Infosys Share Price Today, Infosys Stock Price Live NSE/BSE, Share Price Insights (original) (raw)

- Overview

- News

- Analysis

- Recos

- Financials

- Forecast

- Technicals

- Peers

- Shareholdings

- MF

- F&O

- Corp Actions

- About

Infosys share price insights

View All

- Intraday fact check

In the last 20 years, only 0.7 % trading sessions saw intraday declines higher than 5 % . - Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 53.76% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials) - Sell Signal: Bears on driving seat

50 day moving crossover appeared on Feb 10, 2025. Average price decline of -2.84% within 30 days of this signal in last 5 years. - Stock Returns vs Nifty 100

Stock gave a 3 year return of 8.96% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Infosys Share Price Update

Infosys Ltd. share price moved down by -0.70% from its previous close of Rs 1,875.65. Infosys Ltd. stock last traded price is 1,862.70Share Price Value Today/Current/Last 1,862.701,864.40 Previous Day 1,875.651,876.80

InsightsInfosys

Do you find these insights useful?

- hate it

- meh

- love it

Key Metrics

| (x) | 27.98 |

|---|---|

| (₹) | 66.59 |

| (₹ Cr.) | 7,70,681 |

| 2 | |

| (x) | 8.80 |

| (%) | 2.47 |

| (₹) | 5.00 |

| 0.83 | |

| (₹) | 1,866.87 |

| 52W H/LBV/ShareMCap/Sales |

| (x) | 27.99 |

|---|---|

| (₹) | 66.59 |

| (₹ Cr.) | 7,73,920 |

| 2 | |

| (x) | 8.81 |

| (%) | 2.47 |

| (₹) | 5.00 |

| 0.88 | |

| (₹) | 1,866.37 |

| 52W H/LBV/ShareMCap/Sales |

Key Metrics

| (x) | 27.98 |

|---|---|

| (₹) | 66.59 |

| (%) | 2.47 |

| (₹) | 1,866.87 |

| (x) | 8.80 |

| (₹ Cr.) | 7,70,681 |

| (₹) | 5.00 |

| (₹) | 213.04 |

| 2 | |

| (₹) | 2,006.45 / 1,358.35 |

| 0.83 | |

| 4.04 |

| (x) | 27.99 |

|---|---|

| (₹) | 66.59 |

| (%) | 2.47 |

| (₹) | 1,866.37 |

| (x) | 8.81 |

| (₹ Cr.) | 7,73,920 |

| (₹) | 5.00 |

| (₹) | 213.04 |

| 2 | |

| (₹) | 2,006.80 / 1,359.10 |

| 0.88 | |

| 4.04 |

Infosys Share Price Returns

| 1 Day | -0.7% |

|---|---|

| 1 Week | -1.81% |

| 1 Month | -5.3% |

| 3 Months | -0.33% |

| 1 Year | 10.87% |

| 3 Years | 8.21% |

| 5 Years | 138.49% |

| 1 Day | -0.66% |

|---|---|

| 1 Week | -1.72% |

| 1 Month | -5.2% |

| 3 Months | -0.19% |

| 1 Year | 10.99% |

| 3 Years | 8.33% |

| 5 Years | 138.7% |

Infosys News & Analysis

RIL, HDFC Bank, ITC among top stocks bought and sold by mutual funds last month

RIL, HDFC Bank, ITC among top stocks bought and sold by mutual funds last month

News IT companies building small and micro language models to cuts costs

IT companies building small and micro language models to cuts costs

News 'We don’t know. Vacate the premises': Infosys faces backlash for reportedly denying a crying female employee's plea to stay overnight

'We don’t know. Vacate the premises': Infosys faces backlash for reportedly denying a crying female employee's plea to stay overnight

News- Investor Conference

Announcements

Infosys Share Recommendations

Recent Recos

BUY

Current

Mean Recos by 41 Analysts

Strong

SellSellHoldBuyStrong

Buy

Target₹2015

OrganizationHDFC Securities

ADD

Target₹2225

OrganizationBNP Paribas Securities

OUTPERFORM

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 14 | 14 | 12 | 11 |

| Buy | 14 | 14 | 16 | 15 |

| Hold | 9 | 9 | 9 | 10 |

| Sell | 2 | 2 | 2 | 3 |

| Strong Sell | 2 | 2 | 2 | 2 |

| # Analysts | 41 | 41 | 41 | 41 |

Infosys Financials

Insights

- Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 53.76% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 Total Income 42,623.00 41,698.00 40,153.00 40,652.00 39,610.00 Total Income Growth (%) 2.22 3.85 -1.23 2.63 -0.04 Total Expenses 32,852.00 32,337.00 31,027.00 30,302.00 30,860.00 Total Expenses Growth (%) 1.59 4.22 2.39 -1.81 0.46 EBIT 9,771.00 9,361.00 9,126.00 10,350.00 8,750.00 EBIT Growth (%) 4.38 2.58 -11.83 18.29 -1.75 Profit after Tax (PAT) 6,806.00 6,506.00 6,368.00 7,969.00 6,106.00 PAT Growth (%) 4.61 2.17 -20.09 30.51 -1.71 EBIT Margin (%) 22.92 22.45 22.73 25.46 22.09 Net Profit Margin (%) 15.97 15.60 15.86 19.60 15.42 Basic EPS (₹) 16.43 15.71 15.38 19.25 14.76 Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 ------------------------- --------- --------- --------- --------- --------- Total Income 35,916.00 35,994.00 34,004.00 35,484.00 34,073.00 Total Income Growth (%) -0.22 5.85 -4.17 4.14 0.28 Total Expenses 27,022.00 26,526.00 25,817.00 25,008.00 25,115.00 Total Expenses Growth (%) 1.87 2.75 3.23 -0.43 -1.02 EBIT 8,894.00 9,468.00 8,187.00 10,476.00 8,958.00 EBIT Growth (%) -6.06 15.65 -21.85 16.95 4.09 Profit after Tax (PAT) 6,358.00 6,813.00 5,768.00 8,480.00 6,552.00 PAT Growth (%) -6.68 18.12 -31.98 29.43 4.92 EBIT Margin (%) 24.76 26.30 24.08 29.52 26.29 Net Profit Margin (%) 17.70 18.93 16.96 23.90 19.23 Basic EPS (₹) 15.31 16.41 13.90 20.43 15.79 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 --------------------------- ----------- ----------- ----------- ----------- --------- Total Revenue 1,58,381.00 1,49,468.00 1,23,936.00 1,02,673.00 93,594.00 Total Revenue Growth (%) 5.96 20.60 20.71 9.70 9.39 Total Expenses 1,22,393.00 1,16,146.00 93,826.00 76,045.00 71,587.00 Total Expenses Growth (%) 5.38 23.79 23.38 6.23 10.96 Profit after Tax (PAT) 26,233.00 24,095.00 22,110.00 19,351.00 16,594.00 PAT Growth (%) 8.87 8.98 14.26 16.61 7.73 Operating Profit Margin (%) 23.72 22.89 24.91 26.69 24.42 Net Profit Margin (%) 17.07 16.41 18.17 19.26 18.27 Basic EPS (₹) 63.39 57.63 52.52 45.61 38.97 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 --------------------------- ----------- ----------- ----------- --------- --------- Total Revenue 1,36,350.00 1,27,873.00 1,07,164.00 88,379.00 81,747.00 Total Revenue Growth (%) 6.63 19.32 21.26 8.11 7.62 Total Expenses 1,00,397.00 96,230.00 78,669.00 63,902.00 61,270.00 Total Expenses Growth (%) 4.33 22.32 23.11 4.30 9.35 Profit after Tax (PAT) 27,234.00 23,268.00 21,235.00 18,048.00 15,543.00 PAT Growth (%) 17.04 9.57 17.66 16.12 5.72 Operating Profit Margin (%) 28.09 25.64 27.53 28.63 26.04 Net Profit Margin (%) 21.12 18.76 20.43 21.00 19.66 Basic EPS (₹) 65.62 55.48 50.27 42.37 36.34 All figures in Rs Cr, unless mentioned otherwise

- Employee & Interest Expense

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 1,37,814.00 1,25,816.00 1,17,885.00 1,08,386.00 92,768.00 Total Assets Growth (%) 9.54 6.73 8.76 16.84 9.48 Total Liabilities 49,353.00 50,021.00 42,149.00 31,604.00 26,924.00 Total Liabilities Growth (%) -1.34 18.68 33.37 17.38 36.45 Total Equity 88,461.00 75,795.00 75,736.00 76,782.00 65,844.00 Total Equity Growth (%) 16.71 0.08 -1.36 16.61 1.29 Current Ratio (x) 2.31 1.81 2.00 2.54 2.62 Total Debt to Equity (x) 0.00 0.00 0.00 0.00 0.00 Contingent Liabilities 4,442.00 5,813.00 5,914.00 4,836.00 5,009.00 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ---------------------------- ----------- ----------- --------- --------- --------- Total Assets 1,14,950.00 1,01,337.00 99,387.00 93,939.00 81,041.00 Total Assets Growth (%) 13.43 1.96 5.80 15.92 2.67 Total Liabilities 33,774.00 33,592.00 30,081.00 22,408.00 18,807.00 Total Liabilities Growth (%) 0.54 11.67 34.24 19.15 15.96 Total Equity 81,176.00 67,745.00 69,306.00 71,531.00 62,234.00 Total Equity Growth (%) 19.83 -2.25 -3.11 14.94 -0.76 Current Ratio (x) 2.62 1.90 2.10 2.74 2.88 Total Debt to Equity (x) 0.00 0.00 0.00 0.00 0.00 Contingent Liabilities 3,342.00 5,148.00 5,348.00 4,372.00 4,730.00 All figures in Rs Cr, unless mentioned otherwise Insights

- Increase in Cash from Investing

Company has used Rs 5009.0 cr for investing activities which is an YoY increase of 314.31%. (Source: Consolidated Financials)Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 25,210.00 22,467.00 23,885.00 23,224.00 17,003.00 Net Cash used in Investing Activities -5,009.00 -1,209.00 -6,416.00 -7,456.00 -239.00 Net Cash flow from Financing Activities -17,504.00 -26,695.00 -24,642.00 -9,786.00 -17,591.00 Net Cash Flow 2,613.00 -5,299.00 -7,242.00 6,065.00 -919.00 Closing Cash & Cash Equivalent 14,786.00 12,173.00 17,472.00 24,714.00 18,649.00 Closing Cash & Cash Equivalent Growth (%) 21.47 -30.33 -29.30 32.52 -4.70 Total Debt/ CFO (x) 0.00 0.00 0.00 0.00 0.00 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ----------------------------------------- ----------- ----------- ----------- ---------- ----------- Net Cash flow from Operating Activities 20,787.00 19,169.00 22,096.00 19,902.00 15,572.00 Net Cash used in Investing Activities -3,261.00 821.00 -3,150.00 -6,309.00 -116.00 Net Cash flow from Financing Activities -15,825.00 -25,857.00 -24,275.00 -9,566.00 -17,391.00 Net Cash Flow 1,657.00 -5,736.00 -5,342.00 4,050.00 -1,989.00 Closing Cash & Cash Equivalent 8,191.00 6,534.00 12,270.00 17,612.00 13,562.00 Closing Cash & Cash Equivalent Growth (%) 25.36 -46.75 -30.33 29.86 -12.79 Total Debt/ CFO (x) 0.00 0.00 0.00 0.00 0.00 All figures in Rs Cr, unless mentioned otherwise

- Increase in Cash from Investing

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 29.77 31.95 29.34 25.34 25.35 Return on Capital Employed (%) 36.81 38.79 35.96 31.73 30.83 Return on Assets (%) 19.03 19.15 18.75 17.85 17.88 Interest Coverage Ratio (x) 87.52 133.21 168.93 137.55 130.45 Asset Turnover Ratio (x) 1.17 1.20 1.08 92.69 97.86 Price to Earnings (x) 23.70 24.57 36.23 30.03 16.39 Price to Book (x) 7.05 7.83 10.62 7.61 4.15 EV/EBITDA (x) 14.74 15.30 23.18 18.50 10.11 EBITDA Margin (%) 26.76 25.77 27.77 29.94 27.61 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ------------------------------ ------- ------- ------- ------- ------- Return on Equity (%) 33.54 34.34 30.63 25.23 24.97 Return on Capital Employed (%) 41.23 43.03 38.46 32.23 31.28 Return on Assets (%) 23.69 22.96 21.36 19.21 19.17 Interest Coverage Ratio (x) 141.42 220.08 242.59 195.26 180.62 Asset Turnover Ratio (x) 1.19 1.24 1.08 91.45 97.53 Price to Earnings (x) 22.88 25.51 37.88 32.36 17.54 Price to Book (x) 7.66 8.74 11.57 8.15 4.38 EV/EBITDA (x) 15.67 16.95 25.44 20.99 11.40 EBITDA Margin (%) 30.38 27.86 29.87 31.33 28.76 MANAGEMENT DISCUSSION AND ANALYSIS (FY 20-21)

