. doi: 10.1016/j.neuron.2008.04.009. [DOI] [PubMed] [Google Scholar]

- 78.Davidson RJ, Ekman P, Saron CD, Senulis JA, Friesen WV. Approach-withdrawal and cerebral asymmetry: emotional expression and brain physiology I. J. Pers. Soc. Psychol. 1990;58:330–341. [PubMed] [Google Scholar]

- 79.Harmon-Jones E. Clarifying the emotive functions of asymmetrical frontal cortical activity. Psychophysiology. 2003;40:838–848. doi: 10.1111/1469-8986.00121. [DOI] [PubMed] [Google Scholar]

- 80.Huster RJ, Stevens S, Gerlach AL, Rist F. A spectroanalytic approach to emotional responses evoked through picture presentation. Psychophysiol. 2008;72:212–216. doi: 10.1016/j.ijpsycho.2008.12.009. [DOI] [PubMed] [Google Scholar]

- 81.Ohme R, Reykowska D, Wiener D, Choromanska A. Analysis of neurophysiological reactions to advertising stimuli by means of EEG and galvanic skin response measures. J. Neurosci. Psychol. Econ. 2009;2:21–31. [Google Scholar]

- 82.Kobayashi M, Pascual-Leone A. Transcranial magnetic stimulation in neurology. Lancet Neurol. 2003;2:145–156. doi: 10.1016/s1474-4422(03)00321-1. [DOI] [PubMed] [Google Scholar]

- 83.Illes J, et al. Incidental findings in brain imaging research. Science. 2006;311:783–784. doi: 10.1126/science.1124665. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 84.Thirion B, et al. Analysis of a large fMRI cohort: statistical and methodological issues for group analyses. NeuroImage. 2007;35:105–120. doi: 10.1016/j.neuroimage.2006.11.054. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplement