Union Bank India Share Price Today, Union Bank India Stock Price Live NSE/BSE, Share Price Insights (original) (raw)

- Overview

- News

- Analysis

- Recos

- Financials

- Forecast

- Technicals

- Peers

- Shareholdings

- MF

- F&O

- Corp Actions

- About

Union Bank India share price insights

View All

- Intraday fact check

In the last 20 years, only 4.71 % trading sessions saw intraday gains higher than 5 % . - Falling Gross NPA and Net NPA

The bank's gross NPA% and Net NPA% have fallen continuously over the past 4-years to 4.76% and 1.03%, respectively. (Source: Standalone Financials) - Net Interest Margin - Uptrend

Company is able to expand its net interest margin on a continuous basis over the last 3 years with margins of 2.63% in last year. (Source: Consolidated Financials) - Buy Signal: Bulls on driving seat

50 day moving crossover appeared today. Average price gain of 8.1% within 30 days of this signal in last 5 years. - Union Bank India Share Price Update

Union Bank of India share price moved up by 3.96% from its previous close of Rs 110.61. Union Bank of India stock last traded price is 114.98Share Price Value Today/Current/Last 114.98115.05 Previous Day 110.61110.55

InsightsUnion Bank India

Do you find these insights useful?

- hate it

- meh

- love it

Key Metrics

| (x) | 5.37 |

|---|---|

| (₹) | 21.41 |

| (₹ Cr.) | 87,771.20 |

| 9 | |

| (x) | 0.87 |

| (%) | 3.13 |

| (₹) | 10.00 |

| 1.36 | |

| (₹) | 112.82 |

| 52W H/LBV/ShareMCap/Sales |

| (x) | 5.37 |

|---|---|

| (₹) | 21.41 |

| (₹ Cr.) | 87,824.63 |

| 9 | |

| (x) | 0.86 |

| (%) | 3.13 |

| (₹) | 10.00 |

| 1.32 | |

| (₹) | 112.97 |

| 52W H/LBV/ShareMCap/Sales |

Key Metrics

| (x) | 5.37 |

|---|---|

| (₹) | 21.41 |

| (%) | 3.13 |

| (₹) | 112.82 |

| (x) | 0.87 |

| (₹ Cr.) | 87,771.20 |

| (₹) | 10.00 |

| (₹) | 127.85 |

| 9 | |

| (₹) | 172.50 / 100.81 |

| 1.36 | |

| 1.17 |

| (x) | 5.37 |

|---|---|

| (₹) | 21.41 |

| (%) | 3.13 |

| (₹) | 112.97 |

| (x) | 0.86 |

| (₹ Cr.) | 87,824.63 |

| (₹) | 10.00 |

| (₹) | 127.85 |

| 9 | |

| (₹) | 172.45 / 100.75 |

| 1.32 | |

| 1.17 |

Union Bank India Share Price Returns

| 1 Day | 3.96% |

|---|---|

| 1 Week | -3.56% |

| 1 Month | 10.96% |

| 3 Months | -3.38% |

| 1 Year | -17.72% |

| 3 Years | 148.34% |

| 5 Years | 135.61% |

| 1 Day | 4.07% |

|---|---|

| 1 Week | -3.52% |

| 1 Month | 11.05% |

| 3 Months | -3.32% |

| 1 Year | -17.67% |

| 3 Years | 148.76% |

| 5 Years | 135.76% |

Union Bank India News & Analysis

Ahead of RBI MPC meeting in Feb, these 6 banks have revised FD rates in January

Ahead of RBI MPC meeting in Feb, these 6 banks have revised FD rates in January

News What to do with LTIMindtree, Kalyan Jewellers, Policybazaar? Sujit Modi of Share.Market decodes

What to do with LTIMindtree, Kalyan Jewellers, Policybazaar? Sujit Modi of Share.Market decodes

News 3 stocks that India's largest mutual fund scheme bought and sold in December

3 stocks that India's largest mutual fund scheme bought and sold in December

News- Disclosure under Regulation 30A of LODR

Announcements

Union Bank India Share Recommendations

Recent Recos

STRONG BUY

Current

Mean Recos by 10 Analysts

Strong

SellSellHoldBuyStrong

Buy

Target₹135

OrganizationMotilal Oswal Financial Services

BUY

Target₹165

OrganizationMotilal Oswal Financial Services

BUY

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 9 | 9 | 8 | 7 |

| Buy | - | - | - | - |

| Hold | - | - | 1 | 1 |

| Sell | 1 | 1 | 1 | 1 |

| Strong Sell | - | - | - | - |

| # Analysts | 10 | 10 | 10 | 9 |

Union Bank India Financials

Insights

- Net Interest Margin - Uptrend

Company is able to expand its net interest margin on a continuous basis over the last 3 years with margins of 2.63% in last year. (Source: Consolidated Financials) - Profit Per Employee - Uptrend

Net profit per employee has been continuously increasing over the last 3 years with a growth of 61.26% last year. (Source: Standalone Financials)Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 Total Income 31,749.18 32,812.12 31,325.47 31,611.58 29,801.98 Total Income Growth (%) -3.24 4.75 -0.91 6.07 2.93 Provisions & Contingencies 1,621.86 1,739.03 2,856.76 1,252.65 1,780.56 Provisions & Contingencies Growth (%) -6.74 -39.13 128.06 -29.65 0.44 Profit after Tax (PAT) 4,623.03 4,750.93 3,641.78 3,328.27 3,625.39 PAT Growth (%) -2.69 30.46 9.42 -8.20 1.50 Gross NPA (%) - - - - - Net NPA (%) - - - - - Net Profit Margin (%) 14.56 14.48 11.63 10.53 12.16 Basic EPS (₹) 6.06 6.22 4.77 4.44 4.89 Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 ------------------------------------- --------- --------- --------- --------- --------- Total Income 31,374.50 32,036.46 30,873.62 31,057.52 29,137.26 Total Income Growth (%) -2.07 3.77 -0.59 6.59 3.02 Provisions & Contingencies 1,599.05 1,712.20 2,755.81 1,259.55 1,747.79 Provisions & Contingencies Growth (%) -6.61 -37.87 118.79 -27.93 -1.14 Profit after Tax (PAT) 4,603.63 4,719.74 3,678.85 3,310.55 3,589.91 PAT Growth (%) -2.46 28.29 11.13 -7.78 2.24 Gross NPA (%) 3.85 4.36 4.54 4.76 4.83 Net NPA (%) 0.82 0.98 0.90 1.03 1.08 Net Profit Margin (%) 14.67 14.73 11.92 10.66 12.32 Basic EPS (₹) 6.03 6.18 4.82 4.42 4.84 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ------------------------------------- ----------- --------- --------- --------- ---------- Total Income 1,18,188.36 97,078.53 81,754.07 83,210.54 43,268.49 Total Income Growth (%) 21.75 18.74 -1.75 92.31 9.94 Provisions & Contingencies 14,609.88 17,128.04 16,664.49 16,518.60 12,284.63 Provisions & Contingencies Growth (%) -14.70 2.78 0.88 34.47 16.59 Profit after Tax (PAT) 13,797.12 8,511.66 5,265.32 2,863.40 -3,120.89 PAT Growth (%) 62.61 61.86 84.17 - - Net Interest Margin (%) 2.63 2.57 2.34 2.32 2.09 Net Profit Margin (%) 13.74 10.48 7.71 4.13 -8.32 Basic EPS (₹) 19.15 12.45 7.77 4.47 -13.45 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ------------------------------------- ----------- --------- --------- --------- ---------- Total Income 1,15,858.15 95,376.49 80,468.77 80,104.19 42,491.91 Total Income Growth (%) 21.47 18.53 0.46 88.52 10.25 Provisions & Contingencies 14,562.32 17,033.89 16,641.11 16,353.32 12,078.90 Provisions & Contingencies Growth (%) -14.51 2.36 1.76 35.39 15.38 Profit after Tax (PAT) 13,648.31 8,433.28 5,232.10 2,905.97 -2,897.78 PAT Growth (%) 61.84 61.18 80.05 - - Net Interest Margin (%) 2.62 2.55 2.33 2.30 2.07 Net Profit Margin (%) 13.67 10.44 7.70 4.22 -7.78 Basic EPS (₹) 18.95 12.34 7.73 4.54 -12.49 All figures in Rs Cr, unless mentioned otherwise

- Net Interest Margin - Uptrend

Insights

- Falling Gross NPA and Net NPA

The bank's gross NPA% and Net NPA% have fallen continuously over the past 4-years to 4.76% and 1.03%, respectively. (Source: Standalone Financials)Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Advances 8,74,079.74 7,64,276.68 6,63,355.65 5,93,320.08 3,17,677.43 Advances Growth (%) 14.37 15.21 11.80 86.77 6.32 Deposits 12,24,593.36 11,20,321.92 10,34,367.75 9,25,653.93 4,52,436.15 Deposits Growth (%) 9.31 8.31 11.74 104.59 8.37 Total Equity 97,597.66 78,803.51 70,861.12 64,737.78 33,989.40 Total Equity Growth (%) 23.85 11.21 9.46 90.46 26.66 Gross NPA (%) - - - - - Net NPA (%) - - - - - Capital Adequacy Ratios (%) 16.94 16.01 14.48 12.52 12.71 Contingent Liabilities 5,83,383.05 6,08,099.28 6,51,146.83 3,71,781.47 18,91,129.37 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 --------------------------- ------------ ------------ ------------ ----------- ----------- Advances 8,70,776.09 7,61,845.46 6,61,004.66 5,90,982.88 3,15,049.41 Advances Growth (%) 14.30 15.26 11.85 87.58 6.10 Deposits 12,21,528.37 11,17,716.32 10,32,392.63 9,23,805.34 4,50,668.45 Deposits Growth (%) 9.29 8.26 11.75 104.99 8.36 Total Equity 96,968.97 78,334.21 70,576.14 64,476.74 33,785.64 Total Equity Growth (%) 23.79 10.99 9.46 90.84 27.56 Gross NPA (%) 4.76 7.53 11.11 13.74 14.15 Net NPA (%) 1.03 1.70 3.68 4.62 5.49 Capital Adequacy Ratios (%) 16.97 16.04 14.52 12.56 12.81 Contingent Liabilities 5,82,681.03 6,07,809.42 6,50,247.75 3,70,527.97 1,88,202.36 All figures in Rs Cr, unless mentioned otherwise

- Falling Gross NPA and Net NPA

Insights

- Decrease in Cash from Investing

Company has used Rs 1393.77 cr for investing activities which is an YoY decrease of 45.58%. (Source: Consolidated Financials)Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 19,929.69 6,111.43 36,338.88 20,527.34 -7,681.29 Net Cash used in Investing Activities -1,393.77 -2,561.05 -557.71 -601.09 -377.21 Net Cash flow from Financing Activities -11,488.94 -10,654.16 -786.29 -18,860.66 20,144.22 Net Cash Flow 7,046.98 -7,103.78 34,994.88 29,185.81 12,085.72 Closing Cash & Cash Equivalent 1,19,645.84 1,12,654.45 1,19,758.22 84,763.34 55,248.80 Closing Cash & Cash Equivalent Growth (%) 6.21 -5.93 41.29 53.42 28.00 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ----------------------------------------- ----------- ----------- ----------- ----------- ---------- Net Cash flow from Operating Activities 20,328.70 5,984.33 36,213.89 20,442.99 -7,541.86 Net Cash used in Investing Activities -1,260.57 -2,407.99 -356.62 -582.68 -726.09 Net Cash flow from Financing Activities -11,915.71 -10,926.24 -767.26 -18,676.39 20,328.20 Net Cash Flow 7,152.42 -7,349.90 35,090.01 29,304.14 12,060.25 Closing Cash & Cash Equivalent 1,19,302.87 1,12,150.45 1,19,500.36 84,410.35 55,106.22 Closing Cash & Cash Equivalent Growth (%) 6.38 -6.15 41.57 53.18 28.02 All figures in Rs Cr, unless mentioned otherwise

- Decrease in Cash from Investing

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 15.02 11.72 7.97 4.79 -10.16 Return on Assets (%) 0.98 0.66 0.44 0.26 -0.56 Cost to Income (%) 48.34 47.88 44.48 43.58 47.31 Interest income to Earning assets (%) 7.15 6.29 5.71 6.40 6.74 Interest Expense to Earning assets (%) 4.51 3.72 3.36 4.07 4.65 Price to Earnings (x) 8.50 5.34 5.03 7.62 -3.15 Price to Book (x) 1.28 0.63 0.40 0.37 0.32 Price to Sales (x) 1.17 0.56 0.39 0.31 0.26 Operating Profit Margin (%) -4.08 -9.22 -12.18 -15.97 -23.55 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 -------------------------------------- ------- ------- ------- ------- ------- Return on Equity (%) 14.94 11.68 7.94 4.87 -9.46 Return on Assets (%) 0.98 0.65 0.44 0.27 -0.52 Cost to Income (%) 46.41 46.27 43.59 41.34 46.11 Interest income to Earning assets (%) 7.16 6.30 5.72 6.41 6.76 Interest Expense to Earning assets (%) 4.54 3.74 3.38 4.11 4.68 Price to Earnings (x) 8.58 5.39 5.06 7.51 -3.40 Price to Book (x) 1.28 0.63 0.40 0.37 0.32 Price to Sales (x) 1.17 0.56 0.39 0.32 0.26 Operating Profit Margin (%) -2.43 -7.67 -10.73 -12.26 -21.91

Financial InsightsUnion Bank India

Income (P&L)

Balance Sheet

Cash Flow

- Net Interest Margin - Uptrend

Company is able to expand its net interest margin on a continuous basis over the last 3 years with margins of 2.63% in last year. (Source: Consolidated Financials) - Profit Per Employee - Uptrend

Net profit per employee has been continuously increasing over the last 3 years with a growth of 61.26% last year. (Source: Standalone Financials)

- Net Interest Margin - Uptrend

- Falling Gross NPA and Net NPA

The bank's gross NPA% and Net NPA% have fallen continuously over the past 4-years to 4.76% and 1.03%, respectively. (Source: Standalone Financials)

- Falling Gross NPA and Net NPA

- Decrease in Cash from Investing

Company has used Rs 1393.77 cr for investing activities which is an YoY decrease of 45.58%. (Source: Consolidated Financials)

- Decrease in Cash from Investing

Do you find these insights useful?

- hate it

- meh

- love it

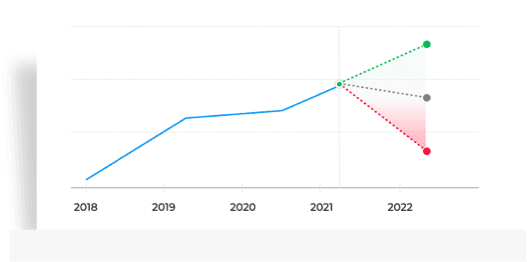

Union Bank India Share Price Forecast

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL - Stock doesn't have any Revenue Forecast Data

Get multiple analysts’ prediction on Union Bank India

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

Union Bank India Technicals

Bullish / Bearish signals for Union Bank India basis selected technical indicators and moving average crossovers.