- Competition matrix

We experience intense competition in traditional services and see a rapidly-changing marketplace with new competitors in niche technology areas who are focused on agility, flexibility and innovation. In future, we expect intensified competition. In particular, we expect increased competition from firms that offer technology-based solutions to business problems, cloud providers and from firms incumbent in those market segments. Additionally, insourcing of technology services by the technology departments of our clients is another ongoing competitive threat. - Customer and revenue matrix

We added 475 new customers (gross) during fiscal 2021 as compared to 376 new customers (gross) during fiscal 2020. For fiscals 2021 and 2020, 96.2% and 97.5%, respectively, of our revenues came from repeat business, which we define as revenues from a client that also contributed to our revenues during the prior fiscal. On a consolidated basis, for the year ended March 31, 2021, approximately 97.1% were export revenues whereas 2.9% were domestic revenues, while for the year ended March 31, 2020, 97.4% were export revenues whereas 2.6% were domestic revenues. - Lower Travel expense

On both standalone and consolidated basis, the travelling cost representing the cost of travel included in cost of sales constituted approximately 0.5% and 2.2% of total revenue for the years ended March 31, 2021 and March 31, 2020, respectively. The decrease in travel costs is on account of reduced travel and visa costs on account of pandemic.

- Competition matrix

Financial InsightsInfosys

Income (P&L)

Cash Flow

- Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 53.76% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)

- Employee & Interest Expense

- Increase in Cash from Investing

Company has used Rs 5009.0 cr for investing activities which is an YoY increase of 314.31%. (Source: Consolidated Financials)

- Increase in Cash from Investing

Do you find these insights useful?

- hate it

- meh

- love it

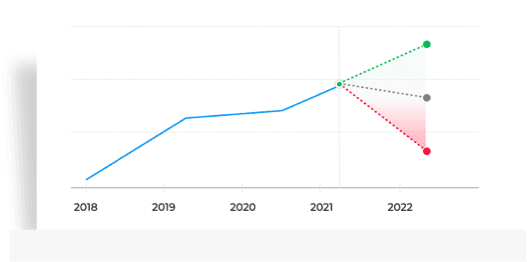

Infosys Share Price Forecast

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL Get multiple analysts’ prediction on Infosys

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL Get multiple analysts’ prediction on Infosys

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

Infosys Technicals

Bullish / Bearish signals for Infosys basis selected technical indicators and moving average crossovers.

5 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

5D EMA: 1891.08

Last 4 Sell Signals_:1 Feb 2025

Average price decline of -1.97% within 7 days of Bearish signal in last 5 years

10 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

10D EMA: 1884.84

Last 4 Sell Signals:1 Feb 2025

Average price decline of -1.99% within 7 days of Bearish signal in last 5 years

14 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

14D EMA: 1883.10

Last 4 Sell Signals:1 Feb 2025

Average price decline of -1.92% within 7 days of Bearish signal in last 5 years

20 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

20D EMA: 1884.07

Last 4 Sell Signals:1 Feb 2025

Average price decline of -2.01% within 7 days of Bearish signal in last 5 years

50 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

50D EMA: 1890.39

Last 4 Sell Signals:17 Jan 2025

Average price decline of -2.84% within 30 days of Bearish signal in last 5 years

Stochastic Crossover

Bullish signal on weekly chart

Appeared on: 7 Feb 2025

Region: Equlibrium

Last 4 Buy Signals:_10 Jan 2025

Average price gain of 5.37% within 7 weeks of Bullish signal in last 10 years

Show More49%

Positive Movement since

1st Jan 2005 on basis

51%

Negative Movement since

1st Jan 2005 on basis

Exclude

Global Meltdown - 1st Jan 2008 to 10th Nov 2008

Covid Crisis - 1st Feb 2020 to 31st Mar 2020Pivot Levels

| R1 | R2 | R3 | PIVOT | S1 | S2 | S3 | |

|---|---|---|---|---|---|---|---|

| Classic | 1892.35 | 1900.75 | 1915.30 | 1886.20 | 1877.80 | 1871.65 | 1857.10 |

Average True Range

| 5 DAYS | 14 DAYS | 28 DAYS | |

|---|---|---|---|

| ATR | 31.84 | 39.15 | 41.08 |

Infosys Peer Comparison

- CHART

- TABLE

Insights

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 8.96% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty IT

Stock generated 8.96% return as compared to Nifty IT which gave investors 23.9% return over 3 year time period. (as of last trading session) - 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Insights

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 8.96% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty IT

Stock generated 8.96% return as compared to Nifty IT which gave investors 23.9% return over 3 year time period. (as of last trading session)

