America's undocumented immigrants pay taxes (original) (raw)

FRONT PAGE

About us

ON OTHER US PAGES

Opinion: Trust and race in America

Opinion: Fighting racism in America

The strengths and weaknesses of US cities during a pandemic MORE

Homelessness in US cities: California is facing a crisis MORE

Mayors of largest US cities (2020) MORE

US mayoral elections November 2019 MORE

US Mayors running for President MORE

US cities are waking up to the harm done by trauma in childhood and adult life MORE

In the US, cities lead in fighting poverty MORE

Corrupt US mayors MORE

Mass shootings in the USA MORE

US mayors to protect DREAMersMORE

America's undocumented immigrants pay billions in taxes MORE

In the US, cities lead in fighting poverty MORE

Spatial Planning and Development in the USA:

Economic growth is of paramount importance MORE

The ups and downs of Amazon’s

search for a second headquarter MORE

American public and mayors agree:

Keep Obamacare, forget Trumpcare MORE

More public involvement in law

enforcement needed to ease strain

between police and US communities MORE

American cities save money

by replacing obsolete urban

infrastructure with green spaces MORE

America’s undocumented immigrants:

Where they live and pay billions in tax

August 2017: At the start of the Trump presidency, in January 2017, more than eleven million undocumented immigrants (1) not only lived and worked in the US but also contributed substantially to the American economy. A study by the Institute of Taxation and Economic Policy (ITEP), published in February 2016 (2), found that undocumented immigrants pay some US$11.6 billion annually in state and local taxes. The Institute estimates that undocumented immigrants nationwide pay roughly eight per cent of their incomes in taxes and compared this figure with the effective tax rate of 5.4 per cent paid by the top one per cent of US taxpayers. State and local tax contributions made

State and local tax contributions made

by undocumented immigrants in the USFor US states with high numbers of undocumented immigrants, the tax revenues can be substantial. In California, some 2.3 million immigrants without proper papers pay an estimated 3.2billioninstateandlocaltaxes.TheStateofTexasbenefitstothetuneof3.2 billion in state and local taxes. The State of Texas benefits to the tune of 3.2billioninstateandlocaltaxes.TheStateofTexasbenefitstothetuneof1.5 billion, while in Florida undocumented immigrants contribute almost 600milliontolocalandstatecoffers.Buteveninstateswithrelativesmallnumbersofimmigrantsthefinancialbenefitstolocalandstatetaxauthoritiescanbesignificant.Maine,withlessthan5,000receivessome600 million to local and state coffers. But even in states with relative small numbers of immigrants the financial benefits to local and state tax authorities can be significant. Maine, with less than 5,000 receives some 600milliontolocalandstatecoffers.Buteveninstateswithrelativesmallnumbersofimmigrantsthefinancialbenefitstolocalandstatetaxauthoritiescanbesignificant.Maine,withlessthan5,000receivessome4.3 million, while in neighbouring Vermont, a similar number of undocumented immigrants pay $3.9 million in taxes.

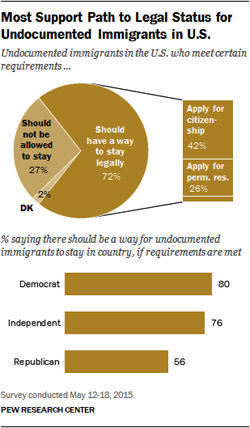

ITEP argues that creating a pathway to citizenship for the 11 million undocumented immigrants living in the US and allowing them to work in the country legally would boost their current state and local tax contributions by more than 2.1billionayear.Personalincometaxcollectionswouldincreasebymorethan2.1 billion a year. Personal income tax collections would increase by more than 2.1billionayear.Personalincometaxcollectionswouldincreasebymorethan1 billion a year. Sales and excise taxes would increase by 695millionandpropertytaxeswouldgrowby695 million and property taxes would grow by 695millionandpropertytaxeswouldgrowby360 million. As a result, the overall state and local taxes paid by undocumented immigrants as a share of their income would increase from 8.0 per cent to 8.6 per cent.

The most significant revenue gain (plus 50 per cent) would come from personal income tax, due to both increased earnings and full compliance with the tax code. Multiple studies have shown that legal immigrants have higher wages than undocumented immigrants, thus gaining legal status could lead to a boost in wages. The wage boost is in part due to better job opportunities that would be made available to workers with legal status and also in part to an increase in higher-level skills and better training. Most comprehensive reform measures to date have included strong incentives or requirements for undocumented immigrants granted legal status to fully comply with tax law.