5 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Feb 2025

5D EMA: 114.49

Last 4 Buy Signals_:4 Feb 2025

Average price gain of 4.90% within 7 days of Bullish signal in last 5 years

10 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Feb 2025

10D EMA: 114.16

Last 4 Buy Signals:4 Feb 2025

Average price gain of 4.79% within 7 days of Bullish signal in last 5 years

14 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Feb 2025

14D EMA: 113.73

Last 4 Buy Signals:4 Feb 2025

Average price gain of 4.76% within 7 days of Bullish signal in last 5 years

20 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Feb 2025

20D EMA: 113.46

Last 4 Buy Signals:4 Feb 2025

Average price gain of 4.73% within 7 days of Bullish signal in last 5 years

50 Day EMA Crossover

Bullish signal on daily chart

Appeared on: 12 Feb 2025

50D EMA: 114.79

Last 4 Buy Signals:5 Feb 2025

Average price gain of 8.10% within 30 days of Bullish signal in last 5 years

MACD Crossover

Bullish signal on weekly chart

Appeared on: 7 Feb 2025

Region: Negative

Last 4 Buy Signals:_29 Nov 2024

Average price gain of 12.37% within 7 weeks of Bullish signal in last 10 years

Show More44%

Positive Movement since

1st Jan 2005 on basis

55%

Negative Movement since

1st Jan 2005 on basis

Exclude

Global Meltdown - 1st Jan 2008 to 10th Nov 2008

Covid Crisis - 1st Feb 2020 to 31st Mar 2020Pivot Levels

| R1 | R2 | R3 | PIVOT | S1 | S2 | S3 | |

|---|---|---|---|---|---|---|---|

| Classic | 117.15 | 119.31 | 125.40 | 113.22 | 111.06 | 107.13 | 101.04 |

Average True Range

| 5 DAYS | 14 DAYS | 28 DAYS | |

|---|---|---|---|

| ATR | 4.86 | 4.35 | 4.10 |

Union Bank India Peer Comparison

- CHART

- TABLE

Insights

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 138.9% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty Bank

Stock generated 138.9% return as compared to Nifty Bank which gave investors 29.76% return over 3 year time period. (as of last trading session) - 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

All values in %

Choose from Peers - IDBI Bank

- Indian Bank

- UCO Bank

- Bank of India

- Central Bank

Insights

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 138.9% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty Bank

Stock generated 138.9% return as compared to Nifty Bank which gave investors 29.76% return over 3 year time period. (as of last trading session)

- Stock Returns vs Nifty 100

Ratio Performance

| NAME | P/E (x) | P/B (x) | ROE % | ROA % | Rev CAGR [3Yr] | OPM | NPM | NIM % | Cost to Income % | Interest income to Earning assets % | Net NPA % | Capital Adequacy Ratio % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Union Bank India | 5.37 | 0.90 | 15.02 | 0.98 | 12.28 | -4.08 | 13.74 | 2.63 | 48.34 | 7.15 | 1.03 | 16.97 |

| PNB | 6.53 | 0.99 | 8.92 | 0.56 | 8.72 | -4.58 | 8.35 | 2.53 | 53.48 | 6.82 | 0.73 | 15.97 |

| Bank of Baroda | 5.38 | 0.91 | 15.67 | 1.13 | 16.61 | -4.21 | 15.85 | 2.92 | 47.76 | 7.15 | 0.68 | 16.31 |

| IOB | 28.98 | 3.27 | 10.73 | 0.75 | 9.69 | -12.46 | 11.07 | 2.79 | 56.30 | 6.83 | 0.57 | 17.28 |

| Canara Bank | 5.00 | 0.88 | 18.40 | 0.99 | 13.96 | -12.54 | 13.82 | 2.50 | 55.68 | 7.19 | 1.27 | 16.28 |

| Add More | ||||||||||||

| Annual Ratios (%) | ||||||||||||

| Choose from Peers |

- IDBI Bank

- Indian Bank

- UCO Bank

- Bank of India

- Central Bank

See All Parameters

Peers InsightsUnion Bank India

- Stock Returns vs Nifty 100

Stock gave a 3 year return of 138.9% as compared to Nifty 100 which gave a return of 35.73%. (as of last trading session) - Stock Returns vs Nifty Bank

Stock generated 138.9% return as compared to Nifty Bank which gave investors 29.76% return over 3 year time period. (as of last trading session)

Do you find these insights useful?