- Stock Returns vs Nifty 100

Ratio Performance

| NAME | P/E (x) | P/B (x) | ROE % | ROCE % | ROA % | Rev CAGR [3Yr] | OPM | NPM | Basic EPS | Current Ratio | Total Debt/ Equity (x) | Total Debt/ CFO (x) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Infosys | 27.89 | 8.72 | 29.77 | 36.81 | 19.03 | 15.38 | 23.72 | 17.08 | 63.39 | 2.31 | 0.00 | 0.00 |

| TCS | 29.28 | 15.63 | 50.73 | 63.51 | 31.34 | 13.46 | 26.45 | 19.13 | 125.88 | 2.45 | 0.00 | 0.00 |

| HCL Tech | 27.19 | 6.80 | 23.00 | 27.92 | 15.73 | 13.30 | 19.57 | 14.29 | 57.99 | 2.61 | 0.03 | 0.10 |

| Wipro | 26.18 | 4.35 | 14.81 | 17.86 | 9.62 | 12.69 | 17.82 | 12.40 | 20.89 | 2.58 | 0.19 | 0.80 |

| Tech Mahindra | 43.65 | 5.76 | 8.84 | 11.70 | 5.42 | 10.93 | 6.93 | 4.58 | 26.66 | 1.86 | 0.06 | 0.24 |

| Add More | ||||||||||||

| Annual Ratios (%) | ||||||||||||

| See All Parameters |

Peers InsightsInfosys

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 8.96% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty IT

Stock generated 8.96% return as compared to Nifty IT which gave investors 23.9% return over 3 year time period. (as of last trading session)

Do you find these insights useful?

- hate it

- meh

- love it

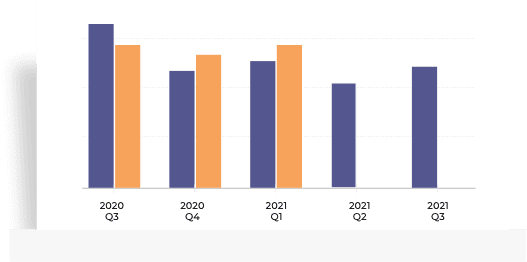

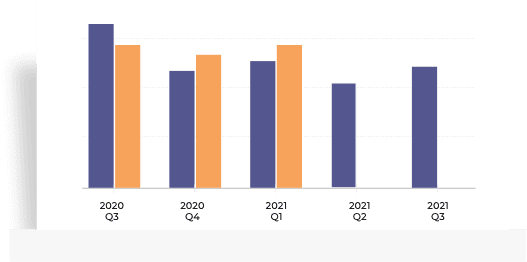

Infosys Shareholding Pattern

Showing Infosys Shareholding as on Dec 2024

Category Dec 2024 Sep 2024 Jun 2024 Mar 2024 Promoters 14.43 14.43 14.61 14.71 Pledge 0.00 0.00 0.00 0.00 FII 33.30 33.28 32.74 34.11 DII 38.02 37.76 37.22 35.56 Mutual Funds 20.05 19.70 19.09 17.93 Others 14.25 14.53 15.43 15.62 Showing Shareholding as on Dec 2024

Category No. of Shares Percentage % Change QoQ Promoters 54,20,28,546 14.43 % 0.00 Pledge 0 0.00 % 0.00 FII 1,25,08,03,960 33.30 % 0.02 DII 1,42,84,05,471 38.02 % 0.25 MF 75,31,44,637 20.05 % 0.35 Others 93,10,31,217 14.25 % -0.28

Infosys MF Ownership

- 3,152.92

Amount Invested (in Cr.) - 4.98%

% of AUM - 0.00

% Change (MoM basis)

- 3,152.92

- 3,152.40

Amount Invested (in Cr.) - 22.08%

% of AUM - 0.00

% Change (MoM basis)

- 3,152.40

- 2,836.11

Amount Invested (in Cr.) - 2.97%

% of AUM - 0.00

% Change (MoM basis)

- 2,836.11

MF Ownership as on 31 December 2024

Infosys F&O Quote

- ExpiryPlease select expiry month:

Price

1,858.95-23.10 (-1.23%)

Open Interest

4,19,70,0004,18,53,200 (35,833.22%)Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 1,893.85 1,897.95 1,850.45 1,882.05 6,423 1,44,358.29 Open Interest as of 12 Feb 2025

- ExpiryPlease select expiry month:

- Type

- Expiry

- Strike Price

Price

23.55-9.70 (-29.17%)