States and their communities that would gain most if undocumented immigrant were granted full legal status include California (plus 449million),NewYork(plus449 million), New York (plus 449million),NewYork(plus246 million), Texas (plus 154million),Illinois(plus154 million), Illinois (plus 154million),Illinois(plus154 million) and Georgia (plus 106million).ButtheITEPanalysisshowsthatsmallerstateswouldalsobenefit.Ifundocumentedimmigrantsweregivenresidencyandworkrights,thetreasurersofColorado(plus106 million). But the ITEP analysis shows that smaller states would also benefit. If undocumented immigrants were given residency and work rights, the treasurers of Colorado (plus 106million).ButtheITEPanalysisshowsthatsmallerstateswouldalsobenefit.Ifundocumentedimmigrantsweregivenresidencyandworkrights,thetreasurersofColorado(plus36 million), Connecticut (plus 22million),Indiana(plus22 million), Indiana (plus 22million),Indiana(plus28 million), Maryland (plus 86million)Massachusetts(plus86 million) Massachusetts (plus 86million)Massachusetts(plus61 million), North Carolina (plus 93million),Washington(plus93 million), Washington (plus 93million),Washington(plus29 million) and Wisconsin (plus $17 million) would all see a not insignificant increase in tax receipts.

Table 1: Undocumented immigrants - numbers and tax amounts paid

| State | Estimate of state and local taxes paid by undocumented immigrants | Estimate of state and local taxes paid if immigrants were granted legal status | Estimated number of undocumented immigrants |

|---|---|---|---|

| Alabama | 63.7million∣63.7 million | 63.7million∣82.0 million | 65,000 |

| Alaska | 3.5million∣3.5 million | 3.5million∣3.9 million | 10,000 |

| Arizona | 231.5million∣231.5 million | 231.5million∣273.9 million | 325,000 |

| Arkansas | 58.6million∣58.6 million | 58.6million∣71.9 million | 70,000 |

| California | 3,170.4million∣3,170.4 million | 3,170.4million∣3,619.4 million | 2,350,000 |

| Colorado | 134.6million∣134.6 million | 134.6million∣170.5 million | 200,000 |

| Connecticut | 136.2million∣136.2 million | 136.2million∣157.8 million | 120,000 |

| Delaware | 12.0million∣12.0 million | 12.0million∣17.2 million | 25,000 |

| Washington DC | 27.1million∣27.1 million | 27.1million∣33.2 million | 25,000 |

| Florida | 588.1million∣588.1 million | 588.1million∣646.9 million | 850,000 |

| Georgia | 358.8million∣358.8 million | 358.8million∣464.4 million | 375,000 |

| Hawaii | 30.2million∣30.2 million | 30.2million∣39.9 million | 45,000 |

| Idaho | 26.2million∣26.2 million | 26.2million∣31.5 million | 45,000 |

| Illinois | 743.3million∣743.3 million | 743.3million∣897.8 million | 450,000 |

| Indiana | 89.3million∣89.3 million | 89.3million∣117.0 million | 110,000 |

| Iowa | 37.4million∣37.4 million | 37.4million∣46.3 million | 40,000 |

| Kansas | 69.3million∣69.3 million | 69.3million∣80.4 million | 75,000 |

| Kentucky | 37.4million∣37.4 million | 37.4million∣53.4 million | 50,000 |

| Louisiana | 61.1million∣61.1 million | 61.1million∣74.7 million | 70,000 |

| Maine | 4.3million∣4.3 million | 4.3million∣5.5 million | 4,000 |

| Maryland | 308.1million∣308.1 million | 308.1million∣393.7 million | 250,000 |

| Massachusetts | 201.4million∣201.4 million | 201.4million∣262.1 million | 210,000 |

| Michigan | 83.8million∣83.8 million | 83.8million∣109.8 million | 130,000 |

| Minnesota | 77.1million∣77.1 million | 77.1million∣94.7 million | 100,000 |

| Mississippi | 21.9million∣21.9 million | 21.9million∣26.9 million | 25,000 |

| Missouri | 48.3million∣48.3 million | 48.3million∣62.7 million | 55,000 |

| Montana | 2.2million∣2.2 million | 2.2million∣3.0 million | 5,000 |

| Nebraska | 42.1million∣42.1 million | 42.1million∣49.5 million | 45,000 |

| Nevada | 91.0million∣91.0 million | 91.0million∣100.1 million | 210,000 |

| New Hampshire | 8.2million∣8.2 million | 8.2million∣9.1 million | 10,000 |

| New Jersey | 590.3million∣590.3 million | 590.3million∣667.6 million | 500,000 |

