MORTGAGES (original) (raw)

Here’s what the Fed interest rate cut means for your finances

Deep interest rate cuts will affect these key aspects of the economy — and your wallet.

Understanding interest rates can help bridge the generational literacy gap

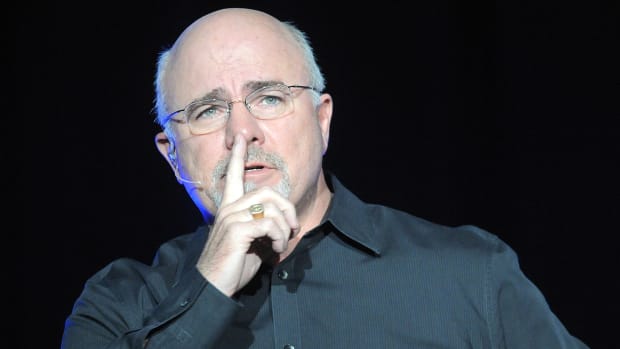

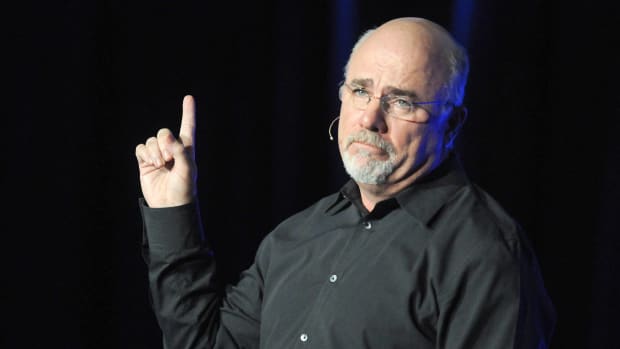

Dave Ramsey warns homebuyers on mortgage, interest rate blunt truth

Cash is king: High mortgage rates are changing home-buying trends

Dave Ramsey bluntly speaks on interest rates and mortgages

A mortgage question looms as Fed interest-rate action appears imminent.

Sep 3, 2024 3:58 AM EDT

Buying a home — what you need to know about your down payment

A few smart financial adjustments can free up the needed cash.

Aug 14, 2024 1:34 PM EDT

Market turmoil gives homebuyers huge mortgage break

When stocks started to dive, bond yields and mortgage rates fell, too, good news for homebuyers.

Aug 6, 2024 4:37 PM EDT

Is there a housing bubble on the horizon?

Millennials are feeling the pain of a volatile housing market.

Jul 25, 2024 9:03 PM EDT

Mortgage rates just had a huge drop

Mortgage lenders see more homes bought and sold when — and if — the Federal Reserve starts cutting rates.

Jul 15, 2024 12:36 PM EDT

Your new mortgage may get cheaper

The Federal Reserve may start to lower interest rates in September. Get ready.

Jun 30, 2024 9:20 PM EDT

5 hidden costs of homeownership: What to consider before signing

Many buyers don’t anticipate the ongoing costs of homeownership after the purchase. Understanding these hidden expenses can help with budgeting beyond the mortgage.

Jul 18, 2024 4:35 PM EDT

How much mortgage debt do Americans have on average?

Mortgages are the most common path to homeownership. How much have Americans borrowed to pay for their homes, and what’s the average monthly mortgage payment?

Jul 18, 2024 4:36 PM EDT

Micron, inflation, and Biden-Trump debate will rock markets

The second quarter will end with a busy week, filled with the potential for surprises and drama.

Jun 23, 2024 10:03 AM EDT

Good news for June homebuyers as mortgage rates fall

Mortgage rates fell to their lowest level since early April.

By Rebecca Mezistrano and Daniel Kuhn

Jun 21, 2024 10:06 AM EDT