Open Interest

7,41,6007,41,600 (0.00%)Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 36.35 42.75 19.15 33.25 2,491 57,025.27 Open Interest as of 12 Feb 2025

Infosys Corporate Actions

Meeting Date Announced on Purpose Details Jan 16, 2025 Dec 13, 2024 Board Meeting Quarterly Results Nov 28, 2024 Oct 25, 2024 POM - Oct 17, 2024 Sep 13, 2024 Board Meeting Quarterly Results & Dividend Jul 18, 2024 Jun 14, 2024 Board Meeting Quarterly Results Jun 26, 2024 Apr 18, 2024 AGM - Type Dividend Dividend per Share Ex-Dividend Date Announced on Interim 420% 21.0 Oct 29, 2024 Oct 17, 2024 Special 160% 8.0 May 31, 2024 Apr 19, 2024 Final 400% 20.0 May 31, 2024 Apr 18, 2024 Interim 360% 18.0 Oct 25, 2023 Oct 12, 2023 Final 350% 17.5 Jun 02, 2023 Apr 13, 2023 All Types Ex-Date Record Date Announced on Details Bonus Sep 04, 2018 Sep 05, 2018 Jul 13, 2018 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jun 15, 2015 - Apr 24, 2015 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Dec 02, 2014 Dec 03, 2014 Oct 10, 2014 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jul 13, 2006 Jul 14, 2006 Apr 14, 2006 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Jul 01, 2004 Jul 02, 2004 Apr 13, 2004 Bonus Ratio: 3 share(s) for every 1 shares held

About Infosys

Infosys Ltd., incorporated in the year 1981, is a Large Cap company (having a market cap of Rs 7,78,820.37 Crore) operating in IT Software sector. Infosys Ltd. key Products/Revenue Segments include Software Products and Software Development Charges for the year ending 31-Mar-2024.For the quarter ended 31-12-2024, the company has reported a Consolidated Total Income of Rs 42,623.00 Crore, up 2.22 % from last quarter Total Income of Rs 41,698.00 Crore and up 7.61 % from last year same quarter Total Income of Rs 39,610.00 Crore. Company has reported net profit after tax of Rs 6,822.00 Crore in latest quarter.The company’s top management includes Mr.Nandan M Nilekani, Mr.Nandan M Nilekani, Mr.Salil Parekh, Mr.Salil Parekh, Mr.Bobby Parikh, Mr.Bobby Parikh, Ms.Chitra Nayak, Ms.Chitra Nayak, Mr.D Sundaram, Mr.D Sundaram, Mr.Govind Iyer, Mr.Govind Iyer, Ms.Helene Auriol Potier, Ms.Helene Auriol Potier, Mr.Michael Gibbs, Mr.Michael Gibbs, Mr.Nitin Paranjpe, Mr.Nitin Paranjpe, Mr.Jayesh Sanghrajka, Mr.Jayesh Sanghrajka, Mr.A G S Manikantha, Mr.A G S Manikantha, Mr.Inderpreet Sawhney, Mr.Inderpreet Sawhney, Mr.Deepak Bhalla, Mr.Deepak Bhalla. Company has Deloitte Haskins & Sells LLP as its auditors. As on 31-12-2024, the company has a total of 415.23 Crore shares outstanding.Infosys Share Price Today is Rs. 1862.70. On previous day, the Infosys Share Price (NSE) closed at Rs. 1880.3, featuring among the most traded securities on the National Stock Exchange.

Shareholdings:

As of 31st Dec, 2024, the promoter held 14.43% of the stake in Infosys shares, out of which 0.0% was pledged. On the same date, foreign institutional investors' (FII) holdings of Infosys stocks was 33.3% as compared to 33.28% in Sep 2024 with increase of 0.02%. The domestic institutional investors (DII) holdings on 31st Dec, 2024 was 38.02% as compared to 37.77% in Sep 2024 with increase of 0.25%. Out of the total DII holdings in Infosys shares 20.05% was held by mutual funds. The rest including public held is 14.25%. Infosys stock price is reflected on both the exchanges - BSE and NSE.

Dividend, Bonus & Split Information:

Infosys Dividend: Ever since 1981, Infosys dividends has been paid out around 59 times. As on 12 Feb, 2025, 03:26 PM IST, The overall dividend yield for Infosys stands at 2.45%. The last dividend paid was on October 29, 2024 (Rs. 21.0). The Earnings Per Share (EPS) for quarter ending 31st Dec 2024 is Rs. 66.59.