| New Mexico | 68.0million∣68.0 million | 68.0million∣76.0 million | 85,000 |

| New York | 1,108.6million∣1,108.6 million | 1,108.6million∣1,355.0 million | 775,000 |

| North Carolina | 275.8million∣275.8 million | 275.8million∣368.5 million | 350,000 |

| North Dakota | 3.8million∣3.8 million | 3.8million∣4.3 million | 5,000 |

| Ohio | 84.9million∣84.9 million | 84.9million∣110.6 million | 95,000 |

| Oklahoma | 77.3million∣77.3 million | 77.3million∣94.3 million | 95,000 |

| Oregon | 78.2million∣78.2 million | 78.2million∣114.9 million | 130,000 |

| Pennsylvania | 139.4million∣139.4 million | 139.4million∣190.9 million | 180,000 |

| Rhode Island | 33.4million∣33.4 million | 33.4million∣40.4 million | 30,000 |

| South Carolina | 67.7million∣67.7 million | 67.7million∣86.1 million | 85,000 |

| South Dakota | 4.3million∣4.3 million | 4.3million∣4.7 million | 5,000 |

| Tennessee | 105.3million∣105.3 million | 105.3million∣115.8 million | 120,000 |

| Texas | 1,542.4million∣1,542.4 million | 1,542.4million∣1,696.7 million | 1,650,000 |

| Utah | 67.1million∣67.1 million | 67.1million∣87.1 million | 100,000 |

| Vermont | 3.9million∣3.9 million | 3.9million∣4.5 million | 4,000 |

| Virginia | 245.9million∣245.9 million | 245.9million∣324.1 million | 300,000 |

| Washington | 292.2million∣292.2 million | 292.2million∣321.4 million | 250,000 |

| West Virginia | 4.2million∣4.2 million | 4.2million∣5.6 million | 4,000 |

| Wisconsin | 80.9million∣80.9 million | 80.9million∣98.3 million | 80,000 |

| Wyoming | 3.6million∣3.6 million | 3.6million∣4.0 million | 5,000 |

| ALL US STATES | $11,643.9 million | $13,770.1 million | 11,100,000 |

Sources: Institute of Taxation and Economic Policy, February 2016; Pew Research Center; US Census Bureau

Most undocumented immigrants

live in America’s large metro areasMost of America’s 11.1 million undocumented immigrants reside in big cities. In fact, according to the Pew Research Center (3), 61 per cent of them live in just 20 major metropolitan areas. The largest concentration can be found in New York, Los Angeles, Houston, Dallas, Miami, Chicago and Washington DC. California and Texas are the two states with an estimated undocumented immigrant population of more than two and one million respectively. By contrast, only 36 per cent of the total US population lived in those metro areas.

The Census Bureau raw data used for the Pew analysis does not separate cities from the larger metro areas that contain them in all cases. But such a distinction is possible for 11 of the top 20 metro areas. Within those areas, the cities with the largest undocumented immigrant populations include New York City, with an estimated 525,000 undocumented immigrants; Los Angeles, with an estimated 375,000 and Chicago, with an estimated 140,000. Other cities with available data are Miami (55,000), Denver (55,000), Philadelphia (50,000), Boston (35,000), San Francisco (35,000), Washington, DC, (25,000) and Seattle (20,000).

Pew Research says that the top 20 metropolitan areas for undocumented immigrants have been remarkably consistent over the past decade. Nineteen of the 20 top metropolitan destinations in 2014 ranked among the top 20 each year over the previous decade.

Undocumented immigrants made up 3.5 per cent of the total US population in 2014. Their share of all residents is above ten per cent in some smaller cities such as Yuma (AZ), McAllen (TX), Salinas (CA) and Gainesville (GA). Large US metro areas with a significantly above average concentration of undocumented immigrants include New York (5.7%), Los Angeles (7.5%), Houston (8.7%), Washington DC (6.8%), Las Vegas (8.0%) and San Jose (6.5%) but in some other important metro areas such as Philadelphia (2.6%), Atlanta (4.5%), San Antonio (3.7%), Minneapolis (2.3%), Baltimore (2.3%), Detroit (1.8%) and Pittsburgh (0.7%) undocumented immigrants are less prevalent.

Undocumented immigrants account for about 25 per cent of all foreign-born US residents. They make up a somewhat higher share of immigrants in the Houston (37%), Dallas (37%), Atlanta (33%), Phoenix (37%), Las Vegas (35%), Denver (37%) and Austin (34%) metro areas. They make up a somewhat lower share of all immigrants in the New York (19%), Miami (18%), San Francisco (17%) and San Jose (17%) metro areas.