- hate it

- meh

- love it

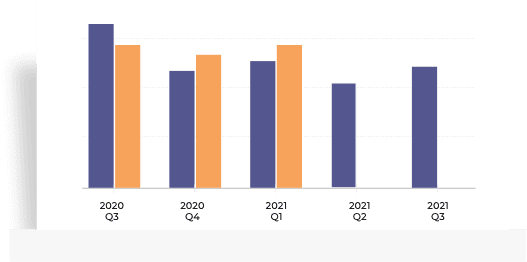

Union Bank India Shareholding Pattern

Showing Union Bank India Shareholding as on Dec 2024

Category Dec 2024 Sep 2024 Jun 2024 Mar 2024 Promoters 74.76 74.76 74.76 74.76 Pledge 0.00 0.00 0.00 0.00 FII 6.46 6.89 7.37 6.75 DII 11.88 11.16 11.32 12.18 Mutual Funds 3.67 2.97 3.08 3.39 Others 6.90 7.18 6.54 6.31 Showing Shareholding as on Dec 2024

Category No. of Shares Percentage % Change QoQ Promoters 5,70,66,60,850 74.76 % 0.00 Pledge 0 0.00 % 0.00 FII 49,29,64,878 6.46 % -0.43 DII 90,64,65,673 11.88 % 0.72 MF 28,02,21,918 3.67 % 0.69 Others 52,75,14,206 6.90 % -0.28

Union Bank India MF Ownership

- 1,166.22

Amount Invested (in Cr.) - 1.5%

% of AUM - 0.00

% Change (MoM basis)

- 1,166.22

- 334.59

Amount Invested (in Cr.) - 0.53%

% of AUM - 10.32

% Change (MoM basis)

- 334.59

- 223.82

Amount Invested (in Cr.) - 8.39%

% of AUM - -0.56

% Change (MoM basis)

- 223.82

MF Ownership as on 31 December 2024

Union Bank India Corporate Actions

Meeting Date Announced on Purpose Details Jan 27, 2025 Jan 20, 2025 Board Meeting Quarterly Results Oct 21, 2024 Oct 16, 2024 Board Meeting Quarterly Results Jul 26, 2024 Jun 11, 2024 AGM Book closure from Jul 20, 2024 to Jul 26, 2024 Jul 19, 2024 Jul 11, 2024 Board Meeting Quarterly Results Jun 11, 2024 Jun 06, 2024 Board Meeting Others Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 36% 3.6 Jul 19, 2024 May 10, 2024 Final 30% 3.0 Jul 28, 2023 May 08, 2023 Final 19% 1.9 Jun 22, 2022 May 13, 2022 Final 19% 1.95 Jun 17, 2016 May 16, 2016 Final 60% 6.0 Jun 18, 2015 May 12, 2015 No other corporate actions details are available.

About Union Bank India

Union Bank of India, incorporated in the year 1919, is a banking company (having a market cap of Rs 87,771.20 Crore).Union Bank of India key Products/Revenue Segments include Interest & Discount on Advances & Bills, Income From Investment, Interest On Balances with RBI and Other Inter-Bank Funds and Interest for the year ending 31-Mar-2024.The Bank has reported Standalone Non Performing Assets (Gross NPAs) at .00 % of total assets and Standalone Net Non Performing Assets (Net NPAs) at .00% of total assets for the quarter ending 31-12-2024.For the quarter ended 31-12-2024, the company has reported a Consolidated Total Income of Rs 31,749.18 Crore, down 3.24 % from last quarter Total Income of Rs 32,812.12 Crore and up 6.53 % from last year same quarter Total Income of Rs 29,801.98 Crore. The bank has reported net profit after tax of Rs 4,623.03 Crore in latest quarter.The bank’s top management includes Mr.Srinivasan Varadarajan, Ms.A Manimekhalai, Mr.Nitesh Ranjan, Mr.Pankaj Dwivedi, Mr.S Ramasubramanian, Mr.Sanjay Rudra, Mr.Sameer Shukla, Mr.Prakash Baliarsingh, Dr.Jayadev Madugula, Mrs.Priti Jay Rao, Mr.Laxman S Uppar, Mr.Suraj Srivastava, Mr.Avinash Vasant Prabhu, Mr.S K Dash, Mr.Ashwini Kumar Choudhary. It has Kirtane & Pandit LLP as its auditoRs As on 31-12-2024, the company has a total of 763.36 Crore shares outstanding.Union Bank India Share Price Today is Rs. 114.98. On previous day, the Union Bank India Share Price (NSE) closed at Rs. 114.85, featuring among the most traded securities on the National Stock Exchange.