Infosys Bonus: The most recent bonus issue had been in year September 4, 2018 around 6 years ago at 1 : 1 ratio. The first bonus issue was announced in Jun 1994.

Stock Forecast:

After showing 42623.0 Cr. of sales and 2.22% of quarterly net profit, there have been multiple ups and downs in the Infosys stock prices in the past few weeks. For example, Infosys stock price on 4th of February 2025 was around Rs. 1898.8. Infosys share price now stands at an average of Rs. 1862.70. Judging by last week's performance, stock is in down trend.

Infosys has a median target price of Rs. 2094.68 in 12 months by 41 analysts. They have provided a high estimate of Rs. 2350.0 and low estimate of Rs. 1570.0 for Infosys share.

Historical Prices and Performance:

Infosys, incorporated in 1981 is a Large Cap company (with a market cap of Rs. 778820.37) operating in IT Software sector.

The Return of Equity (ROE) in last five financial years given by Infosys stock was 29.77%, 31.95%, 29.34%, 25.34% and 25.35% respectively.

The Infosys share gave a 3 year return of 8.96% as compared to Nifty 50 which gave a return of 32.79%.

Infosys announced 420.0% final dividend on October 29, 2024.

Key Metrics:

PE Ratio of Infosys is 28.17

Prices/Sales Ratio of Infosys is 4.04

Price/Book Ratio of Infosys is 8.8

Peer Insights:

Peers are businesses with comparable activities, buisness objectives and affiliation with a particular industry area. For Infosys, major competitors and peers include TCS, HCL Tech, Wipro and Tech Mahindra. As of Sep 2024, the dividend yield of Infosys stands at 2.45% while TCS, HCL Tech, Wipro and Tech Mahindra stand at 1.84%, 3.02%, 0.32% and 2.4% respectively. The PE ratio and PB Ratio of the company are among its competitors stand at 28.17 and 8.8 respectively.

Recommendations:

The current total number of analysts covering the stock stands at 41, Three months ago this number stood at 41. Out of total, 14 analyst have a'Strong Buy' reco, 14 analyst have a'Buy' reco, 9 analyst have a'Hold' reco, 2 analyst have a'Sell' reco.

Mean recommendations by 41 analyst stand at'Buy'.

Leadership of Infosys :