Pew Research also found that undocumented immigrants account for five per cent of the US workforce (those who are working or actively looking for work); and 66 per cent of all undocumented immigrants have been in the US for ten years or more.

Table 2: Number of undocumented immigrants in major US metro regions

| Rank | Metro region (4) | Estimated number of undocumented immigrants | Undocumented as percentage of metro population |

|---|---|---|---|

| 1 | New York, NY | 1,150,000 | 5.7 |

| 2 | Los Angeles, CA | 1,000,000 | 7.5 |

| 3 | Houston, TX | 575,000 | 8.7 |

| 4 | Dallas, TX | 475,000 | 6.9 |

| 5 | Miami, FL | 450,000 | 7.3 |

| 6 | Chicago, IL | 425,000 | 4.5 |

| 7 | Washington DC | 400,000 | 6.8 |

| 8 | Riverside, CA | 250,000 | 5.6 |

| 9 | Phoenix, AZ | 250,000 | 5.5 |

| 10 | Atlanta, GA | 250,000 | 4.5 |

| 11 | San Francisco, CA | 240,000 | 5.3 |

| 12 | Boston, MA | 180,000 | 3.7 |

| 13 | Las Vegas, NV | 170,000 | 8.0 |

| 14 | San Diego, CA | 170,000 | 5.3 |

| 15 | Philadelphia, PA | 160,000 | 2.6 |

| 16 | Seattle, WA | 150,000 | 3.9 |

| 17 | Denver, CO | 130,000 | 4.7 |

| 18 | San Jose, CA | 120,000 | 6.5 |

| 19 | Orlando, FL | 110,000 | 4.6 |

| 20 | Austin, TX | 100,000 | 5.0 |

| 21 | Charlotte, NC | 95,000 | 3.8 |

| 22 | Portland, OR | 90,000 | 3.7 |

| 23 | McAllen, TX | 85,000 | 10.2 |

| 24 | San Antonio, TX | 85,000 | 3.7 |

| 25 | Minneapolis, MN | 85,000 | 2.3 |

| 26 | Tampa, FL | 75,000 | 2.6 |

| 27 | Detroit, MI | 75,000 | 1.8 |

| 28 | Bridgeport, CT | 65,000 | 6.7 |

| 29 | Baltimore, MD | 65,000 | 2.3 |

| 30 | Raleigh, NC | 60,000 | 4.5 |

| 31 | Sacramento, CA | 60,000 | 2.6 |

| 32 | Salt Lake City, UT | 55,000 | 4.7 |

| 33 | Nashville, TN | 55,000 | 2.8 |

| 34 | Salinas, CA | 50,000 | 10.2 |

| 35 | El Paso, TX | 50,000 | 5.7 |

| 36 | Oxnard, CA | 50,000 | 5.7 |

| 37 | Fresno, CA | 50,000 | 5.2 |

| 38 | Oklahoma City, OK | 50,000 | 3.6 |

| 39 | Bakersfield, CA | 45,000 | 5.1 |

| 40 | Kansas City, KS | 45,000 | 2.2 |

| 41 | Brownsville, TX | 40,000 | 9.0 |

| 42 | Stockton, CA | 40,000 | 5.4 |

| 43 | Albuquerque, NM | 40,000 | 4.3 |

| 44 | Providence, RI | 40,000 | 2.4 |

| 45 | Indianapolis, IN | 40,000 | 2.1 |

| 46 | Santa Maria, CA | 35,000 | 8.1 |

| 47 | Cape Coral, FL | 35,000 | 4.8 |

| 48 | Tucson, AZ | 35,000 | 3.6 |

| 49 | Milwaukee, WI | 35,000 | 2.1 |

| 50 | Columbus, OH | 35,000 | 1.8 |

| 51 | Naples, FL | 30,000 | 8.4 |

| 52 | Fayetteville, AR | 30,000 | 6.5 |

| 53 | Visalia, CA | 30,000 | 6.4 |

| 54 | Greensboro, NC | 30,000 | 3.6 |

| 55 | New Haven, CT | 30,000 | 3.4 |

| 56 | Honolulu, HI | 30,000 | 3.0 |

| 57 | Memphis, TN | 30,000 | 2.6 |

| 58 | New Orleans, LA | 30,000 | 2.6 |

| 59 | Hartford, CT | 30,000 | 2.3 |

| 60 | Yakima, WA | 25,000 | 9.9 |

| 61 | Reno, NV | 25,000 | 6.0 |

| 62 | Trenton, NJ | 25,000 | 5.9 |

| 63 | Santa Rosa, CA | 25,000 | 5.4 |

| 64 | Modesto, CA | 25,000 | 4.7 |

| 65 | Winston, NC | 25,000 | 3.8 |

| 66 | Omaha, NE | 25,000 | 2.3 |

| 67 | Richmond, VA | 25,000 | 2.2 |

| 68 | Virginia Beach, VA | 25,000 | 1.4 |

| 69 | St. Louis, MO | 25,000 | 0.9 |

| 70 | Yuma, AZ | 20,000 | 10.3 |

| 71 | Gainesville, GA | 20,000 | 10.1 |

| 72 | Laredo, TX | 20,000 | 7.5 |

| 73 | Provo, UT | 20,000 | 3.3 |

| 74 | Lakeland FL | 20,000 | 3.1 |

| 75 | Boise City, ID | 20,000 | 3.0 |

| 76 | North Port, FL | 20,000 | 3.0 |

| 77 | Grand Rapids, MI | 20,000 | 2.0 |