Shareholdings:

As of 31st Dec, 2024, the promoter held 74.76% of the stake in Union Bank India shares, out of which 0.0% was pledged. On the same date, foreign institutional investors' (FII) holdings of Union Bank India stocks was 6.46% as compared to 6.89% in Sep 2024 with decrease of 0.43%. The domestic institutional investors (DII) holdings on 31st Dec, 2024 was 11.88% as compared to 11.16% in Sep 2024 with increase of 0.72%. Out of the total DII holdings in Union Bank India shares 3.67% was held by mutual funds. The rest including public held is 6.9%. Union Bank India stock price is reflected on both the exchanges - BSE and NSE.

Stock Forecast:

After showing 31749.18 Cr. of sales and 3.24% of quarterly net loss, there have been multiple ups and downs in the Union Bank India stock prices in the past few weeks. For example, Union Bank India stock price on 4th of February 2025 was around Rs. 113.88. Union Bank India share price now stands at an average of Rs. 114.98. Judging by last week's performance, stock is in up trend.

Union Bank India has a median target price of Rs. 151.33 in 12 months by 12 analysts. They have provided a high estimate of Rs. 180.0 and low estimate of Rs. 130.0 for Union Bank India share.

Historical Prices and Performance:

Union Bank India, incorporated in 1919 is a Large Cap company (with a market cap of Rs. 84435.31) operating in Banks sector.

The Return of Equity (ROE) in last five financial years given by Union Bank India stock was 15.02%, 11.72%, 7.97%, 4.79% and -10.16% respectively.

The Union Bank India share gave a 3 year return of 138.9% as compared to Nifty 50 which gave a return of 32.79%.

Union Bank India announced 27.0% final dividend on January 20, 2014.

Key Metrics:

PE Ratio of Union Bank India is 5.16

Prices/Sales Ratio of Union Bank India is 1.17

Price/Book Ratio of Union Bank India is 0.86

Peer Insights:

Peers are businesses with comparable activities, buisness objectives and affiliation with a particular industry area. For Union Bank India, major competitors and peers include PNB, Bank of Baroda, IOB and Canara Bank. As of Sep 2024, the dividend yield of Union Bank India stands at 3.26% while PNB, Bank of Baroda, IOB and Canara Bank stand at 1.58%, 3.61%, 0.0% and 3.57% respectively. The PE ratio and PB Ratio of the company are among its competitors stand at 5.16 and 0.86 respectively.

Leadership of Union Bank India :