A G S Manikantha is Co. Secretary & Compl. Officer

Inderpreet Sawhney is Chief Compliance Officer

Jayesh Sanghrajka is Chief Financial Officer

Shaji Mathew is Group Head - HR

Sunil Kumar Dhareshwar is Global Head

Martha King is Chief Client Officer

Sumit Virmani is Chief Marketing Officer

Mohammed Rafee Tarafdar is Chief Technology Officer

Nabarun Roy is Group Head

S Nandini is Group Head

D R Balakrishna is Head

Binod Choudhary is Business Head

Deepak Bhalla is Chief Risk Officer

Hemant Lamba is Head

Sushanth Michael Tharappan is Head - Human Resource

Thirumala Arohi is Head

Nandan M Nilekani is Chairman

Salil Parekh is Managing Director & CEO

D Sundaram is Lead Independent Director

Michael Gibbs is Independent Director

Govind Iyer is Independent Director

Chitra Nayak is Independent Director

Bobby Parikh is Independent Director

Helene Auriol Potier is Independent Director

Nitin Paranjpe is Independent Director

A G S Manikantha is Co. Secretary & Compl. Officer

Inderpreet Sawhney is Chief Compliance Officer

Jayesh Sanghrajka is Chief Financial Officer

Shaji Mathew is Group Head - HR

Sunil Kumar Dhareshwar is Global Head

Martha King is Chief Client Officer

Sumit Virmani is Chief Marketing Officer

Mohammed Rafee Tarafdar is Chief Technology Officer

Nabarun Roy is Group Head

S Nandini is Group Head

D R Balakrishna is Head

Binod Choudhary is Business Head

Deepak Bhalla is Chief Risk Officer

Hemant Lamba is Head

Sushanth Michael Tharappan is Head - Human Resource

Thirumala Arohi is Head

Nandan M Nilekani is Chairman

Salil Parekh is Managing Director & CEO

D Sundaram is Lead Independent Director

Michael Gibbs is Independent Director

Govind Iyer is Independent Director

Chitra Nayak is Independent Director

Bobby Parikh is Independent Director

Helene Auriol Potier is Independent Director

Nitin Paranjpe is Independent Director

Show More

Executives

Auditors

NM

Nandan M Nilekani

Chairman

NM

Nandan M Nilekani

Chairman

SP

Salil Parekh

Managing Director & CEO

SP

Salil Parekh

Managing Director & CEO

BP

Bobby Parikh

Independent Director

BP

Bobby Parikh

Independent Director

CN

Chitra Nayak

Independent Director

CN

Chitra Nayak

Independent Director

DS

D Sundaram

Lead Independent Director

DS

D Sundaram

Lead Independent Director

GI

Govind Iyer

Independent Director

GI

Govind Iyer

Independent Director

HA

Helene Auriol Potier

Independent Director

HA

Helene Auriol Potier

Independent Director

MG

Michael Gibbs

Independent Director

MG

Michael Gibbs

Independent Director

NP

Nitin Paranjpe

Independent Director

NP

Nitin Paranjpe

Independent Director

JS

Jayesh Sanghrajka

Chief Financial Officer

JS

Jayesh Sanghrajka

Chief Financial Officer

AG

A G S Manikantha

Co. Secretary & Compl. Officer

AG

A G S Manikantha

Co. Secretary & Compl. Officer

IS

Inderpreet Sawhney

Chief Compliance Officer

IS

Inderpreet Sawhney

Chief Compliance Officer

DB

Deepak Bhalla

Chief Risk Officer

DB

Deepak Bhalla

Chief Risk Officer

Show MoreDeloitte Haskins & Sells LLP

Key Indices Listed on

Nifty 50, BSE Sensex, Nifty IT, + 50 more

Address

No. 44, Hosur Road,Electronics City,Bengaluru, Karnataka - 560100

More Details

FAQs about Infosys share

- 1. What is Infosys share price and what are the returns for Infosys share?

As of today Infosys share price is down by 0.70% basis the previous closing price of Rs 1,880.3. Infosys share price is Rs 1,862.70. Return Performance of Infosys Shares:- 1 Week: Infosys share price moved down by 1.81%

- 3 Month: Infosys share price moved down by 0.33%

- 2. What's the market capitalization of Infosys?

Market Capitalization of Infosys stock is Rs 7,70,682 Cr. - 3. Who is the CEO of Infosys?

Salil Parekh is the Managing Director & CEO of Infosys - 4. Which are the key peers to Infosys?

Top 4 Peers for Infosys are HCL Technologies Ltd., Wipro Ltd., Tech Mahindra Ltd. and Tata Consultancy Services Ltd. - 5. Who are the key owners of Infosys stock?

* Promoter holding have gone down from 14.71 (31 Mar 2024) to 14.43 (31 Dec 2024)

* Domestic Institutional Investors holding has gone up from 35.56 (31 Mar 2024) to 38.02 (31 Dec 2024)

* Foreign Institutional Investors holding have gone down from 34.11 (31 Mar 2024) to 33.3 (31 Dec 2024)

* Other investor holding have gone down from 15.62 (31 Mar 2024) to 14.25 (31 Dec 2024) - 6. What is the PE & PB ratio of Infosys?

The PE ratio of Infosys stands at 28.17, while the PB ratio is 8.78. - 7. What are the returns for Infosys share?

Return Performance of Infosys Shares:- 1 Week: Infosys share price moved down by 1.81%

- 3 Month: Infosys share price moved down by 0.33%

- 8. What has been highest price of Infosys share in last 52 weeks?

Infosys share price saw a 52 week high of Rs 2,006.45 and 52 week low of Rs 1,358.35. - 9. Who's the chairman of Infosys?

Nandan M Nilekani is the Chairman of Infosys - 10. What are the key metrics to analyse Infosys Share Price?

Key Metrics for Infosys are:- PE Ratio of Infosys is 27.98

- Price/Sales ratio of Infosys is 4.04

- Price to Book ratio of Infosys is 8.80

- 11. What dividend is Infosys giving?

Infosys Ltd. announced an equity dividend of 420% on a face value of 5.0 amounting to Rs 21 per share on 17 Oct 2024. The ex dividend date was 29 Oct 2024. - 12. What is the CAGR of Infosys?

The CAGR of Infosys is 11.21. - 13. What are the Infosys quarterly results?

Total Revenue and Earning for Infosys for the year ending 2024-03-31 was Rs 158381.00 Cr and Rs 26233.00 Cr on Consolidated basis. Last Quarter 2024-12-31, Infosys reported an income of Rs 42623.00 Cr and profit of Rs 6806.00 Cr.

Trending in Markets

Top Gainers As on 03:19 PM | 12 Feb 2025

Top Losers As on 03:21 PM | 12 Feb 2025

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.