| 78 | Greenville, SC | 20,000 | 2.0 |

| 79 | Birmingham, AL | 20,000 | 1.7 |

| 80 | Jacksonville, FL | 20,000 | 1.6 |

| 81 | Louisville, KY | 20,000 | 1.5 |

| 82 | Cincinnati, OH | 20,000 | 1.0 |

| 83 | Merced, CA | 15,000 | 6.3 |

| 84 | San Luis Obispo, CA | 15,000 | 5.2 |

| 85 | Atlantic City, NJ | 15,000 | 4.9 |

| 86 | Santa Cruz, CA | 15,000 | 4.7 |

| 87 | Port St. Lucie, FL | 15,000 | 3.5 |

| 88 | Vallejo, CA | 15,000 | 3.4 |

| 89 | Deltona, FL | 15,000 | 2.2 |

| 90 | Little Rock, AR | 15,000 | 2.2 |

| 91 | Wichita, KS | 15,000 | 2.1 |

| 92 | Columbia, SC | 15,000 | 1.8 |

| 93 | Allentown, PA | 15,000 | 1.7 |

| 94 | Worcester, MA | 15,000 | 1.5 |

| 95 | Cleveland, OH | 15,000 | 0.8 |

| 96 | Pittsburgh, PA | 15,000 | 0.7 |

| 97 | Napa, CA | 10,000 | 8.1 |

| 98 | Madera, CA | 10,000 | 6.8 |

| 99 | El Centro, CA | 10,000 | 6.3 |

| 100 | Hanford, CA | 10,000 | 5.6 |

| USA TOTAL | 11,100,000 | 3.5 |

Source: Pew Research Center, 2014

NOTES (1) The term ‘undocumented immigrants’ is used throughout this article to describe immigrants who have no official authorisation to work and reside in the US.

(2) Methodology used by the Institute of Taxation and Economic Policy (ITEP ):

While the spending and income behaviour of undocumented immigrant families is not as well documented as that of US citizens, the estimates used for this article represent a best approximation of the taxes families headed by undocumented immigrants likely pay.

The ITEP methodology used to calculate the current and potential tax contribution of undocumented immigrants uses six main data points:

1. Estimated undocumented immigrant population in each state.

2. Estimated impacted population under the 2012 and 2014 Executive Actions (by former President Obama) in each state.

3. Average size of undocumented immigrant families/taxpaying units.

4. Range of annual undocumented immigrant family/taxpayer income in each state.

5. Estimated number of undocumented immigrants who are homeowners.

6. Estimated effective tax rates (taxes as share of income) for income, sales, and property taxes paid by low- and moderate-income families in each state.

Additional assumptions were made about the change in tax contributions that would occur in two instances: if all 11 million undocumented immigrants were granted legal status under comprehensive immigration reform.

(3) Methodology used by Pew Research Center: Rankings based on unrounded numbers. Margin of error represents 90-per cent confidence interval. Many differences are not statistically significant; only New York, Los Angeles, Houston, Washington and San Francisco differ from the area ranked immediately below. Metro areas defined using the 2013 definitions for metropolitan statistical areas (MSAs) from the US Office of Management and Budget. Pew Research Center estimates based on augmented 2014 American Community Survey

(4) US metro regions US metro regions typically consist of a large core city and include surrounding communities which may be in different states. For example: The New York metro region comprises New York City, Newark and Jersey City and includes parts of New York State, New Jersey and Pennsylvania. The Los Angeles metro region takes in Long Beach and Anaheim, while the Miami metro region also includes Fort Lauderdale and West Palm Beach. The Dallas metro region consists of Dallas, Fort Worth and Arlington. (The US Census Bureau offers more information.)