Sumit Srivastava is General Manager

S K Dash is Co. Secretary & Compl. Officer

Ashwini Kumar Choudhary is Chief Risk Officer

Avinash Vasant Prabhu is Chief Financial Officer

Sanjay Narayan is General Manager

Ajay Kumar Singh is Chief Vigilance Officer

Pravin Sharma is Chief General Manager

K Bhaskara Rao is Chief General Manager

Abhijit Basak is Chief General Manager

Sudarshana Bhat is Chief General Manager

Srinivasan Varadarajan is Non Executive Chairman

A Manimekhalai is Managing Director & CEO

S Ramasubramanian is Executive Director

Nitesh Ranjan is Executive Director

Sanjay Rudra is Executive Director

Pankaj Dwivedi is Executive Director

Jayadev Madugula is Shareholder Director

Priti Jay Rao is Shareholder Director

Laxman S Uppar is Part Time Non Official Director

Suraj Srivastava is Part Time Non Official Director

Sameer Shukla is Government Nominee Director

Prakash Baliarsingh is Nominee Director

Show More

Executives

Auditors

SV

Srinivasan Varadarajan

Non Executive Chairman

AM

A Manimekhalai

Managing Director & CEO

NR

Nitesh Ranjan

Executive Director

PD

Pankaj Dwivedi

Executive Director

SR

S Ramasubramanian

Executive Director

SR

Sanjay Rudra

Executive Director

SS

Sameer Shukla

Government Nominee Director

PB

Prakash Baliarsingh

Nominee Director

JM

Jayadev Madugula

Shareholder Director

PJ

Priti Jay Rao

Shareholder Director

LS

Laxman S Uppar

Part Time Non Official Director

SS

Suraj Srivastava

Part Time Non Official Director

AV

Avinash Vasant Prabhu

Chief Financial Officer

SK

S K Dash

Co. Secretary & Compl. Officer

AK

Ashwini Kumar Choudhary

Chief Risk Officer

Show MoreNBS & Co

Chhajed & Doshi

G S Mathur & Co.

P Chandrasekar LLP

Key Indices Listed on

Nifty Next 50, Nifty 100, Nifty 200, + 25 more

More Details

FAQs about Union Bank India share

- 1. What is Union Bank India share price and what are the returns for Union Bank India share?

Union Bank India share price is Rs 114.98 as of today. Union Bank India share price is up by 3.96% based on previous share price of Rs 114.85. Union Bank India share price trend:- Last 3 Months: Union Bank India share price moved down by 3.38%

- Last 3 Years: Union Bank India Share price moved up by 148.34%

- 2. Who's the chairman of Union Bank India?

Srinivasan Varadarajan is the Non Executive Chairman of Union Bank India - 3. What is the market cap of Union Bank India?

Market Capitalization of Union Bank India stock is Rs 87,771.20 Cr. - 4. What has been highest price of Union Bank India share in last 52 weeks?

52 Week high of Union Bank India share is Rs 172.50 while 52 week low is Rs 100.81 - 5. What dividend is Union Bank India giving?

Union Bank of India announced an equity dividend of 36% on a face value of 10.0 amounting to Rs 3.6 per share on 10 May 2024. The ex dividend date was 19 Jul 2024. - 6. What are the key metrics to analyse Union Bank India Share Price?

Union Bank India share can be quickly analyzed on following metrics:- Stock's PE is 5.37

- Price to Book Ratio of 0.87

- 7. Who is the Chief Executive Officer of Union Bank India?

A Manimekhalai is the Managing Director & CEO of Union Bank India - 8. Who's the owner of Union Bank India?

* Promoter holding has not changed in last 9 months and holds 74.76 stake as on 31 Dec 2024

* Domestic Institutional Investors holding have gone down from 12.18 (31 Mar 2024) to 11.88 (31 Dec 2024)

* Foreign Institutional Investors holding have gone down from 6.75 (31 Mar 2024) to 6.46 (31 Dec 2024)

* Other investor holding has gone up from 6.31 (31 Mar 2024) to 6.9 (31 Dec 2024) - 9. What is the CAGR of Union Bank India?

The CAGR of Union Bank India is 9.7. - 10. Who are the peers for Union Bank India in Banks sector?

Within Banks sector Union Bank India, IDBI Bank Ltd., Canara Bank, Indian Overseas Bank, Indian Bank, Bank of Baroda, Punjab National Bank, UCO Bank, Bank of India, Central Bank of India and Bank of Maharashtra are usually compared together by investors for analysis. - 11. What is the PE & PB ratio of Union Bank India?

The PE ratio of Union Bank India stands at 5.17, while the PB ratio is 0.87. - 12. What are the returns for Union Bank India share?

Return Performance of Union Bank India Shares:- 1 Week: Union Bank India share price moved down by 3.56%

- 3 Month: Union Bank India share price moved down by 3.38%

- 13. What are the Union Bank India quarterly results?

On Consoldiated basis, Union Bank India reported a total income and loss of Rs 31749.18 Cr and Rs 4623.03 respectively for quarter ending 2024-12-31. Total Income and profit for the year ending 2024-03-31 was Rs 118188.36 Cr and Rs 13797.12 Cr.

Trending in Markets

Top Gainers As on 03:58 PM | 12 Feb 2025

Top Losers As on 03:58 PM | 12 Feb 2025

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.